Read on to see how this lender can help your business to grow.

Quick Cash Capital – working capital solutions of up to $500,000 with flexible terms and conditions for your small business to grow and expand.

Quick Cash Capital, or QCC, provides amazing working capital solutions for small businesses to grow, expand, cover their needs, and achieve goals. The solutions feature flexible terms & conditions, free quotes, early payoff discounts, and amounts that range from $20,000 to $500,000.

Quick Cash Capital, or QCC, provides amazing working capital solutions for small businesses to grow, expand, cover their needs, and achieve goals. The solutions feature flexible terms & conditions, free quotes, early payoff discounts, and amounts that range from $20,000 to $500,000.

Quick Cash Capital, or QCC, offers a wide range of amounts from $20,000 to $500,000 with flexible terms and conditions. Also, the company provides expert guidance with fast approvals and simple application processes. Check out the list of benefits before getting a free quote!

Quick Cash Capital provides two working capital solutions, the Small Business Finance and Merchant Cash Advance. In both cases, the amounts range from $20,000 to $500,000.

The application takes only a few minutes, and you can qualify in about ten minutes. After completing the process, the network of underwriters checks the information and approves your loan within some hours. Therefore, if all works well, you can receive your funds on the same day.

Yes, you can. Your creditworthiness matters in the application. However, Quick Cash Capital considers more factors in the process. Getting approved doesn’t depend exclusively on your credit score.

No, you don’t need a business plan or to load a lot of documents to apply for a working capital solution at Quick Cash Capital. Your business must be at least one year old, and your gross revenues need to be $120,000 per year or $10,000 per month over the last three months. The process only requires three months of bank statements rather than complex information.

If you like what you see here, learn how to apply for a Quick Cash Capital and get a financial solution for your business.

How to apply for the Quick Cash Capital review?

Quick Cash Capital offers working capital solutions for small businesses. Read the full review!

If you’d like a second option, check the following recommendation. QuickBridge also has loans for small businesses and can help you boost yours.

How to apply for a loan at Quickbridge?

Quickbridge offers many lending solutions for businesses. Check out how to apply!

Trending Topics

How to apply for the Citi Simplicity® Card?

Are you looking for a card to help you save money with intro APRs? If so, read our post to learn how to apply for the Citi Simplicity® Card!

Keep Reading

Capital One Venture Rewards Credit Card overview

Check out this Capital One Venture Rewards Credit Card overview to learn how you can have access to VIP travel benefits and more!

Keep Reading

Plasma crypto: how does it work? Get Started With Plasma Today!

Every investor has already thought about investing in digital coins. So, read this Plasma crypto review to decide if you should invest in it!

Keep ReadingYou may also like

How to buy cheap WestJet flights

Find out how to buy cheap WestJet flights on their website so that you can travel more and spend less! Night flights from $49.99! Read on!

Keep ReadingBusy Days, Easy Meals: Time-Saving Airfryer Recipes in Minutes!

Spend less time in the kitchen and create delicious meals with these quick and easy air fryer recipes. Learn how to use your air fryer to whip up a meal quickly!

Keep Reading

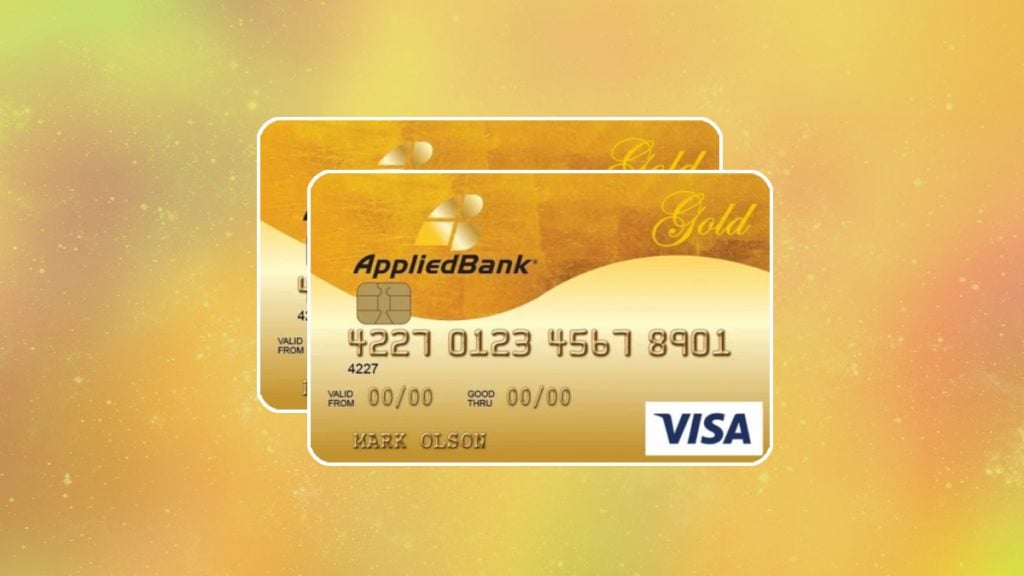

Applied Bank® Gold Preferred® Secured Visa® Card application: how does it work?

Wondering how to apply for the Applied Bank® Gold Preferred® Secured Visa® Card? Learn everything you need to know here, including application requirements.

Keep Reading