CA

Quick Check™ Capital One® review: find the best card for you

If you want to protect your credit score when applying for a credit card, check out our Quick Check™ by Capital One® review to learn more about this credit checking service!

Quick Check™ by Capital One®: is it worth it?

If you are unsure about applying for a credit card because you don’t know much about your credit score, there is a solution. You can use credit check services that allow you to know if you will be approved for a credit card or not. So, read our Quick Check™ by Capital One® review to know about one of the best ones in the market!

How to apply for Quick Check™ by Capital One®?

Are you looking for a platform to check your credit score without harm? Read on to know how to use Quick Check™ by Capital One®!

With a good credit checking service, you can know for sure if you will be approved for a credit card you really want. Also, there is no harm to your current credit score during the process. So, keep reading our post to know more about this amazing credit checking service!

How does Quick Check™ by Capital One® work?

This credit checking service offered by Capital One® allows you to know with 100% sure if you will be approved for a certain credit card. Also, you don’t need to worry about your credit score because it won’t be harmed during the process.

Using a great credit checking service before you apply for a credit card can be one of the best ways to protect your credit score. Also, you can get very fast responses from Quick Check™. You can even get your evaluation response in as little as 15 seconds after you provide the necessary information.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Does Quick Check™ affect your credit score?

One of Quick Check™’s best features is that it does not impact your credit score during the analysis process. Also, you can find the card of your dreams with 100% certainty that you will get approved.

How to use Score360?

FreeScore360 can give you information about your scores from all three major bureaus. Read more if you want to know how to get this service!

Quick Check™ by Capital One® highlights

This credit checking platform offers amazing benefits for credit card users because they don’t have to worry about their credit score to apply for a card. For example, you can just provide some of your information to Quick Check™ and get a response in as little as 15 seconds.

This way, you will protect your credit score and be sure that you will get approved for the credit card you want. Also, if you get a response saying that you won’t get approved, you can find ways to increase your score and understand your financial situation.

Pros

- You can see the cards you are pre-approved for and choose the best one.

- The analysis process does not impact your credit score.

- You can apply for your card with easier steps after the analysis.

Cons

- You might get a bad response and not find the credit card you like.

How to use Quick Check™ by Capital One® before applying for a credit card?

Quick Check™ by Capital One has a perfectly easy-to-use platform. Plus, you can do it all online from your home. So, check out our post below to know all about how to use this credit checking platform!

How to apply for Quick Check™ by Capital One®?

Are you looking for a platform to check your credit score without harm? Read on to know how to use Quick Check™ by Capital One®!

About the author / Victória Lourenço

Reviewed by / Aline Barbosa

Senior Editor

Trending Topics

Auto Credit Express® review: what you need to know before applying

In this Auto Credit Express® review article, we will show you how you can get a new car even if you have a bad credit history. Check it out!

Keep Reading

How to get a CUMIS Home Insurance quote?

Check out now how the CUMIS Home Insurance application works and how your business can access comprehensive protection at reasonable prices.

Keep Reading

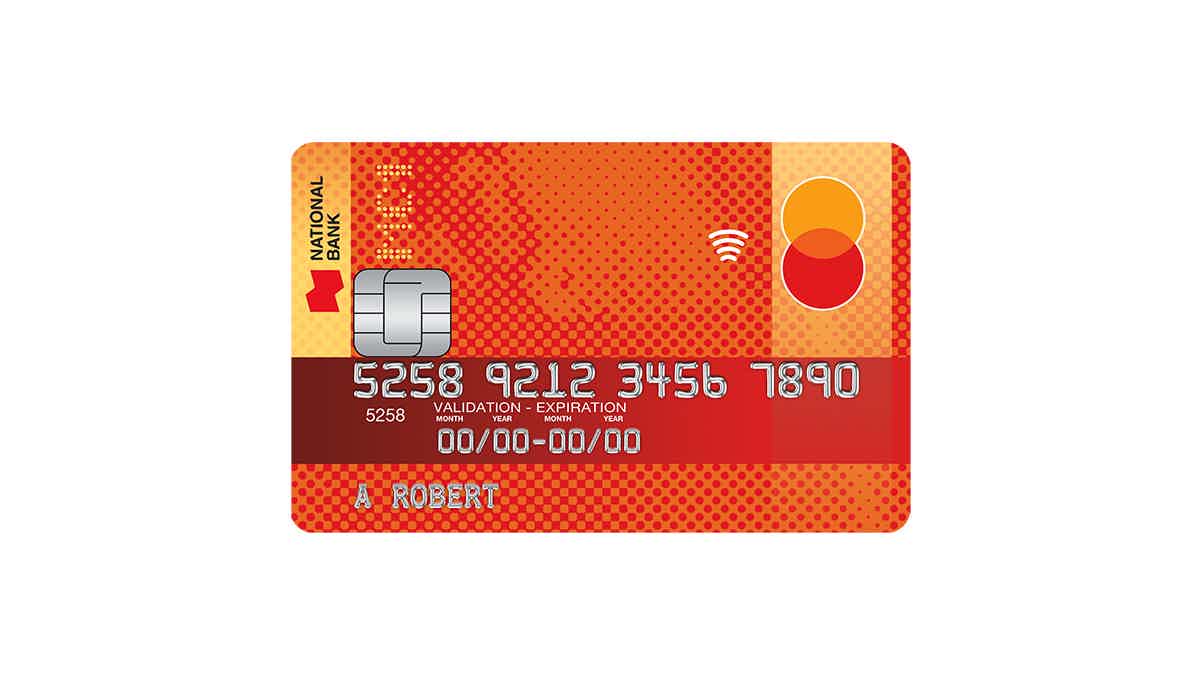

How to apply for the MC1 Mastercard® credit card?

An MC1 Mastercard® credit card provides you with a complete package of security features at a zero annual fee. Learn how to apply for it now!

Keep ReadingYou may also like

Learn to apply easily for the Honest Loans

Get a loan for an emergency, pay your bills, or even a personal goal. Learn how to apply for Honest Loans and understand how they can help you without paying for their service. Read on!

Keep Reading

Twitter shareholders filed a lawsuit against Elon Musk

Elon Musk’s Twitter deal started a new chapter last week when the company’s shareholders filed a lawsuit against the CEO of Tesla and SpaceX. Read more below!

Keep Reading

ClearMoneyLoans.com review: how does it work and is it good?

ClearMoneyLoans.com is a lending service that could help you get the money you need for your next project or purchase. But is it the best option for you? Check out this review to see how.

Keep Reading