Finances (US)

Thecreditapplication.com review: B2B credit application!

Are you looking for a platform to solve your B2B credit management deals? Read our Thecreditapplication.com review to learn how this platform works!

Thecreditapplication.com: grow your business with B2B credit! Read this full review to see how

Have you ever heard about B2B credit? Well, if you have a company, you should know all about it. There are platforms to help you with this type of negotiation! You’ll love to read our Thecreditapplication.com review!

How to join Thecreditapplication.com?

Get the B2B credit application management you need by reading our post and learning how to join Thecreditapplication.com!

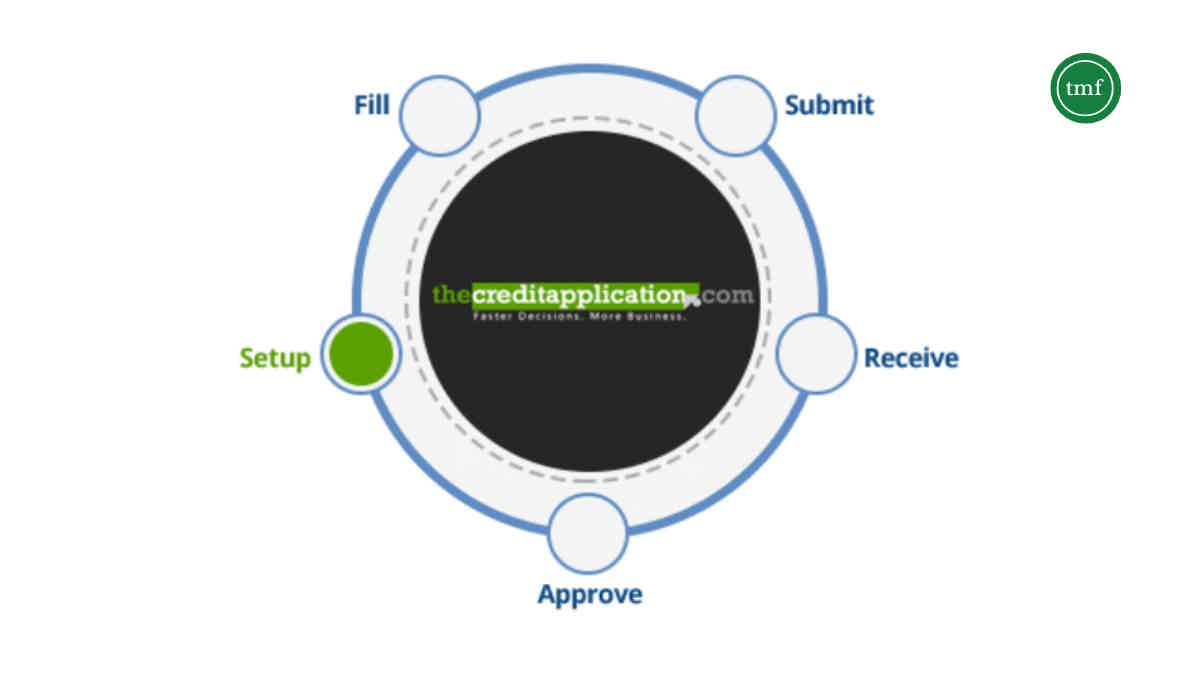

With Thecreditapplication.com, you can make credit applications for your business quickly to complete your business with customers as quickly as possible.

Moreover, with B2B credit, you can make agreements with another business to sell and get your payments later. However, if you try to do it alone, you may get into trouble if your customer doesn’t pay.

So, you can use a platform like Thecreditapplication.com to help you in this process! Therefore, you can read on our Thecreditapplication.com review to learn more about this B2B credit platform!

Full review: How does Thecreditapplication.com work?

If you have a business and need to perform B2B credit management to have your customer relationship run smoothly, you’ll need a manager to help you.

Thecreditapplication.com is a platform developed by Emagia, which is a finance solutions provider. And they create other platforms to help you with your finances.

So, with Thecreditapplication.com, you can get a platform to help you manage the cash flow, deal with customer defaults, get intelligence reports to review, and more!

Also, you can even find different plans depending on your business type. So, if you only need one online credit application form with a limit of 50 applications per month, you can get the Premium plan.

However, if your company makes more credit applications, you can get the custom plan to get multiple credit application forms and other reports.

And if you only need a few applications of up to 10 per month, you can get the free plan!

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Thecreditapplication.com benefits review

As we mentioned, you can get many benefits from this credit application platform. Thecreditapplication.com works with leading credit bureaus, such as Experian, to give you the best services.

However, you should know about this platform’s downsides before you join in. For example, there is not much information online about this platform. And you should pay attention to every step before you join.

So, if you want to learn the pros and cons before deciding if this is the right platform for you, read our list below at this Thecreditapplication.com review!

Pros

- Different plans to choose from according to your company type: free, premium, or custom.

Cons

- The website doesn’t show much information about the specifics of each plan, only what they promise will be delivered.

How good does your credit score need to be?

There is not much information on the official website about the credit score needed to join this platform. You should contact them to learn more about this type of information.

How to join Thecreditapplication.com?

You can join Thecreditapplication.com online with just a few clicks. But remember that you must choose the right plan and read all the terms and conditions before completing the application.

How to join Thecreditapplication.com?

Get the B2B credit application management you need by reading our post and learning how to join Thecreditapplication.com!

About the author / Victória Lourenço

Reviewed by / Aline Barbosa

Senior Editor

Trending Topics

How do you get the Stratus Rewards Visa Card?

Learn how you can apply for the Stratus Rewards Visa Card and take your credit card game to the next level!

Keep Reading

BankProv Review: is it trustworthy?

BankProv features solutions for businesses, including cryptocurrency and other innovative products and services. Read the BankProv Review!

Keep Reading

What is a store card? A complete guide on how to use it

What is a store card? A complete guide on how to use it, how it works, and the differences between a store card and a regular credit card.

Keep ReadingYou may also like

First Progress Platinum Prestige Mastercard® Secured Credit Card application

If you need a credit card with benefits and for those with bad credit, check out our post to learn about the First Progress Platinum Prestige Mastercard® Secured Credit Card application!

Keep Reading

Student credit cards for no credit: top 4 options

Find out the difference between a regular and a student credit card for no credit. See the benefits of student cards to pick one. Keep reading!

Keep Reading

Learn to apply easily for the Avant Personal Loan

The guide will tell you how to apply for an Avant Personal Loan. If you have bad credit, don't worry! You can still get approved. Read on to learn more!

Keep Reading