Comparison (US)

Amazon Prime Rewards Visa Signature vs Fit Mastercard Credit Card: a comparison

Whether you're an Amazon loyalist or need to rebuild your credit score, the Amazon Prime Rewards Visa Signature Card or Fit Mastercard card should fit your needs perfectly. Keep reading to learn which option is best for you!

Amazon Prime Rewards Visa Signature Card or Fit Mastercard Credit Card: which is the best?

Whether you’re a frequent Amazon shopper or looking for a way to re-establish your credit score, there are two new credit cards worth considering. The Amazon Prime Rewards Visa Signature and the Fit Mastercard Credit Card are top-of-the-line products with unique features that could benefit you. So, keep reading our comparison to know which one is best: Amazon Prime Rewards Visa Signature Card or Fit Mastercard Card!

How do you get the Amazon credit card?

Are you interested in getting the best perks as a Prime member? Read more to know how to apply to get the Amazon Prime Rewards card!

How do you get the Fit Mastercard credit card?

Do you need to reestablish personal finances? The Fit Mastercard card can be a good option for you. Read our post about how to apply for it!

| Amazon Prime Rewards Visa Signature Card | Fit Mastercard Credit Card | |

| Sign-up bonus | Get a $100 Amazon Gift Card. | None. |

| Annual fee | No annual fee (with Prime membership). | $99 |

| Rewards* | 2% cash back for purchases made at restaurants, drugstores, and gas stations. *Terms apply. | N/A |

| Other perks* | You can get 5% cash back for Amazon purchases and Whole Foods if you have Prime membership. *Terms apply. | N/A |

| APR | 14.24% to 22.24% variable APR. | 22.99% variable APR |

Amazon Prime Rewards Visa Signature Card

Amazon offers some excellent features to its clients. One of them is the Amazon Prime Rewards Visa Signature Card. This Amazon credit card provides perfect perks for those who have Prime membership. For example, as a Prime member, you can earn 5% cash back at Amazon purchases and Whole Foods. Also, as a new cardholder, you can choose between cash back or 0% promo intro APR for 6 to 18 months. However, this promo is only valid for $50 or more purchases.

In addition, as a new cardholder, you can earn a $100 Amazon Gift Card as a welcome bonus. Moreover, you can get 2% cash back for purchases made at restaurants, drugstores, and gas stations. Plus, there is a 1% cash back reward for any other purchase you make with your Amazon card.

Moreover, there is no annual fee associated with this credit card, so you can take advantage of all of its benefits. However, it is preferable that you already have an Amazon Prime membership before applying for this card. This is because you can make the most of the cash back rewards and other benefits the Amazon card provides.

However, keep in mind that you need a very high credit score to qualify for this Amazon credit card. For example, you will have better chances to get approved if you have a credit score ranging from good to excellent. Therefore, check your score before you try to apply for this excellent Amazon credit card.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

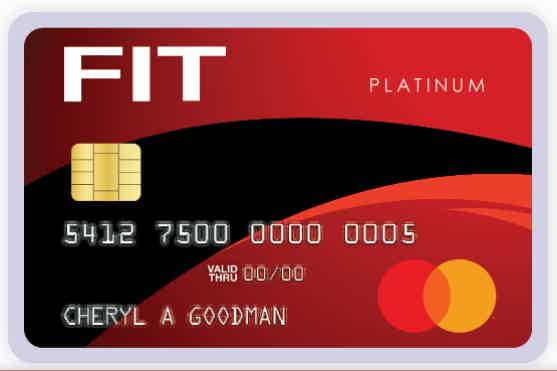

Fit Mastercard Credit Card

If you’re looking for an easy way to improve your credit score, the Fit Mastercard may be just what you need! The application process is simple and quick – approval will allow fraud liability coverage at no cost. In addition monthly accesses of FREE reports about where exactly are strengths (or weaknesses) in terms on finances with major bureaus like Experian, Equifax, or TransUnion. The issuer also reports all monthly payments to the three credit bureaus.

The Fit card is a great choice for those who need financial help in their personal life. The benefits of this particular credit card are related to re-establishing your finances or if you have bad credit and debt, it can be an option worth considering as well!

There are a lot of fees to pay when getting this card, but don’t worry because it’s not really about the rewards and bonuses. The best thing you can do is just use your credit score as an opportunity for improvement!

The Fit Card is a credit card that does not require you to have an excellent score. The company accepts people with bad-to fair scores, so even if your own personal FICO score falls between 300 – 670 there’s still hope! And don’t worry about being denied because they also offer applications for those without any history on their accounts or cards in order to make sure everyone gets equal treatment at application time.

Benefits of the Amazon Prime Rewards Visa Signature Card

- Relatively high cash back rewards of 5% back for Amazon purchases (with Prime membership) and 2% cash back for purchases made at drugstores, gas stations, and restaurants.

- You can get 1% cash back on every other purchase you make.

- There is no annual fee and no foreign transaction fees.

- You can choose an intro APR bonus as a new cardholder.

Benefits of the Fit Mastercard card

- Available to people with bad or no credit history.

- Reports all payments to the three main credit bureaus.

- $0 fraud liability.

Disadvantages of the Amazon Prime Rewards Visa Signature Card

- You need a Prime membership to get all the best perks this card offers.

- There is no way for you to transfer your points to other programs.

Disadvantages of the Fit Mastercard Card

- There is no welcome bonus for new cardholders.

- You need to have Apple Pay and Apple products, or the rewards won’t be worth it.

Amazon Prime Rewards Visa Signature Card or Fit Mastercard Card: which you should choose?

It can be very easy to decide which one of these excellent credit cards you should choose. However, it is only easy if you like Amazon or need to repair damaged credit rates. To get the Amazon Prime Rewards card, you need a good/excellent credit score. Therefore, the Fit Mastercard can help you get there with responsible use.

But, if you are still unsure about which card to choose, we can help you with a different option. So, check out our post with a full review of the Citi Rewards+® credit card!

Citi Rewards+® credit card full review

If you want a rewards credit card that offers bonus points on groceries, gas, and other expenses, the Citi Rewards+® may be a good fit!

About the author / Victória Lourenço

Reviewed by / Aline Barbosa

Senior Editor

Trending Topics

How to join Merrill Edge investing?

Get investments choices with no commission fees and no account minimum at Merrill Edge investing. Learn how to join today!

Keep Reading

Car warranty: is it worth it and what is a good price?

If you are buying a car, your mind probably wandered around the question: Is it worth getting a car warranty? Find out here!

Keep Reading

JetBlue Flight Deals review: from flights to hotel stays!

If you're looking for a great way to save on your next vacation, you can read our JetBlue Flight Deals review to learn about this airline!

Keep ReadingYou may also like

GO2bank Checking application: how does it work?

Need some help applying for the GO2bank Checking and earning up to 7% cashback? Our guidepost can walk you through every step of the way. Read on!

Keep Reading

Apply for the Delta SkyMiles® Reserve American Express Card

Are you looking for an incredible travel credit card? If so, read our post about the Delta SkyMiles® Reserve American Express Card application process!

Keep Reading

Chime Credit Builder Visa Credit Card application: how does it work?

Like everything on the Chime Credit Builder Visa card, the application process is simple, easy, and efficient. If that's something you appreciate on a credit issuer, you're going to love this credit card.

Keep Reading