Loans (US)

What you need to know about credit scores and loans

What you need to know about credit scores and loans is here! Learn definitions and how your credit score and reports affect the chances of loan approval.

Applying for a loan: credit score and other evaluation criteria

What you need to know about credit scores and loans! Find out how your credit score affects the odds of you getting approved for a loan!

Every time you apply for a loan or any other line of credit, an evaluation is done. The criteria gather several factors, including credit scores and reports.

It is crucial to understand all about that because it reflects your financial health and the odds of getting approved when applying for what you need.

How to choose a Credit Card?

Do you know how to choose a credit card? Check out the 5 easy steps we have prepared for you so you can choose the best credit card for you!

Therefore, learn definitions and how your credit score affects the chances of you getting the approval you want for a loan or other type of line of credit.

Keep reading to stay tuned about what you need to know about credit scores and loans.

Facts about loans

A loan is a financial contract between two parties, usually one being an individual and the other being an institution like a bank.

The individual borrows an amount of money from the institution, and both parties set the terms and conditions.

The amount of money borrowed is not equal to the amount to be repaid since there will be interest charged during the period of time settled.

Many people go after this type of line of credit to consolidate debt, accomplish a dream like renovating a home, pay off a vacation or a wedding, or any other personal reason that can be a goal or a need.

In fact, more individuals apply for loans than are able to save money to accomplish something they want without requiring borrowing from lenders.

However, not many people can actually get approved for a loan. That’s why it is essential to understand the evaluation criteria in a loan application.

It involves several factors that impact the decision of an institution to approve or not the loan you need. But, there is one factor that is one of the most important and usually is underrated.

Check out all about it right below!

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Facts about credit scores

A credit score is a number that shows the creditworthiness of a consumer. Usually, it ranges from 300 to 850, with 300 being bad and 850 being excellent punctuation.

The higher your score is, the better your chances to get approved for amazing lines and types of credit, including loans and credit cards.

A credit score is calculated based on reports that show how your behavior as a consumer is. Including late payments, delinquencies, number of credit accounts active or not, and several other information.

So, in general, a credit score reflects your credit history. And how responsible you are with your finances, especially when it comes to debt payoff.

That’s why the credit score is one of the most important factors that impact a financial institution’s decision of approving a consumer’s loan or not.

Keep reading to learn more about what you need to know about credit scores and loans. And find out the odds of getting a loan with different credit scores, from poor scores to the good ones.

How your credit score affects the odds of you getting approved for a loan

Basically, a credit score shows the risk of a consumer paying or not a debt. The lower the punctuation is, the higher the risk.

On the other hand, the higher the score is, the lower the risk is.

Therefore, your creditworthiness is measured by your credit score.

Of course, that’s not the only factor that impacts a decision of you getting the approval you want, but it is definitely a big one.

Normally, a credit score of at least 700 is likely to be approved for a loan with reasonable terms and conditions.

Although the market features some lenders that focus on bad credit scores, the terms and conditions are not the best. Also, the interest rates will be higher.

Since bad credit scores are risky, the lenders that provide cash to borrowers with low punctuation need to cover the risk by being less flexible with the conditions and more expensive about the terms.

On the other hand, people with at least good credit scores are likely to get better deals and fast approval when applying for a loan, no matter the purpose.

Therefore, it is crucial to be aware of your credit score and history. Furthermore, it is essential to put into practice some ways of building credit.

There are many tools available on the market to help you with that. Typically, credit cards might be a hand regarding this issue.

However, it is also important to understand your financial situation before applying for a card. Credit cards work like loans. So, all explained in this article applies to cards, too.

Recommendation: 8 best credit cards for building credit scores fast

Credit cards might be excellent tools that help you build or rebuild your credit score and history. However, you must be careful about selecting a new addition to your wallet.

Although they might help you with your financial health. They also could become an obstacle on your path since the chances of getting stuck in debt are high if you have no control of your finances.

But, making sure you are aware of your situation and behavior as a consumer, choosing the right credit card might lead you to a good credit score.

Some cards are amazing when it comes to building credit fast.

So, now learn more about which ones are the best! We have prepared a list of the eight cards that are better evaluated among several factors.

Find out more about it in the next post!

8 best credit cards for building credit score fast

Check out the 8 best credit cards for building credit scores fast, read the reviews, and choose which one fits your needs and goals better!

About the author / Aline Augusto

Reviewed by / Aline Barbosa

Senior Editor

Trending Topics

Chase Ink Business Preferred® Credit Card review

Are you looking for a card to earn points for your business? Read our Chase Ink Business Preferred® Credit Card review to learn more!

Keep Reading

Stocks as an Investment: a guide for beginners

Is the stock market right for you? Come learn how to invest in stocks. We want to help you with five simple steps!

Keep Reading

Progressive Home Insurance review: comprehensive protection

Check out the Progressive Home Insurance review article and learn how to protect your property with comprehensive and affordable coverage.

Keep ReadingYou may also like

Learn to apply easily for the Flagstar Bank Mortgage

Are you ready to apply for your mortgage through Flagstar Bank? Great! Enjoy low minimum down payments and fast process!

Keep Reading

The hidden cost of banking: 6 common bank fees you may not know about

It's no secret that banks charge fees. But what many people don't know is why they do it. This post will explain the common bank fees and why they're necessary.

Keep Reading

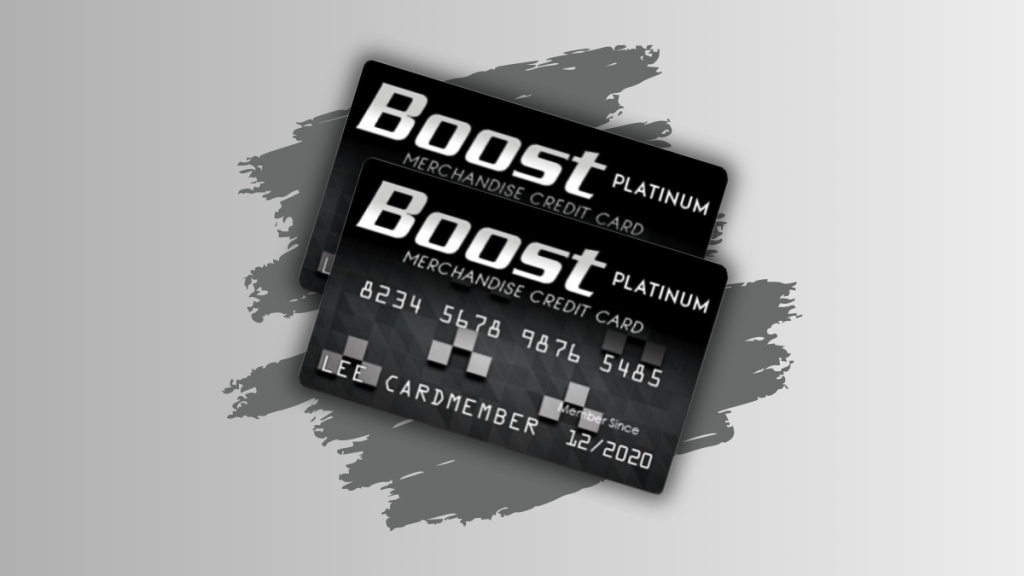

Application for the BOOST Platinum Card

Learn how to apply for the BOOST Platinum Card, perfect for consumers looking for an easier way to shop. This card offers no interest on purchases, a $750 credit limit, and no credit checks.

Keep Reading