Read on to learn how this credit card can save you interest while allowing you to earn rewards at very affordable fees.

Westpac Low Rate Credit Card – choose to earn up to $250 cashback within five months or get 0% p.a. for 28 months on balance transfers.

Westpac Low Rate Credit Card suits those looking for a free interest period. The card lets you choose between a welcome bonus of up to $250 cashback within five months or a 0% p.a. for 28 months on balance transfers. Not only that, but also a free interest period of up to 55 days on purchases, rewards, and a spectacular mobile app.

Westpac Low Rate Credit Card suits those looking for a free interest period. The card lets you choose between a welcome bonus of up to $250 cashback within five months or a 0% p.a. for 28 months on balance transfers. Not only that, but also a free interest period of up to 55 days on purchases, rewards, and a spectacular mobile app.

Westpac Low Rate Credit Card lives up to its name. This Mastercard offers low rates on purchases, cash advances, and balance transfers, as well as gives you the opportunity of building solid finances through the help of a spectacular mobile app. Learn more about the main benefits!

Westpac Low Rate Credit Card is suitable for those who are looking for low rates on purchases, balance transfers, and cash advances. The card lets you choose the offer that works better for you as a welcome bonus. But it does not end there; you can enjoy an additional free interest period along with rewards, protection, and an amazing mobile app that helps you manage your finances.

Yes, you can add one additional cardholder. In fact, there is no extra cost when doing it. The additional cardholder must be at least 16 years old.

The SmartPlan offers you the possibility of spreading large purchases into regular installments that you can afford. In summary, this program helps you achieve big dreams by lowering costs at reasonable rates and affordable and fixed installments.

Westpac gathers several security measures to protect your credit card and your personal information. The protection includes your online account. Also, it provides the Westpac Added Online Security and the Fraud Money Back Guarantee to ensure protection against unauthorized transactions.

If you are interested in applying for a Westpac Low Rate Credit Card, learn how the process works!

How to apply for the Westpac Low Rate Credit Card?

Check out the eligibility requirements before starting to apply for the Westpac Low Rate Credit Card, and earn cashback as a welcome bonus.

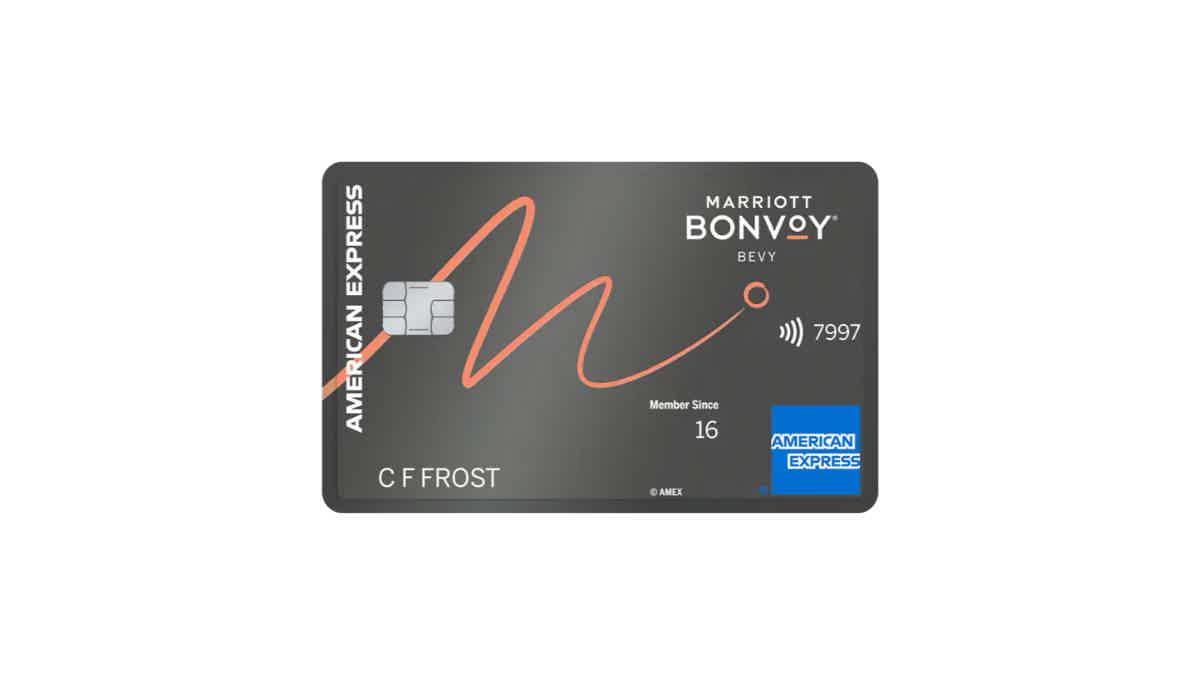

Now, if you are more interested in a travel card, check out how to apply for a Marriott Bonvoy Bevy™ American Express® Card!

How to apply for the Marriott Bonvoy Bevy™ card?

Learn how to apply for Marriott Bonvoy Bevy™ American Express® Card and enjoy earning 125,000 Marriott Bonvoy® Bonus Points within 3 months.

Trending Topics

Woolworths Personal Loan full review: Easy loans!

Are you looking for a lender with flexible options and no prepayment or monthly fees? Read our Woolworths Personal Loan review!

Keep Reading

How to apply for a Bank of Queensland Low Rate Card?

Do you need a card with low rates and no p.a. periods? If so, read on to learn how to apply for the Bank of Queensland Low Rate Credit Card!

Keep Reading

How to apply for the BOQ Platinum Visa Credit Card?

If you're looking for a new balance transfer credit card, read on to learn how to apply for the BOQ Platinum Visa Credit Card!

Keep ReadingYou may also like

How to stop smartphone hackers? Follow these 10 FBI tips

Learn how to protect yourself from hackers with these 10 FBI tips. With cybercrime on the rise, it's more important than ever to be vigilant about your online security.

Keep Reading

Chase Bank Account application: how does it work?

Chase Bank is one of the most popular banks in the United States. They offer a wide variety of accounts and services to their customers. If you are interested in opening a Chase bank account, this guide will give you all the information you need to get started.

Keep Reading

What is credit card stacking and how to do it?

Would you like to optimize your credit cards rewards? You can do it with the credit card stacking method. Learn more about it by reading this article.

Keep Reading