Reviews (US)

Credit One Bank® Platinum Rewards Visa with No Annual Fee credit card full review

Credit One Bank® offers a range of credit cards that give you rewards and many other benefits. In this post, we present the Credit One Bank® Platinum Rewards Visa with No Annual Fee review!

Credit One Bank®Platinum Rewards Visa with No Annual Fee card: get unlimited 2% cash back!

It is important to pay attention to the fees when you search for a credit card. Credit One Bank® is a financial institution that delivers cards with no annual fees. But extra offers are welcome, too, right? Thinking of it, the Credit One Bank® Platinum Rewards Visa with No Annual Fee card gives you 2% cash back on eligible everyday purchases.

Plus, it is a Visa credit card, which gives you the freedom to know that it is accepted all over the country.

Learn now how it works!

| Credit Score | Good – Excellent |

| Annual Fee | $0 |

| Regular APR | 23.99% (variable) |

| Welcome bonus | None |

| Rewards | 2% cash back on eligible purchases |

Apply Credit One Bank® Platinum No Annual Fee

Get 2% cash back with Credit One Bank® Platinum Rewards Visa with No Annual Fee! Learn how to apply for this credit card.

How does the Credit One Bank® Platinum Rewards Visa with No Annual Fee credit card work?

This credit card features two things that we love: a $0 annual fee and rewards!

Firstly, you earn 2% cash back on eligible purchases, such as:

- Gas;

- Groceries;

- Subscriptions for eligible cellphone services, internet, TV, and cable.

Secondly, it allows you to choose your payment due date so you can plan better and feel comfortable with it.

Thirdly, it offers some protection and convenience bonuses, as follows:

- Credit One mobile app so you can manage and customize your account 24/7 right in the palm of your hand;

- $0 Fraud Liability so you won’t be responsible for unauthorized purchases on your credit card;

- Experian free online access so you can monitor your credit.

And all of that with no annual fee and rewards like we have explained above.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Credit One Bank® Platinum Rewards Visa with No Annual Fee benefits

The main benefits this card offers you are the $0 annual fee and the rewards. Although you can’t get a better tier of cash back, a 2% is good compared to other traditional credit cards. Plus, it is applicable to everyday purchases.

Also, it provides you with a great mobile app, free online access to Experian, and $0 Fraud Liability.

On the other hand, you should pay attention to some other fees. Like other cards in the market, Platinum Rewards Visa with No Annual Fee charges a foreign transaction fee, as well as a cash advance fee.

Read out the list of pros and cons before applying to it!

Pros

- No annual fee

- 2% cash back on eligible everyday purchases

- $0 Fraud Liability

- Experian free online access

- Credit One mobile app

Cons

- No introductory offers like 0% APR

- Quite high regular APR

- $1 or 3% foreign transaction fee, whichever is greater

- 5% or $10 cash advance fee, whichever is greater

- Minimum $1 interest charge

How good does your credit score need to be?

All those perks come with a good credit score required for the application. So, it is recommended that you have at least a 670-credit punctuation to be accepted.

How to apply for Credit One Bank® Platinum Rewards Visa with No Annual Fee?

If you are interested in applying for a Credit One Bank® Platinum Rewards Visa with No Annual Fee credit card, you should read our next post, in which we explain how the application works. Check it out!

Apply Credit One Bank® Platinum No Annual Fee

Get 2% cash back with Credit One Bank® Platinum Rewards Visa with No Annual Fee! Learn how to apply for this credit card.

About the author / Aline Augusto

Reviewed by / Aline Barbosa

Senior Editor

Trending Topics

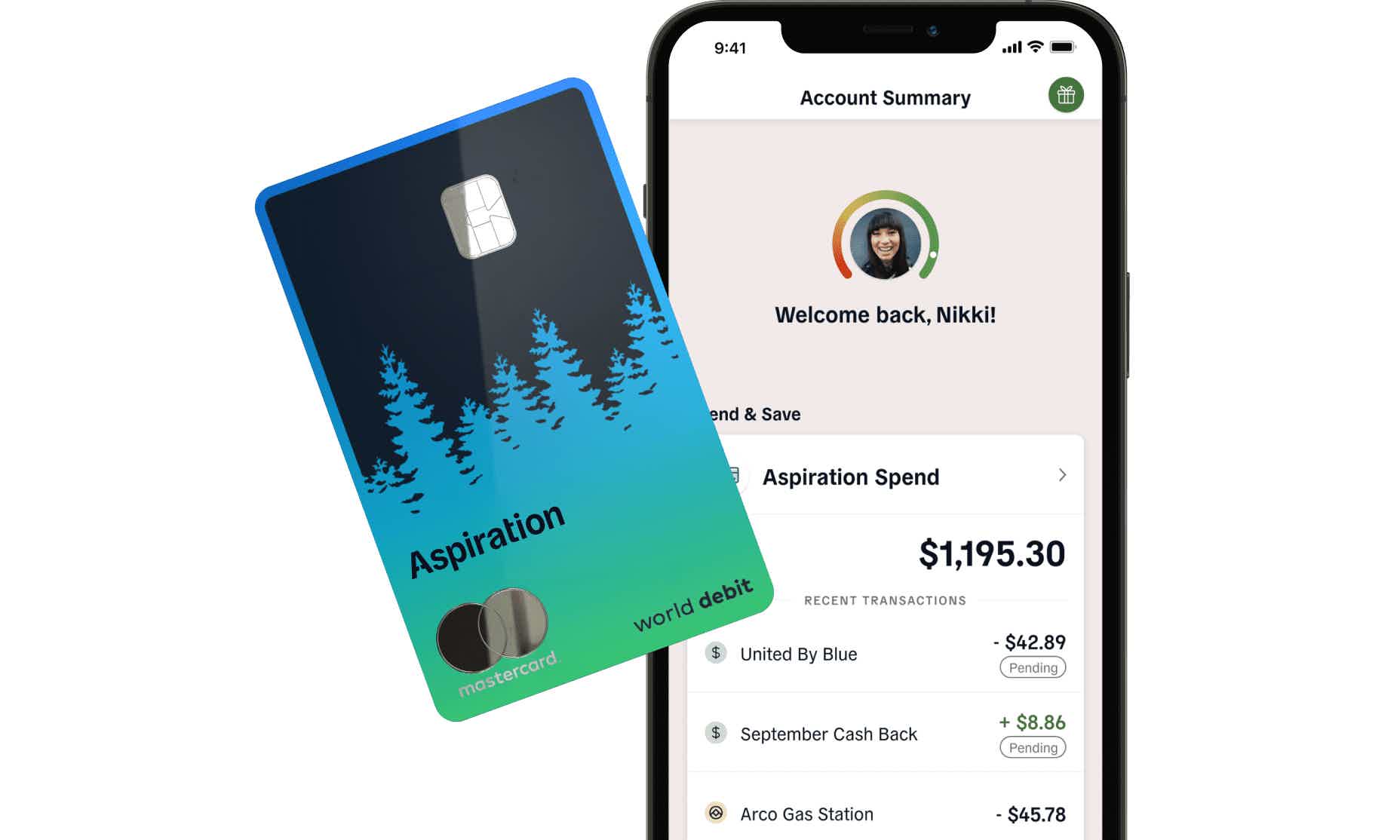

How to apply for the Aspiration Spend & Save™ Account?

The Aspiration Spend & Save™ Account is a hybrid account with perks and environmental conscience. Learn how to apply for it!

Keep Reading

What type of account do you need?

What type of account do you need? Increase your wealth by choosing the right account that fits your profile, budget, needs, and objectives.

Keep Reading

How to apply for ElectroFinance Lease?

ElectroFinance Lease offers lease-to-own for those who need and want to buy electronics but don't have enough money for them. Check it out!

Keep ReadingYou may also like

How to build credit fast from scratch with our tips for beginners!

Are you new to credit and wish to build a strong one? We can help you. Just follow these tips, and your score will skyrocket.

Keep Reading

Types of loans: understand which one is best for you

When it comes to borrowing money, there are many types of loans. Learn more about each type and determine which is best for you. Keep reading!

Keep Reading

Appy for the Neo Credit Card: No annual fee!

Discover the simple steps on how to apply for the Neo Credit Card. Our guide provides a clear, efficient pathway to enjoying its high cashback rewards and digital-first convenience.

Keep Reading