Read on to see how this savings account can help you build your future!

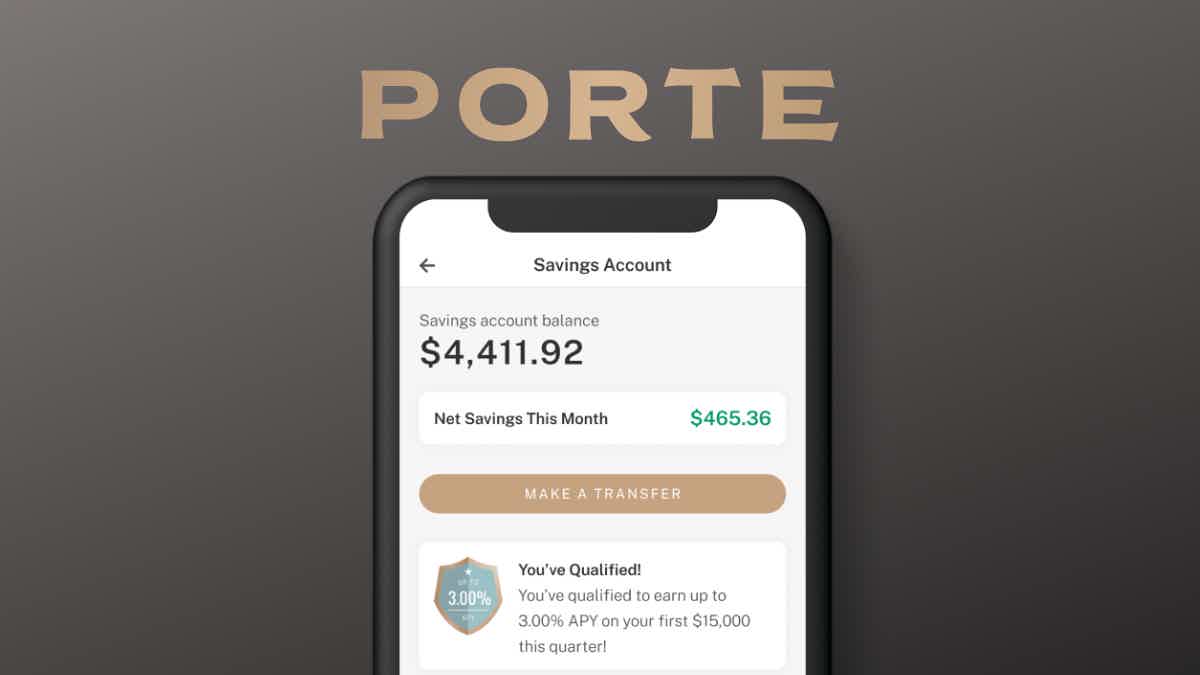

Porte Savings Account – earn up to 3.00% APY without worrying about monthly service fees and minimum balances.

Porte Savings Account is an amazing mobile banking service that gathers accessible technology with affordability. The account offers good interest rates, doesn’t charge any monthly service fees, and doesn’t require minimum balances, so you can build your future without worrying about high costs and bureaucracy.

Porte Savings Account is an amazing mobile banking service that gathers accessible technology with affordability. The account offers good interest rates, doesn’t charge any monthly service fees, and doesn’t require minimum balances, so you can build your future without worrying about high costs and bureaucracy.

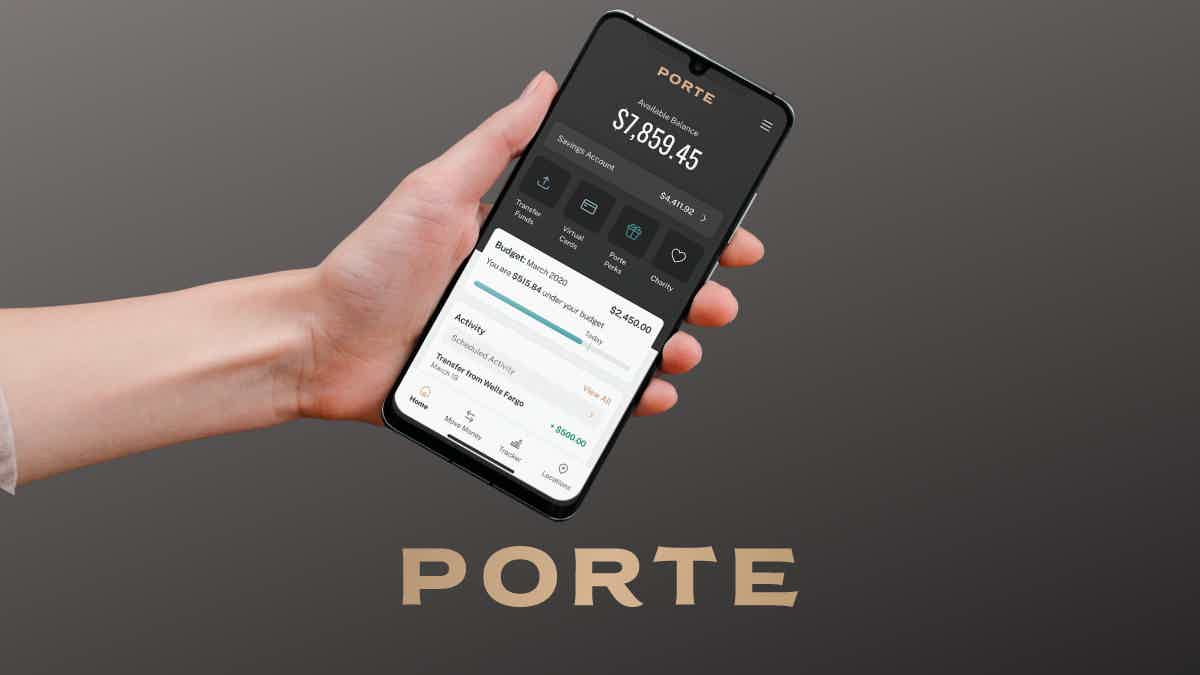

Porte Savings Account features a fantastic dashboard in which you can easily manage your finances at no cost. And you can access up to 3.00% APY if you meet some simple requirements. Check out the main benefits before applying to balance your decision!

Porte Savings Account offers up to 3.00% APY if you qualify for Bonus Savings. So, the requirements you must meet are: Open a Porte Savings Account; Set up a direct deposit and receive at least $3,000 in qualifying Direct Deposits during a calendar quarter; Complete 15 qualifying transactions through the card in the same calendar quarter. Then, you will be able to get one of the highest APY available, approximately 14 times the national average, on balances of up to $15,000.

Fortunately, Porte doesn’t require a minimum balance. So, you can save how much you want without worrying about it.

Yes, it is! You can feel peace of mind because your funds will be FDIC-insured.

Fortunately, Porte Savings Account doesn’t charge any monthly service fees. Therefore, you can start building your future without paying a high cost for it.

To open or apply for a Porte Savings Account you must be at least 18 years old and need to be a permanent resident or a U.S. citizen living in one of the 50 states or the District of Columbia.

If you are interested in applying for a Porte Savings Account, learn how the process works now!

How to apply for the Porte Savings Account?

Find out how easy it is to apply for a Porte Savings Account and start earning up to 3.00% APY at no monthly service fees (conditions apply).

Now, if you want to find out more about an alternative, check out the Upgrade Rewards Checking review and application!

How to apply for an Upgrade Rewards Checking?

You can apply for your Upgrade to Rewards Checking Account online and earn rewards at no fees. This post will tell you how to do it.

Trending Topics

How to apply for Bloomingdale’s American Express® Card?

Looking for a card with perks at Bloomingdale’s and no annual fee:? If so, you can read on to apply for Bloomingdale’s American Express® Card!

Keep Reading

How to choose a mortgage for first-time buyers!

You probably have questions if you’re about to get your first home. So, read on to learn about mortgage for first-time buyers!

Keep Reading

TJX Rewards® Platinum Mastercard® full review: 5% back!

Are you looking for a card with 5% rewards and discounts on TJ Maxx? If so, read our TJX Rewards® Platinum Mastercard® review!

Keep ReadingYou may also like

Navy Federal cashRewards Credit Card Review: $250 bonus cash back

Read our Navy Federal cashRewards Credit Card Review to discover if it fits your wallet. Earn cash back on all your purchases!

Keep Reading

How to apply and get verified on the Electro Finance Lease easily

Do you have bad credit and are in need of a new phone, laptop, or gaming console? Electro Finance Lease is here to help! They offer accessible applications and fast verification for those who need it. So what are you waiting for? Learn how to apply today!

Keep Reading

Axos Bank Rewards Checking Account Review: Earn Amazing Rewards

Axos Bank Rewards Checking Account is the perfect solution to simplify your finances - earn up to $300 welcome bonus!

Keep Reading