Get a high APY without having to worry about fees!

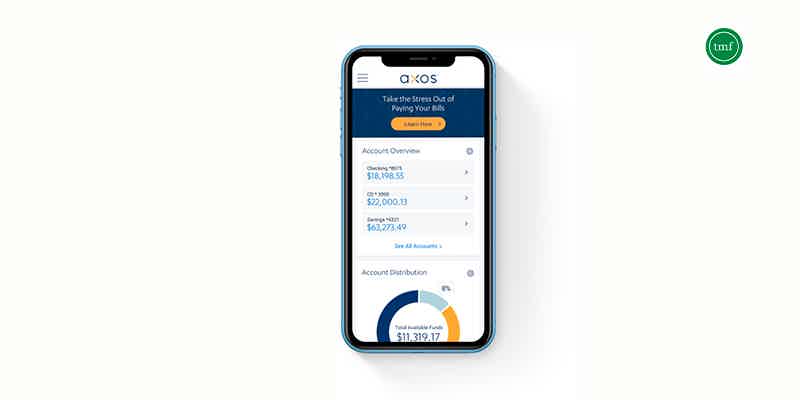

Axos Rewards Checking account, high-interest with easy management.

Axos Rewards Checking account features high-interest rates with no monthly maintenance fees or overdraft and NSF fees. Also, it doesn’t require a minimum balance. You can get unlimited domestic ATM fee reimbursements and free mobile deposits with this checking account.

Axos Rewards Checking account features high-interest rates with no monthly maintenance fees or overdraft and NSF fees. Also, it doesn’t require a minimum balance. You can get unlimited domestic ATM fee reimbursements and free mobile deposits with this checking account.

If you're looking for a rewards checking account, Axos' got one of the best in the market. You'll be able to earn a high APY without worrying about fees. Plus, you can easily manage your account on-the-go via mobile. Check some of the benefits the Axos Rewards Checking account has to offer:

Applying for the Axos Rewards Checking Account is simple, straightforward and only takes about 15 minutes. All you need to apply is your Social Security Number and a valid U.S. ID. If you apply by March 31, 2023, you can earn a $100 bonus by using the promo code RC100.

Yes! Axos uses top security measures to make sure your money is safe and secure. With the Axos Rewards Checking Account, you’ll have 2-step authentication, 128-Bit SSL encryption, anti-virus and malware protection on your devices, automatic logout and account monitoring.

With an Axos Rewards Checking Account, earning interest is as easy as using your account for money management. Direct deposits of $1,500 or more earn a 0.40% APY. Using your Axos Visa® Debit Card for a total of 10 transactions per month will earn an extra 0.30%. Managing your portfolio and using an Axos Invest Self Directed Trading Account will earn 0.20% each. And finally, if you have a personal loan with Axos, paying its balance every month earns 0.15%.

So if you are looking for an amazing way to save and make money, the Axos Rewards Checking Account is an incredible option. Check the following link to learn how to open your account and what to expect from the application process.

How to apply for an Axos Rewards Checking account?

High APY with an Axos Rewards Checking account! Learn how to apply!

But if what you’re after is a low-cost savings account, the Marcus Savings Account might be a better choice for your needs. Check the link below to learn what they have to offer and how you can open your account.

How to apply for a Marcus Savings account?

Get a high APY in savings with Marcus account by Goldman Sachs®! Check out how to apply for it!

Trending Topics

How to apply for an Alaska Airlines Visa® Credit Card?

See how to apply for an Alaska Airlines Visa® Credit Card and enjoy earning miles on every purchase you make while accessing valuable perks!

Keep Reading

Capital One Savor Rewards Credit Card full review

The Capital One Savor Rewards Credit Card features a good rate of cashback, and many other benefits. So, check out this card's full review!

Keep Reading

How to apply for the Journey Student Credit Card from Capital One Card?

Journey Student Rewards from Capital One card offers unlimited 1% cash back on all purchases without an annual fee. Apply for it right now!

Keep ReadingYou may also like

Cheap WestJet flights: low fares from $49.99

Keep reading and learn how to save big on your next flight with Westjet airlines! Enjoy the Lower Fare finder and save a lot on your next trip!

Keep Reading

Children's Health Insurance Program (CHIP): Find an Affordable Child Care

Learn about the Children's Health Insurance Program and how you can find low-cost or free child care with this government-funded program. Read on to learn more!

Keep Reading

3 Best student credit cards: choose yours!

In this article we point out the most important factors you should consider when choosing a student credit card, and give you 3 recommendations.

Keep Reading