Read on to learn how this credit card might be a perfect tool for you to accumulate points while paying reasonable and competitive rates and fees.

Nectar Credit Card – earn 20,000 bonus Nectar points once spending £2,000 in the first three months of your Cardmembership.

Nectar Credit Card is an amazing AMEX choice for those looking to accumulate points to redeem at Nectar partners. You will earn up to 3X points on eligible purchases. Also, American Express waives the annual fee in the first year. Besides, you will earn 20,000 bonus Nectar points once spending £2,000 in the first three months of your Cardmembership.

Nectar Credit Card is an amazing AMEX choice for those looking to accumulate points to redeem at Nectar partners. You will earn up to 3X points on eligible purchases. Also, American Express waives the annual fee in the first year. Besides, you will earn 20,000 bonus Nectar points once spending £2,000 in the first three months of your Cardmembership.

Nectar Credit Card offers rewards, affordability, travel perks, experiences, a good welcome bonus, competitive rates, and much more. Besides, you can check your eligibility with no impact on your credit score. Before applying, check out all you will get by holding this great AMEX!

Nectar Credit Card is a great option for those who want to earn points on purchases and want to enjoy purchasing at Nectar partners. Also, the card waives the annual fee in the first year. Like other AMEX cards, this one offers travel perks, among other advantages for shoppers and travelers. So, if you want to get the whole experience, the Nectar Credit Card may be your next ally.

American Express offers different channels, so you can contact a specialist from wherever you are. Firstly, the official website offers Live Chat. You can also contact them using your mobile app. Secondly, you can call American Express by checking the back of your card for contact numbers.

Of course. American Express offers prequalification with no impact on your credit score. Therefore, you can check your eligibility within a few minutes before proceeding with an application.

Some of the eligibility requirements are: You must be at least 18 years old and living in the UK; You must not have a history of bad debt; You need to have a current UK bank or building society account. Other requirements apply. Then, check out the post on how to apply for a Nectar Credit Card to find out how the process works.

If you are interested in applying for a Nectar Credit Card, learn how the process works!

How to apply for the Nectar Credit Card?

Check out how to apply for a Nectar Credit Card and start earning up to 3X points on eligible purchases at no annual fee in the first year.

Now, if you are more interested in another AMEX card, check out how to apply for an American Express Platinum Cashback Everyday Credit Card!

How to apply: AMEX Platinum Cashback Everyday

It is time to learn how easy it is to apply for an American Express Platinum Cashback Everyday Credit Card and earn cashback on everything!

Trending Topics

Chase Freedom Flex℠ vs Chase Freedom Unlimited® card: Which is the best?

Do you need a card with valuable cash back rewards? Read more to know which one is best: Chase Freedom Flex℠ or Chase Freedom Unlimited®!

Keep Reading

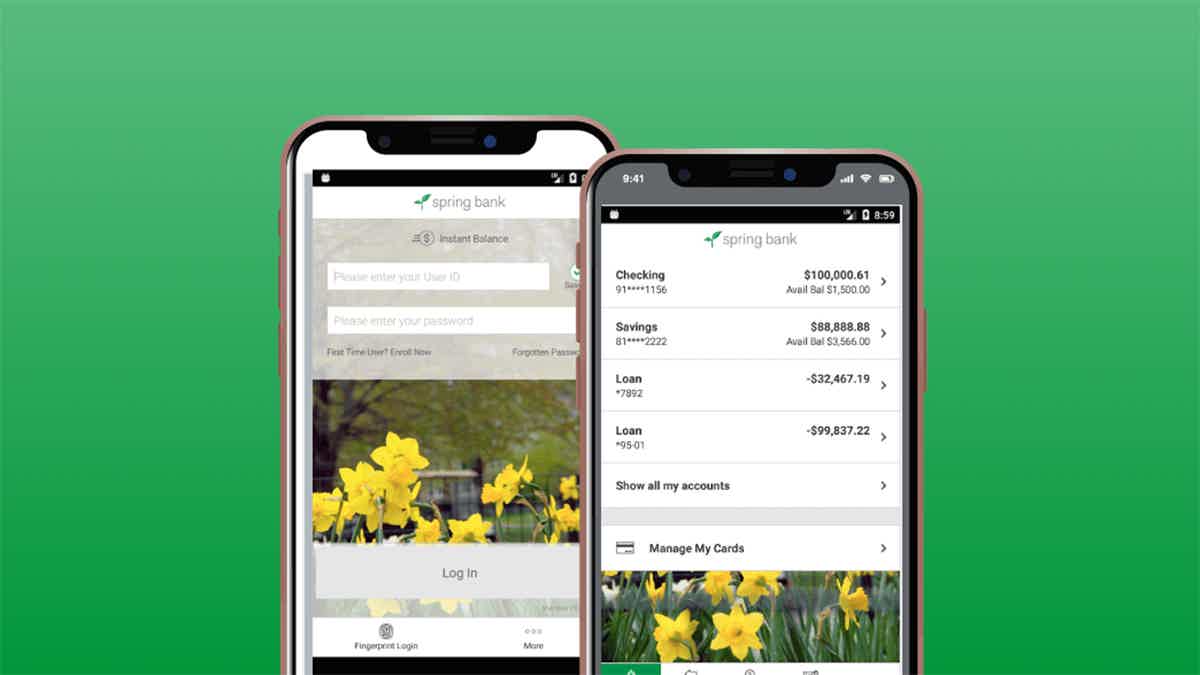

Spring Bank Review: is it trustworthy?

The Spring Bank review shows you how it can help you achieve sustainable financial health with services for personal and business banking.

Keep Reading

NFTs: everything you need to know!

Find out everything you need to know about NFTs here, what is it, and their potential implications for the future of digital assets!

Keep ReadingYou may also like

Walmart MoneyCard® review: Perfect for Walmart shoppers

The Walmart MoneyCard® is here to make your life easier and your shopping experience better! Read our full review to learn more.

Keep Reading

First Citizens Bank Secured Cash Back Credit Card application: how does it work?

Find out if you can apply for the First Citizens Bank Secured Cash Back Credit Card. Earn unlimited 1% cash back at eligible purchases!

Keep Reading

Application for the Luxury Gold card: how does it work?

If you need some extra luxury in your life, this card is for you. Consider applying for the Luxury Gold card and get the VIP experience you deserve. This article will show you how to get one.

Keep Reading