Account (US)

American Express® High Yield Savings account full review

Grow your money at a higher rate than the national rate. Then, learn all about it in this American Express® High Yield Savings account review post!

Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.

Partner Offer through CreditCards.com

American Express® High Yield Savings account: 0.40% APY!

American Express® features an account with a 1.15% APY, and you’ll learn all about it in this American Express® High Yield Savings account review!

How to get American Express® High Yield Savings

Learn how to open an American Express® High Yield Savings account today and start growing your money!

| APY | 1.15% Rates & Fees |

| Fees | $0 Rates & Fees |

| Perks | 24/7 customer service Educational resources * Terms apply |

But it is not only that. By applying for it, you pay no monthly fees, there are no minimums, and you get access to excellent 24/7 customer service.

It is FDIC insured, and you feel peace of mind knowing that you can rely on American Express’s trustworthiness.

Plus, you get access to tools and resources to enhance your strategies for saving.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

How does the American Express® High Yield Savings account work?

If you are searching for a savings account with no minimum required and no fees, you may have just found one.

American Express® offers an account with a higher rate than the national average rate. Also, there are no monthly fees at all, and no minimum balance is required.

And you get some perks, such as 24/7 customer support, a Tips & Tools section where you can get educational resources on how to grow and save money.

The high interest is compounded daily and posted to accounts monthly. And the online and telephone withdrawals or debits are limited to nine per monthly statement cycle.

Furthermore, it is FDIC insured, and you certainly will know the reliability that American Express® delivers.

American Express® High Yield Savings account benefits

First of all, there is no minimum balance required, and there are no monthly fees so that you can get a high APY on your savings without costs to zero the interest earned.

Second of all, you get excellent 24/7 customer support and educational resources so you can save and grow your money with confidence.

On the other hand, it can improve ATM access since it doesn’t feature an ATM card.

Also, it could improve the processing time of deposits and withdrawals.

Plus, it doesn’t feature an option to add a checking account.

Pros

- You can earn 0.40% APY, which is higher than the national average rate;

- There are no monthly or maintenance fees;

- You get outstanding 24/7 customer service;

- You can access the Tips & Tools section for educational reasons.

Cons

- It doesn’t feature an ATM card so that you can withdraw funds from ATMs;

- It takes some days to process deposits and withdrawals.

How good does your credit score need to be?

Unfortunately, we weren’t able to check this information. However, you can pre-qualify without harming your credit.

How to apply for an American Express® High Yield Savings account?

If you want to start the New Year saving and growing your money at a higher rate without paying any fees, an American Express® High Yield Savings account might be an option for you! Learn how to open it!

How to get an American Express® High Yield Savings

Learn how to open an American Express® High Yield Savings account today and start growing your money!

Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.

Partner Offer through CreditCards.com

About the author / Aline Augusto

Reviewed by / Aline Barbosa

Senior Editor

Trending Topics

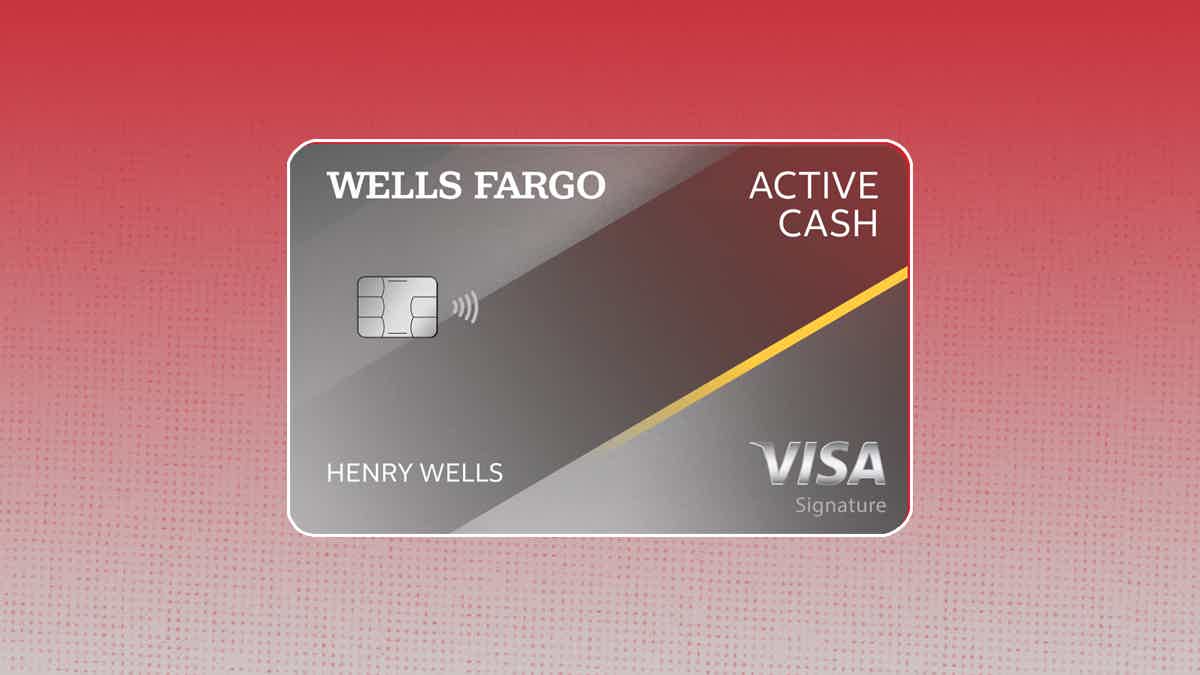

How can you apply for the Wells Fargo Active Cash® Card?

Learn how you can easily apply for the Wells Fargo Active Cash® Card and start earning cash back on all of your daily purchases!

Keep Reading

My Best Buy® Visa® Credit Card review: 5% cash back rewards!

If you're a fan of shopping at Best Buy, then you'll want to check out our My Best Buy® Visa® Credit Card review to learn all about it!

Keep Reading

First Access Visa® Card application

First Access Visa® credit card helps you build your credit score and it doesn’t need a secured deposit. Check out how to apply for it now!

Keep ReadingYou may also like

Investing for students: how to get started today!

This guide will help you start investing today if you're a student. Learn six steps to learn about investing for students and start your investment journey!

Keep Reading

Milestone Mastercard - Unsecured For Less Than Perfect Credit application

Learn more about the Milestone Mastercard and how to get pre-approved without hurting your credit score. Qualify with poor credit!

Keep Reading

Extra Debit Card application: how does it work?

Applying for an Extra Debit Card doesn't have to be a hassle. Learn how the process! Earn points on everyday purchases! Read on!

Keep Reading