Reviews (US)

How to apply for the Milestone® Mastercard® – Less Than Perfect Credit Considered?

The Milestone® Mastercard® - Less Than Perfect Credit Considered card application is straightforward. Also, you can pre-qualify quickly and easily without worrying about harming your credit score. Learn how to apply for it!

Milestone® Mastercard® – Less Than Perfect Credit Considered application

The Milestone® Mastercard® – Less Than Perfect Credit Considered application is straightforward. Also, Milestone® is specially made for those with a poor credit score who struggle to apply for credit cards.

Because it is an unsecured card, it doesn’t require a security deposit. Also, since it reports to all three major credit bureaus, you can start building your credit history if you use it responsibly.

In addition, having your own Mastercard® means that you have in your hands one of the most widely accepted cards all across the U.S.

Furthermore, it offers a warranty, protection, and an online platform where you can manage and track your account 24/7.

And the best part is that you can pre-qualify for a card without impacting your credit score!

How to apply for a Milestone® Mastercard®?

Milestone® Mastercard® card doesn’t require a security deposit and helps you build your credit. Learn how to apply for it today!

Apply online

You’ll find the application process easy and fast-paced. So, you can enjoy all of this great card’s benefits right away!

The first step is to access the Milestone® website and click on Quick Pre-Qualification, Get Started, or Pre-Qualify Today.

It won’t impact your credit score, and it takes a few seconds to receive your offer. Also, if you have already received an offer in your mail, you can enter it right away.

Then, fill in your personal and basic information.

After receiving an offer, you can enter it to get your card.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Apply using the app

Apply using the website as described above. After getting the approval, you can also manage and track your account online 24/7.

Milestone® Mastercard® – Less Than Perfect Credit Considered vs. Chime® Credit Builder Card

On one side, there is the Milestone® Mastercard®, an unsecured credit card that charges an annual fee and interest. However, it doesn’t require a minimum deposit.

On the other side is the Chime® Credit Builder Card, a secured card that requires a Chime account and a security deposit. But note that it doesn’t charge any fees or interest.

Check out the comparison below to decide which one is the best for your financial needs!

| Milestone® Mastercard® – Less Than Perfect Credit Considered Card | Chime® Credit Builder Card | |

| Credit Score | Poor/Bad | No credit history required |

| Annual Fee | $35 – $99* *Dependent on credit worthiness | $0 |

| Regular APR | 24.9% | N/A |

| Welcome bonus | N/A | N/A |

| Rewards | N/A | N/A |

How to apply for a Chime® Credit Builder card?

Build your credit with no fees or interest with Chime® Credit Builder Card! See how it works to get yours!

About the author / Aline Augusto

Reviewed by / Aline Barbosa

Senior Editor

Trending Topics

GO2bank Review: is it trustworthy?

Read this GO2bank Review, and enjoy opening a mobile account with no fees and a complete package of advantages. Start building credit now!

Keep Reading

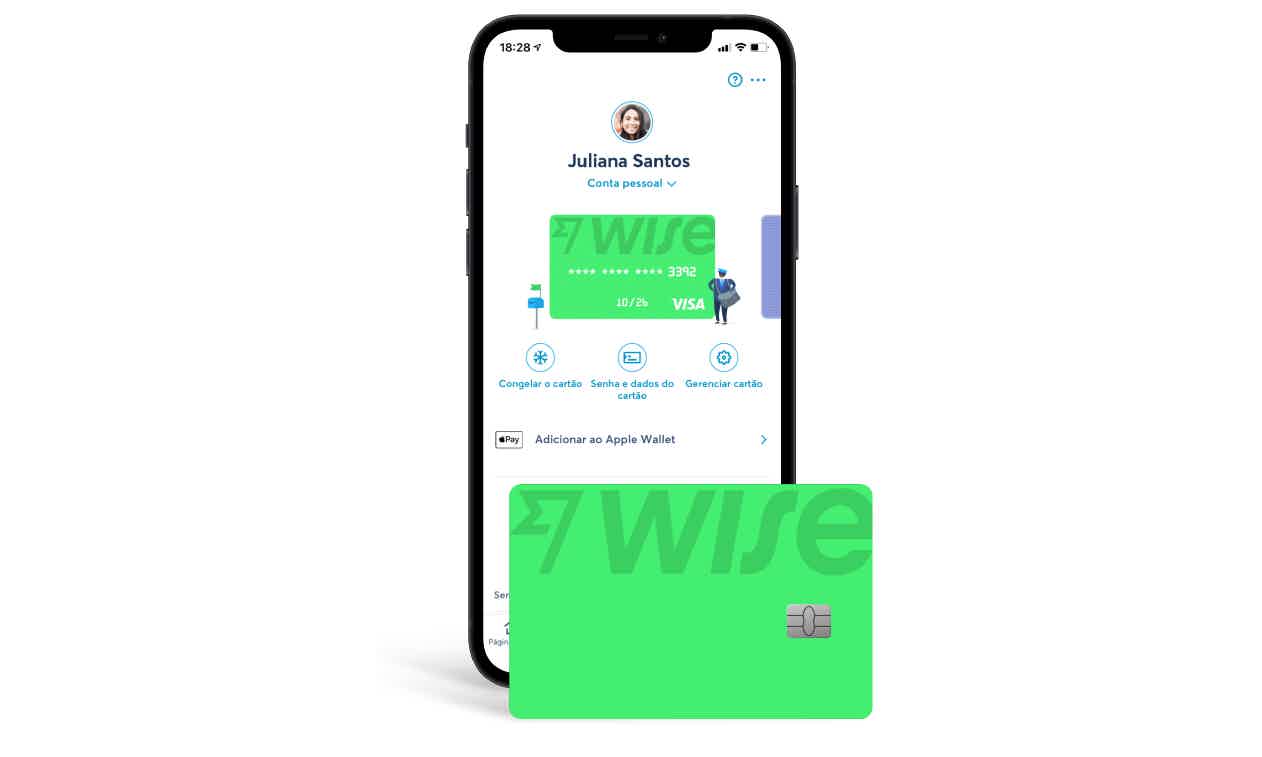

Wise Debit Card full review

In this Wise debit card review article, you will learn how it works and the benefits of having a cheap borderless account! Check it out!

Keep Reading

Serve® American Express® Reloadable Prepaid Card review

Learn about a card that offers free reloads at over 45,000 locations. Check out the Serve® American Express® Reloadable Prepaid Card review!

Keep ReadingYou may also like

$0 annual fee: Apply for Navy Federal Platinum Credit Card

Apply for the Navy Federal Platinum Credit Card to enjoy a 0.99% intro APR offer on your purchases and balance transfers. Read on and learn more!

Keep Reading

Capital One Savor Cash Rewards Credit Card vs. Capital One Walmart Rewards® Mastercard®: card comparison

Unsure if you should apply for the Capital One Savor Cash Rewards Credit Card or Capital One Walmart Rewards® Mastercard®? Check out this comparison to see which offers the best benefits for you!

Keep Reading

Luxury Titanium or Luxury Gold card: choose the best!

If you have any doubt about deciding upon the Luxury Titanium or Luxury Gold card, there is something you can be sure about: they are a VIP experience. That's the major benefit of Luxury Cards. But of course, you need more details to decide. Please keep reading to get them.

Keep Reading