Loans (US)

Accion Opportunity Fund review: overcome obstacles and access opportunities

In the Accion Opportunity Fund review, you will learn how it works and how you can access multiple resources to grow your small business.

Accion Opportunity Fund: up to $100,000 with flexible terms

Accion Opportunity Fund (AOF) is a non-profit lender that helps small businesses to overcome obstacles and access opportunities.

The loans offered are customizable, and repayment terms are flexible enough to fit your needs and goals.

How to apply for the Accion Opportunity Fund?

Learn how the Accion Opportunity Fund application works so you can get the funds you need to overcome obstacles holding your business back.

| APR | As low as 5.99% |

| Loan Purpose | Business capital |

| Loan Amounts | From $5,000 to $100,000 |

| Credit Needed | All credit scores are considered |

| Terms | It depends on your offer |

| Origination Fee | Not disclosed |

| Late Fee | Not disclosed |

| Early Payoff Penalty | None |

Also, the AOF client base is mostly composed of diverse customers, including over 90% women, people of color, and people with low-to-moderate income.

How does the Accion Opportunity Fund work?

Accion Opportunity Fund has been active for 25 years on the market and mostly attends diverse and minority communities.

It is a non-profit lender, and it has invested $516 million to help small businesses to overcome obstacles and access opportunities.

The lending options offered feature flexible repayment schedules to fit your needs. Also, AOF provides amounts that range from $5,000 to $100,000.

Although it doesn’t disclose all associated fees, the APR can be as low as 5.99%. In addition, all histories and credit scores are considered in the application.

In summary, this lender offers two types of loans including the Southern Opportunity Resilience (SOAR) Fund for small businesses impacted by the pandemic period and a Progress Loan, a lending option provided by investments from American Express.

Furthermore, Accion Opportunity Fund offers multiple resources to help you grow your business, including a Coaching Hub and Learning Programs.

In general, AOF loans are fantastic options for small businesses run by diverse people and minorities who usually don’t get access to traditional lenders, especially when it comes to low-to-moderate income.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Accion Opportunity Fund benefits

Accion Opportunity Fund differs from traditional lenders in almost all. Besides it is a non-profit lender, it offers a complete package of products and services at a very low cost.

Also, the terms and conditions are flexible enough to fit your needs and goals.

Pros

- AOF offers loans for small businesses, especially those run by diverse people and minorities with low-to-moderate income;

- It provides a whole package of services, including Coaching Hub and Learning Programs;

- It offers loan amounts ranging from $5,000 to $100,000, with flexible repayment schedules and APR as low as 5.99%;

- It counts on investments from American Express;

- The application process is simple, easy, and fast.

Cons

- It doesn’t disclose all fees associated with the loans.

How good does your credit score need to be?

Since Accion Opportunity Fund loans are provided for small businesses, especially those run by minorities with low-to-moderate income, all credit scores are considered in the application.

How to apply for Accion Opportunity Fund?

Learn how to apply for an Accion Opportunity Fund if you are interested in getting funds to overcome obstacles and grow your small business.

How to apply for the Accion Opportunity Fund?

Learn how the Accion Opportunity Fund application works so you can get the funds you need to overcome obstacles holding your business back.

About the author / Aline Augusto

Reviewed by / Aline Barbosa

Senior Editor

Trending Topics

What is a medical credit card?

What is a medical credit card? Read this post to learn all about it, and check the list of the best ones available for you to choose from.

Keep Reading

What a point means in the stock market: we explain everything

Do you want to keep up with a company's stock changes? You'll need to understand what a point means in the stock market! So, read on!

Keep Reading

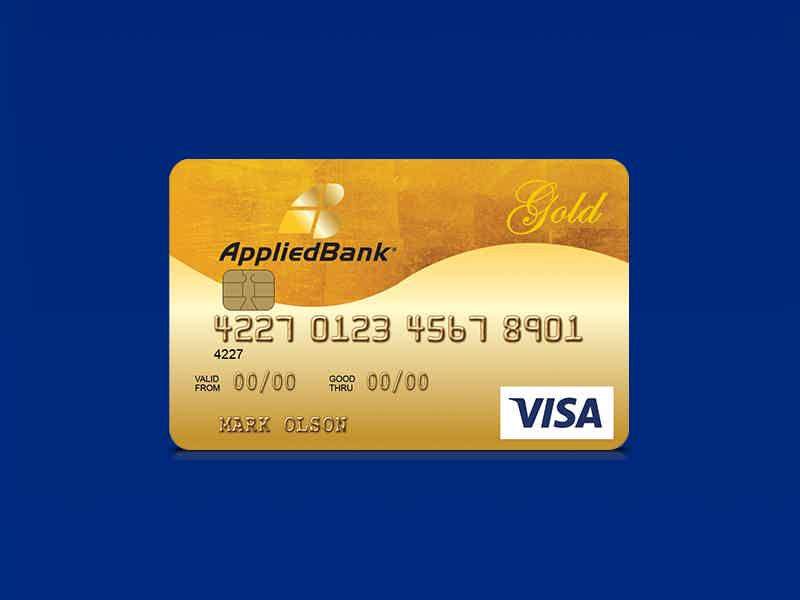

Applied Bank® Secured Visa® Gold Preferred® Credit Card full review

Looking for a card that doesn’t require a credit check? Then, keep reading our Applied Bank® Secured Visa® Gold Preferred® Credit Card review!

Keep ReadingYou may also like

Learn how to download the Capitec Bank App

Need help with the Capitec Bank App download? This quick guide will show you how! Keep reading!

Keep Reading

WWE Netspend® Prepaid Mastercard®: apply today

Apply for the WWE Netspend® Prepaid Mastercard® and simplify your finances - 0% APR and amazing benefits! Read on and learn more!

Keep Reading

How to buy cheap Southwest Airlines flights

Discounted tickets are available online, and in this post, you'll find out how to buy cheap Southwest Airlines flights. With our help, you can ensure you're using the right steps when booking to get a great deal. Keep reading!

Keep Reading