Credit Cards (US)

SavorOne Rewards for Good Credit card full review

Capital One features one more credit card full of rewards and no annual fees. Check out the SavorOne Rewards for Good Credit review!

SavorOne Rewards for Good Credit card

If you have a good credit rating, then you may be eligible for the SavorOne Rewards for Good Credit from Capital One. This card offers exclusive rewards and benefits for people who have a strong credit history. So if you’re looking for some extra perks, the SavorOne card is a great option. Plus, it comes with no annual fee. So why not check out our SavorOne Rewards for Good Credit review? You may be surprised at how much value this card can offer.

| Credit Score | Good – Excellent |

| Annual Fee | $0 |

| Regular APR | Purchase APR: 29.74% (Variable); Balance Transfer APR: 29.74% (Variable); Cash Advance APR: 29.74% (Variable). |

| Welcome bonus | None |

| Rewards | Unlimited 3% cash back on eligible purchases |

How to get a SavorOne Rewards for Good Credit?

SavorOne Rewards for Good Credit is a low-cost credit card full of rewards. See how to apply for it!

How does the SavorOne Rewards for Good Credit card work?

If you enjoy entertainment, dining, streaming services, this card might be a great option for you. Since it rewards these categories, you can earn cash back while purchasing your favorite stuff.

And, it doesn’t end there. You get 1% cash back on all other purchases. Plus, the rewards don’t expire, and there is no minimum amount for redemption.

Capital One also provides you with the regular benefits, protection, and assistance, as follows:

- Extended Warranty

- Travel Accident Insurance and Assistance

- Concierge Service

- Security and Account Alerts

- $0 Fraud Liability

- Credit reports by CreditWise

- 24/7 Customer Service

- Capital One Mobile App

If you think that’s all, you are mistaken. This credit card also gives you the opportunity to experience special culinary, sports, and music events.

And all of it with no annual fees.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

SavorOne Rewards for Good Credit benefits

Besides the traditional benefits offered by Capital One, this SavorOne credit card offers the following rewards:

- Unlimited 3% cash back on eligible purchases at grocery stores, streaming services, entertainment, and dining categories;

- 1% cash back on other purchases;

- 8% cash back when purchasing tickets at Vivid Seats.

Also, it doesn’t charge any foreign transaction fees like other similar credit cards.

So, it is a great rewards card with low costs. Good, right?

However, it requires at least a good credit score for the application process.

Pros

- Great and flexible rewards program

- No annual fees

- No foreign transaction fees

Cons

- It requires a good credit score

How good does your credit score need to be?

It is recommended at least a good credit score to apply for this credit card. It is better if you have an excellent score, though.

How to apply for a SavorOne Rewards for Good Credit?

SavorOne Rewards for Good Credit is definitely a great credit card, but you should note that it requires a good credit score, at least. If you have the minimum punctuation, go for it and click on our next post!

How to get a SavorOne Rewards for Good Credit?

SavorOne Rewards for Good Credit is a low-cost credit card full of rewards. See how to apply for it!

The content on this page is accurate as of the posting date; however, some of the offers mentioned may have expired.

For Capital One products listed on this page, some of the above benefits are provided by Visa® or Mastercard® and may vary by product. See the respective Guide to Benefits for details, as terms and exclusions apply.

About the author / Aline Augusto

Reviewed by / Aline Barbosa

Senior Editor

Trending Topics

Boom crypto review: how does it work? Get Started With Boom Today!

Check out this Boom crypto review article so you can get a complete analysis of the smart contract-based first self-burning cryptocurrency.

Keep Reading

Indigo® Mastercard® with Fast Pre-qualification review

Read this Indigo® Mastercard® with Fast Pre-qualification review post to understand how this card can help you build or rebuild your credit!

Keep Reading

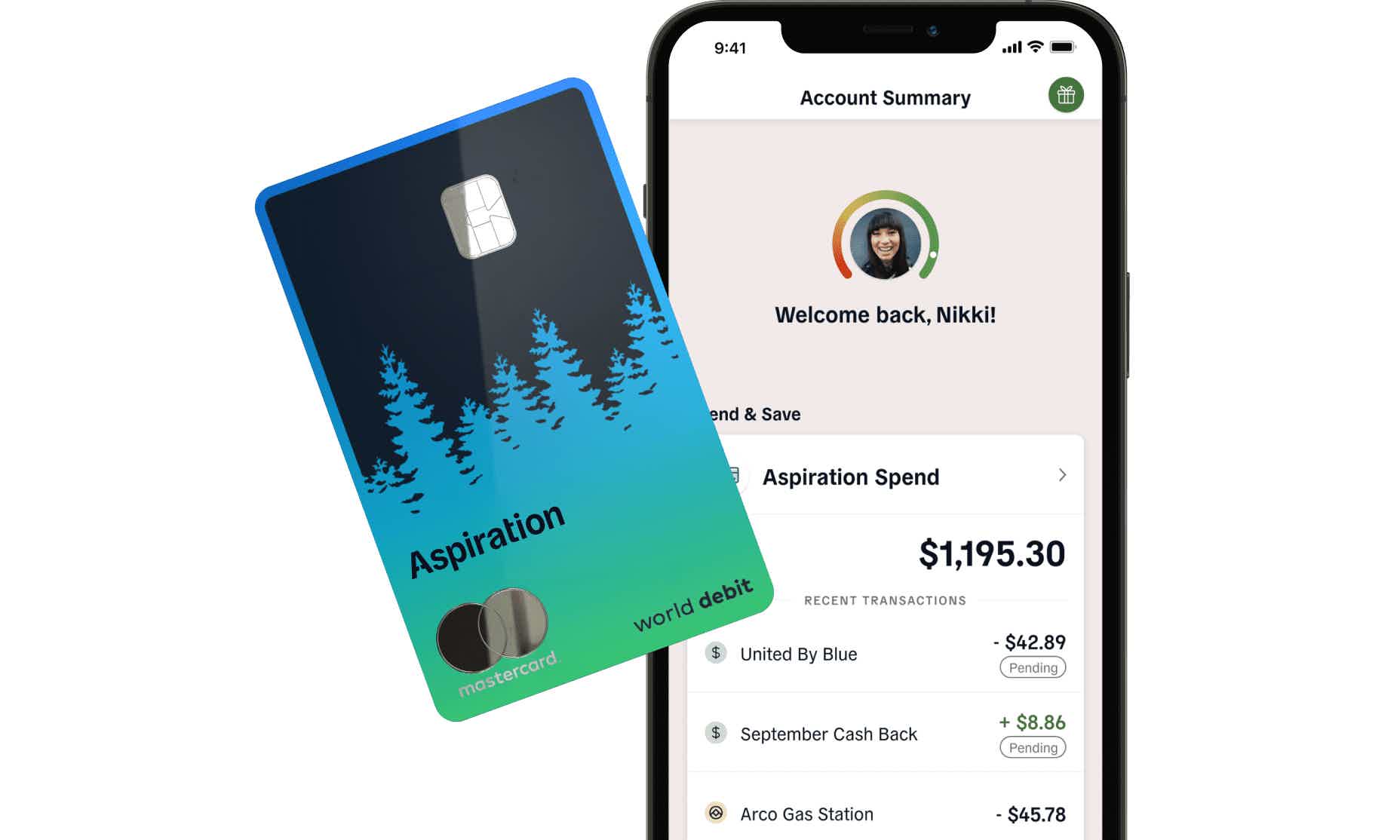

How to apply for the Aspiration Spend & Save™ Account?

The Aspiration Spend & Save™ Account is a hybrid account with perks and environmental conscience. Learn how to apply for it!

Keep ReadingYou may also like

Aspire® Cash Back Reward Card application: how does it work?

Are you wondering if you qualify for an Aspire® Cash Back Reward Card? You've come to the right place. Learn the ins and outs to apply for this card. Read on!

Keep Reading

What is a CD: how it works, interest and more!

If you're new to investments, take a look at Certificates of Deposit. It is an excellent option to play safe but earn more than a savings account. Keep reading to learn more about CDs.

Keep Reading

Luxury Titanium or Luxury Gold card: choose the best!

If you have any doubt about deciding upon the Luxury Titanium or Luxury Gold card, there is something you can be sure about: they are a VIP experience. That's the major benefit of Luxury Cards. But of course, you need more details to decide. Please keep reading to get them.

Keep Reading