Reviews (US)

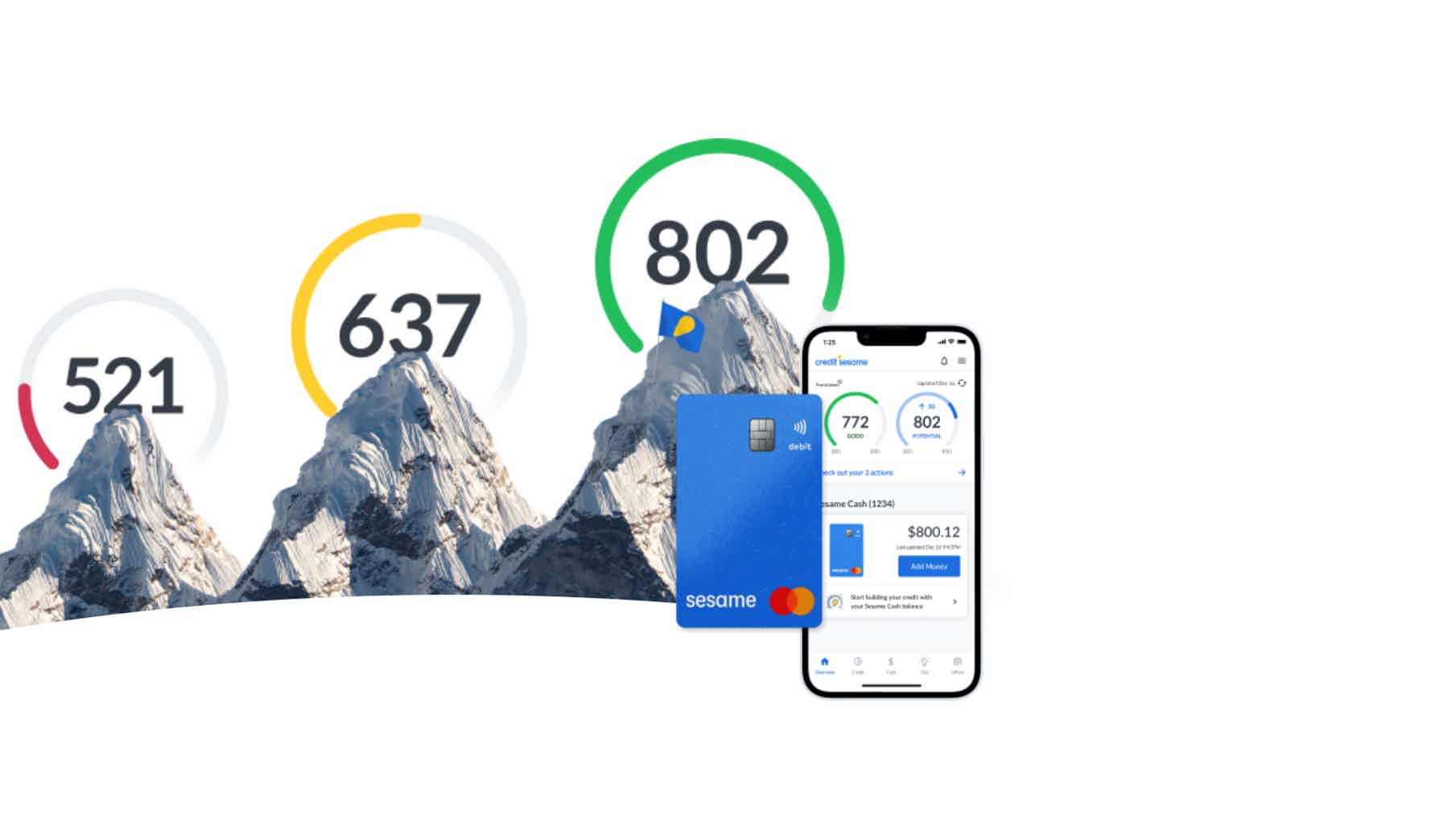

Credit Sesame Credit Score & Monitoring full review

Understanding your credit score is a fundamental and significant part of financial education. Check out the Credit Sesame review and how this tool can help you with that.

Credit Sesame: free credit score, free credit report card, and free credit monitoring alerts!

Check out the Credit Sesame review and how this tool can help you!

Not all companies really offer free tools for credit monitoring. Most of them actually give a free-trial period, and suddenly you are paying for their services because you forgot to cancel the signature.

It is not the case with Credit Sesame. This online platform offers free access to your TransUnion credit report and credit score.

So, you get monthly updates and reports from your TransUnion credit score, Daily monitoring and alerts, identity theft insurance, and more.

Check out the summary below.

| Credit Tools | Credit Score checking, Report, Monitor, alerts, debt, assets, online platform, mobile app, graphs |

| Security & Protection | Identity Theft Insurance for free |

| Identity Theft Insurance Limit | $50,000 |

| 30-day Trial Available | It is free since day 1 |

| Free Report Offered | TransUnion |

| Monthly Price | $0 |

| Mobile App | Yes |

How to join Credit Sesame?

Monitor your credit score through Credit Sesame! Check out how to join it online.

How do the Credit Sesame Credit Score & Monitoring work?

Credit Sesame is an online platform that lets you check and monitor your credit score. You must be wondering why this is important for you and why you should consider this a tool to enhance your finances.

Well, if you understand how it works, you can make better financial decisions to increase your credit and get better deals with banks and other financial institutions.

The platform features a dashboard where you can get a complete overview of your credit score, including information like credit history, total balance, interest rates, and monthly payments from your debts.

In a tab called “My Finances”, you can submit all your credit cards and bank accounts information.

In order to allow you to check, monitor, and report your credit score, Credit Sesame uses TransUnion, one of the largest credit reporting bureaus.

Also, Credit Sesame allows you to set up alerts for you to know when your credit score changes. So, you can always be aware and protected against identity theft or fraud.

In addition, you get $50,000 as Identity Theft Insurance.

You can set your goals on the dashboard and follow your credit score and financial situation to make wise decisions with all those features.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Credit Sesame Credit Score & Monitoring benefits: is it legit and accurate?

It is legit, but you need to know that it uses one major credit bureau to check information. On the other hand, you can get a complete dashboard with all the essential financial information to make decisions.

And it is free, unlike other credit companies that monitor credit scores.

Pros

- It provides an excellent dashboard where you can link your financial information;

- It allows you to check, monitor, and set up alerts for your credit score changes;

- Plus, it offers premium products if you want to pay for them;

- It is free when you sign up for the basic features;

- It provides $50,000 as Identity Theft Insurance.

Cons

- Some great features are paid.

Is Credit Sesame really free?

All the basic information is free. The dashboard allows you to access premium products, but they must be paid for.

How to join Credit Sesame?

If you want to join Credit Sesame to enjoy all its free services, check out our next post!

How to join Credit Sesame?

Monitor your credit score through Credit Sesame! Check out how to join it online.

About the author / Aline Augusto

Reviewed by / Aline Barbosa

Senior Editor

Trending Topics

TAB Bank Review: is it trustworthy?

Check out this TAB Bank Review article and learn how you can establish solid financial planning with its great full-service online banking.

Keep Reading

How to apply for the Valero® Credit Card?

If you need a card to help you get fuel discounts and rewards for no annual fee, learn how to apply for the Valero® Credit Card!

Keep Reading

How to apply for the BankAmericard® Credit Card?

See how to apply for a BankAmericard® Credit Card and enjoy low costs at a 0% introductory APR period for purchases and balance transfers.

Keep ReadingYou may also like

What is a reverse mortgage and should you get one?

Find the answer to "What is a reverse mortgage?" and understand if it's right for you. Read on to learn about this unique type of loan.

Keep Reading

Visa vs. Mastercard: are they really different?

If you're thinking about which credit card to apply for, here's a comparison of the two most popular networks in the world: Visa vs. Mastercard. Check it out to see which one is for you!

Keep Reading

Flagstar Bank Mortgage review: how does it work and is it good?

Looking for a mortgage? Check out our review of Flagstar Bank Mortgages - mortgages in all 50 states with fast appliction process.

Keep Reading