Loans (US)

Regional Finance Personal Loans review: loans for all credit scores

Check out the Regional Finance Personal Loans review and learn how you can borrow up to $25,000 to cover an unexpected or expected expense.

Regional Finance Personal Loans: up to $25,000 for whatever you need

Let’s review Regional Finance Personal Loans. They offer a personalized touch to lending services. The company provides access to solutions for whatever you need them to.

How to apply for the Regional Finance Loans

Check out how the Regional Finance Personal Loans application works so you can borrow up to $25,000 to cover expected or unexpected expenses.

Also, Regional Finance offers many physical branches in 16 states with hundreds of specialists to help you figure out which loan conditions might be good for you!

| APR | Not disclosed |

| Loan Purpose | Personal (travel expenses, auto repair costs, home furniture, home appliances, debt consolidation, holiday expenses, and much more) |

| Loan Amounts | From $600 to $25,000 |

| Credit Needed | All credit scores are considered |

| Terms | Not disclosed |

| Origination Fee | Not disclosed |

| Late Fee | Not disclosed |

| Early Payoff Penalty | Not disclosed |

Now, keep reading to learn how it works and how you can get up to $25,000 to cover whatever expense you might have.

How does the Regional Finance Personal Loans work?

Regional Finance is a good option for those who need fast cash with flexible requirements. Also, it might be a great choice for those who have less-than-perfect credit and those who want personalized help to get a loan.

The loan amounts vary from $600 to $25,000. Although this lender doesn’t disclose all fees, rates, and terms, it allows you to prequalify for free with no impact on your credit.

As the lending solutions and offers are personalized, you must start a prequalification or qualification to check out the rates, terms, and fees that will be applied to your loan.

Furthermore, Regional Finance differs from many other lenders when it provides more than 350 physical locations in 16 states for you to get the help you need through the process.

In addition, the company offers flexibility when it comes to the reason why you need a loan.

Therefore, you can get it for whatever you want, including debt consolidation and unexpected, or expected expenses like travel purchases or car repair costs.

Usually, it takes a couple of days to get the funds you need. As soon as are prequalified, you can call Regional Finance or even go to the nearest local branch to leave the documents required.

Then, your funds will be released as soon as you agree to the final terms and conditions.

The process can also be done through the Regional Finance online platform.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Regional Finance Personal Loans benefits

Regional Finance offers loans ranging from $600 to $25,000 for different purposes, including debt consolidation, home & car repairs, emergency expenses, vacation & holiday expenses, pet & medical expenses, and much more.

Also, the lender provides personalized customer service with more than 350 physical branches across 16 states. Let’s highlight the pros and cons of this Regional Finance Personal Loans review.

Pros

- It offers loan amounts ranging from $600 to $25,000;

- It provides more than 350 physical locations with specialists to help you through the lending process;

- It features flexibility for loan purposes;

- It offers personalized terms and rates according to your finances and conditions;

- Payment processes are easy, and you can choose the best option for you, including doing it online, by mail, by phone, or at your neighborhood branch.

Cons

- It doesn’t disclose rates, fees, and terms unless you apply for a loan.

How good does your credit score need to be?

Fortunately, all credit scores are considered in the application.

How to apply for Regional Finance Personal Loans?

If you want to find out more about how the application works, keep reading our next post that explains it all for you!

How to apply for the Regional Finance Personal?

Regional Finance Personal Loans: up to $25,000 for whatever you need!

About the author / Aline Augusto

Reviewed by / Aline Barbosa

Senior Editor

Trending Topics

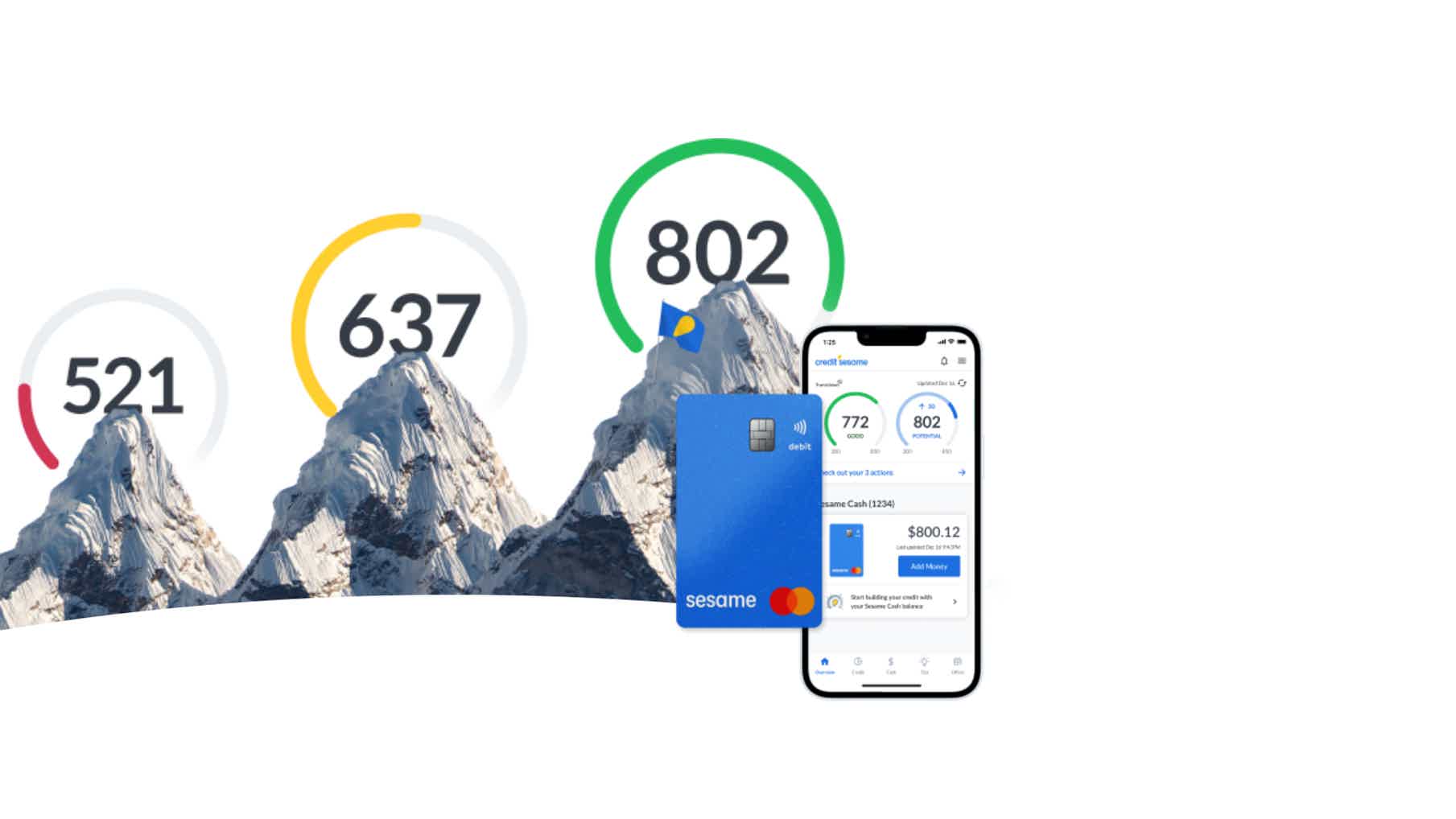

Credit Sesame Credit Score & Monitoring full review

Check, understand, and monitor your credit score through an excellent online platform. Read our Credit Sesame review to learn more about it!

Keep Reading

American Express® High Yield Savings account full review

American Express® features an account with a high rate for your savings. Check out the American Express® High Yield Savings account review!

Keep Reading

Best secured cards after bankruptcy: rebuild credit!

Life after bankruptcy doesn't have to be hard. You can read our post to see a list of the best secured cards to use after bankruptcy. Read on!

Keep ReadingYou may also like

Tomo Credit Card review: Build Credit with no interest

Accessible to all credit types, Tomo Credit Card offers 0% purchase APR, and benefits on popular brands. Keep reading and learn more!

Keep Reading

Women, Infants, and Children (WIC): nutritional support for families

The Women, Infants and Children program provides pregnant women and new mothers with infants under five years old with supplemental foods. Read on to learn more about this program!

Keep Reading

Can you get a credit card with no job?

Looking for a credit card without having to depend on regular employment? Read our guide, and discover how you can get a credit card with no job!

Keep Reading