Loans (US)

Caliber Home Loans review: conventional, FHA, VA, and USDA loans

Check out the Caliber Home Loans review and learn how to take advantage of a variety of products, low mortgage rates, and flexible terms.

Caliber Home Loans: low rates with flexible terms

Caliber Home Loans was founded in 2008 when Caliber Funding and Vericrest Financial were merged. This lender offers a variety of loan products for home purchases and mortgage refinance.

How to apply for the Caliber Home Loans?

Check out how the Caliber Home Loans application works, find the best option for you, and access valuable resources and tools in the process.

Also, according to Caliber and the reviews, the company provides low rates and flexible terms.

| APR | Not disclosed |

| Loan Purpose | Mortgage |

| Loan Amounts | It depends on the product |

| Credit Needed | It depends on the product |

| Terms | It depends on the product |

| Origination Fee | Not disclosed |

| Late Fee | Not disclosed |

| Early Payoff Penalty | Not disclosed |

Caliber Home Loans features helpful resources and many tools so you can estimate your home loan. Keep reading to find out how it works and the loans offered.

How does Caliber Home Loans work?

Caliber Home Loans provides a full range of loan options for those who want to purchase a home or those who need to refinance a mortgage.

Also, this lender specializes in the military community through VA loans and VA Streamline Refinance.

In addition, it offers conventional loans with flexible terms that can go up to 30 years or more. Plus, the conventional loan option features several ARM programs and down payments as low as 3%.

You can also count on FHA loans and refinance in case your creditworthiness is less-than-perfect, and your income is limited.

On the other hand, Caliber Home Loans offers USDA loans with zero down payments and competitive fixed rates if you are looking to live in the countryside.

Although the lender doesn’t disclose all fees and rates, you can find a loan consultant right next to you to find out the best loan option to refinance your mortgage or purchase your home.

Furthermore, Caliber offers helpful tools and resources on its platform, including a loan calculator, homeownership steps, educational articles, and more.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Caliber Home Loans benefits

Caliber Home Loans is a lender that gathers many home loan options, including VA, FHA, conventional, and USDA loans.

Also, it offers refinancing options. Furthermore, it allows you to get access to helpful resources, including a calculator that helps you estimate your rates.

Pros

- Caliber Home Loans offers a complete range of mortgages, including VA, FHA, conventional, and USDA loans;

- It provides flexible terms that can go up to 30 years, and it features competitive rates, according to reviews and the official website;

- It offers refinancing options;

- It features helpful resources, including a calculator;

- It offers physical locations and specialized consultancy.

Cons

- It doesn’t disclose all fees and rates.

How good does your credit score need to be?

It depends on the home loan option you apply for. For example, if you decide to go with an FHA loan, poor credit is considered in the application.

However, if you decide to apply for a conventional loan, it is recommended that you have a higher credit score.

How to apply for Caliber Home Loans?

Caliber Home Loans gathers many home loan options and refinance deals. And you may find a good deal for you. Learn how to find a loan consultant.

How to apply for the Caliber Home Loans?

Check out how the Caliber Home Loans application works, find the best option for you, and access valuable resources and tools in the process.

About the author / Aline Augusto

Reviewed by / Aline Barbosa

Senior Editor

Trending Topics

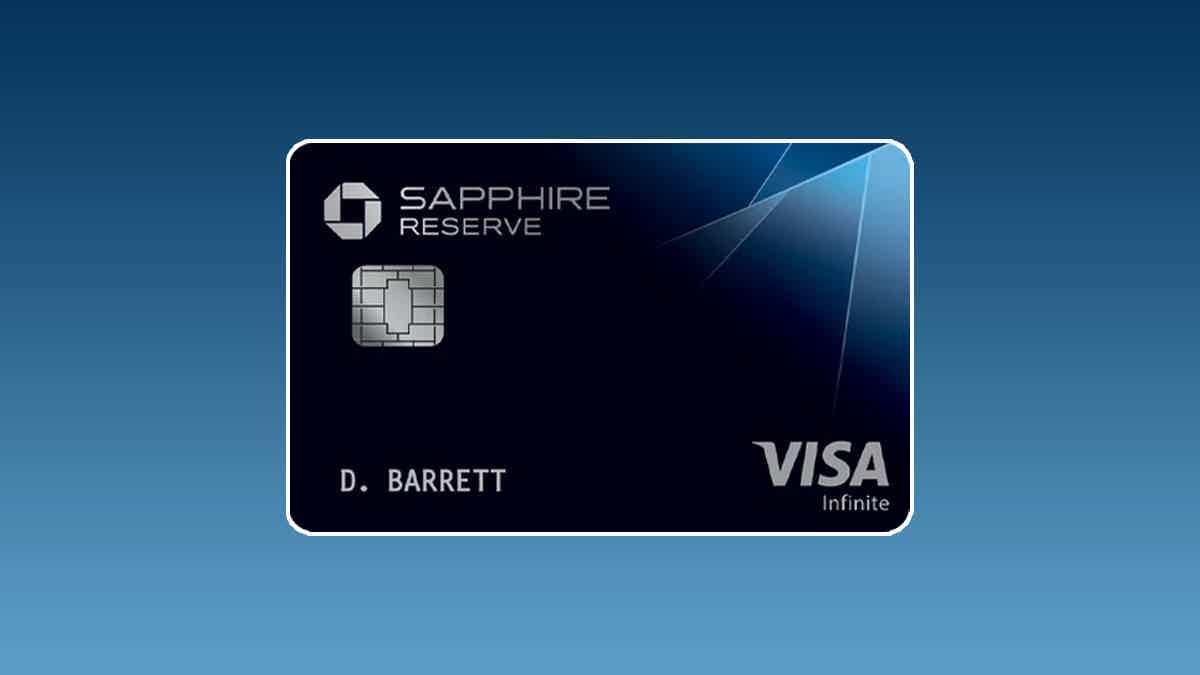

How do you get the Chase Sapphire Reserve® Card?

Do you want incredible travel and dining perks in one credit card? Then, read more to know how to apply for the Chase Sapphire Reserve® Card!

Keep Reading

Mutual Funds as Investments: a guide for beginners

Mutual funds are profitable and a great opportunity for beginners. So, read our post to know more about Mutual Funds as investments!

Keep Reading

Best home insurance companies

Learn the best home insurance companies we have selected for you and decide which fits your needs, budget, and goals better! Check it out!

Keep ReadingYou may also like

Prime Visa Card application: how does it work?

Wondering how to get your hands on the Prime Visa Card? We'll show you how easy it is to apply so you can start earning stellar bonus points in all your spending today!

Keep Reading

Learn how to download the Anxiety Relief Hypnosis App

Follow this guide to download the Anxiety Relief Hypnosis app. It will help you relax, stop anxiety, sleep better, and more!

Keep Reading

Learn to apply easily for the LendingPoint Personal Loan

Learn how to apply for a LendingPoint Personal Loan. This post uncomplicates the process straightforwardly so that you can make your application as soon as possible. Keep reading to learn more!

Keep Reading