Finances (US)

785 credit score: is it good for your finances?

Learn what a 785 credit score means to your personal finances. Check out your possibilities and how to improve your score in case you don’t have a good one.

Learn what a credit score of 785 means to your personal finances

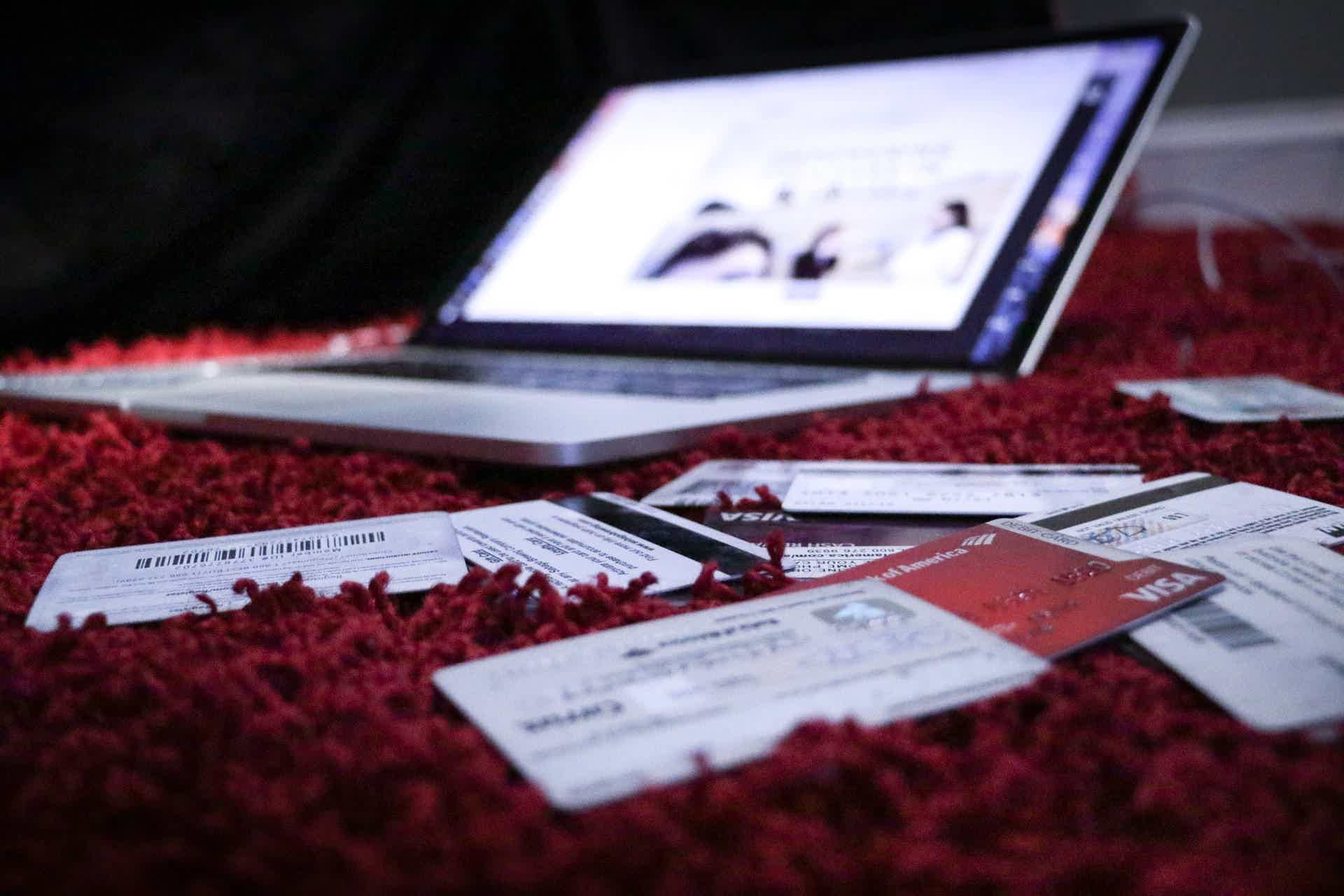

Learn what a 785 credit score punctuation means to your personal finances and how to improve it! When you start checking your finances, you face some reports from credit bureaus, such as Experian, Equifax, and TransUnion.

Basically, those companies check the consumer’s credit history, including debt, number of credit cards, open accounts, repayment history, and many other elements.

After checking all those factors, they calculate a score called a credit score. This punctuation varies from 300 to 850, and it measures the creditworthiness of a consumer.

But it is not just that. The credit score is also considered when you ask for a loan, apply for a new credit card, and more.

Companies, banks, and lenders take all of your credit histories into consideration, so the higher your credit score is, the better.

For example, if you have a score considered good, you can access better financial products and services with lower interest rates and higher rewards, amounts, and terms.

Therefore, it is pretty essential you learn about the credit scores and follow tips to improve yours.

Milestone® – Less Than Perfect Credit Considered

Build credit and achieve your goals with a Milestone® Mastercard® – Less Than Perfect Credit Considered! Check out how the application process works!

Is 785 a good or bad credit score?

The credit score, also called FICO® Score, ranges from 300 to 850. From 300 to 579 is considered very poor. So, probably, some factors are negatively affecting your punctuation.

From 580 to 669 is considered fair.

Also, from 670 to 739, we have a good credit score. In this range, you may get better financial products and services.

From 740 to 799, we have a very good score. So, 785 is pretty good. With this score, you will definitely find better opportunities on the market, such as rewards credit cards with no annual fee, loans with lower interest rates and longer terms for repayment, and much more.

According to reports, 25% of Americans have a very good credit score.

Finally, from 800 to 850 is considered the top-tier or exceptional. With this last range of scores, you will find and be offered the best on the market.

Usually, with an exceptional credit score, you get premium credit cards and all the exclusivity you want.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

What kind of loan can you get with this score?

If your credit score is 785, which means it is considered very good, you may have options and opportunities with lower interest rates and better terms and conditions.

A mortgage loan requires at least a 620 credit score, according to studies. So, with a 785 punctuation, you would get an average rate of approximately 2.36% based on a 30-year term.

In comparison, that percentage would increase approximately 0.20% for the range of 670 to 739.

If you think 0.20% is almost nothing, you can calculate the variation of interest rate you would pay by the end of 30 years, on a total amount of $400,000, for example.

The difference would be approximately $48,567. That’s a lot if you think in terms of the amount paid in interest rate in 30 years that you could save.

Also, that applies to most personal loans and auto loans.

Furthermore, if we consider credit card options, you would definitely be approved for most available on the market, including those with great rewards, no annual fee, and lower interest rates.

Is 785 a good credit score to buy a house?

Since 785 is a good credit score, you most likely be approved for better mortgage options to get your house.

You would get lower interest rates with a good amount and flexible terms as described above. According to studies and reports, the average difference between the interest rate paid for those with a good credit score and those with a very good credit score is more than 0.20%.

So, you can buy your house and access better deals in order to do that.

How to improve your credit score: simple tips

Now you know the importance of achieving a 785 credit score. To hold very good credit means to get better options for loans, credit cards, and more.

So, follow our tips to start building a very good credit score from today!

Be aware of your credit score

The first tip is just simple like that. You can’t design a plan to improve your credit score if you don’t even know what it is.

So, access the credit bureaus and learn about your score and reports.

Pay your bills on time

The best way to improve your credit score is by paying your bills on time. So, set up autopay, for example. Or organize your bills in a way to pay earlier. In that case, you can avoid interest and have a good payment history on the reports.

The best your consumer behavior, the higher your score will be.

Be careful when applying for multiple credit cards

When you apply for a credit card, the process might impact your credit score. When you apply for multiple, the credit bureaus see it as a potential failure on payments.

Unless you are super organized, holding many credit cards can be useful. However, it is proven that people with a lot of cards might spend more and get their finances disorganized over time.

So, be careful!

Apply for a credit card that helps you build or rebuild your credit score

Instead of applying for many credit cards, you should consider applying for one that helps you with your personal finances.

There are many options available on the market that helps you improve your credit. And we have chosen one for you! Check out the Credit One for Rebuilding Credit full review!

Credit One Bank® Platinum for Rebuilding Credit

Check out our Credit One Bank® Platinum Visa for Rebuilding Credit review, and learn about its benefits, such as cash back and more!

About the author / Aline Augusto

Reviewed by / Aline Barbosa

Senior Editor

Trending Topics

Quick Cash Capital review: working capital solutions to small businesses

Check out the Quick Cash Capital review article and learn how to get great working capital solutions to grow and expand your small business.

Keep Reading

How to apply for the U.S. Bank Cash+® Visa® Secured Card?

Check how to apply for U.S. Bank Cash+® Visa® Secured Card, so you can start building your credit while enjoying cash back.

Keep Reading

U.S. Bank Cash+® Visa® Secured Card full review

Check out the U.S. Bank Cash+® Visa® Secured Card review article and learn how to build credit while enjoying rewards on eligible purchases.

Keep ReadingYou may also like

Alaska Airlines Visa® Credit Card review

Find out how you can get an annual companion fare on flights to the lower 48 states and Canada in the Alaska Airlines Visa® Credit Card review.

Keep Reading

How to buy cheap Allegiant Air flights

Are you ready to soar in the sky? Uncover exclusive discounts and know how and where to buy cheap Allegiant air flights. You can get flights from $34.

Keep Reading

Apply for the Chase Slate Edge℠ and Improve your Finances!

Need to consolidate your credit card balances or make a big purchase without paying interest? If so, you might want to apply for the Chase Slate Edge℠!

Keep Reading