Loans (US)

Prosper Personal Loans full review

Are you searching for a loan that makes it possible to do a home improvement or a debt consolidation? Then, check out all about the Prosper Personal Loans!

Prosper Personal Loans to accomplish some purchases

Prosper Personal Loans is an option if you need to borrow money to pay off some expenses. Such as home improvements, credit cards, debt consolidations, vehicle purchases, medical expenses, and more.

It offers amounts from $2,000 to $40,000, with terms that vary from 3 to 5 years. Also, it accepts fair credit scores. But, note that it charges an origination fee from 2.4% to 5%. See the summary right below.

| Apr | From 7.95% to 35.99% |

| Loan Purpose | Credit card & debt consolidation home improvements Large purchases, like vehicle medical & dental expenses |

| Loan Amounts | From $2,000 to $40,000 |

| Credit Needed | At least a fair credit score |

| Terms | From 3 to 5 years |

| Origination Fee | From 2.4% to 5% |

| Late Fee | 5% or $15, whichever is greater |

| Early Payoff Penalty | None |

How to apply for Prosper Personal Loans?

The Prosper Personal Loans make it possible for you to improve your home or pay off medical expenses. See how to apply for it!

All you need to know about the Prosper Loans

Although Prosper doesn’t require a perfect credit score for the application, it requires a credit history without bankruptcy in the past year.

Also, if you are looking for a small amount to borrow between $2,000 and $40,000, this loan might be for you.

But, you have to pay attention to the fees charged. For example, Prosper charges an origination fee and APR starting at 7.95%.

Moreover, there is no sign-up bonus or a discount.

The late fee is charged when borrowers make payments after 15 days from the due date. On the other hand, there is no prepayment or payoff penalty fee.

Finally, Prosper features some perks, such as flexible payment dates once a year and the Hardship program, where the company assists borrowers impacted by the pandemic.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Prosper benefits and more

Prosper is an option if you are searching for a small amount of loan in the short term.

Also, it is good for you if you have a fair credit score and don’t apply for loans with better amounts, terms, and fees.

Plus, you can check the rate without impacting your credit score.

Pros

- Requires at least fair credit score

- Good for home improvements and debt consolidation

- Flexible payment date

- No early payoff penalty

- Hardship program

Cons

- Charges origination fee

- No sign-up bonus

- Not available in West Virginia, Iowa and U.S. Territories

Why apply for Prosper Personal Loans?

The Prosper Loans are good for you if you have a fair credit score, need a small amount of money in the short term.

It is best for home improvements, debt consolidation, and medical expenses.

Who can apply for a loan at Prosper?

You need to fulfill some requirements for the application, as follows:

- Be 18 years old or more;

- Have a Social Security Number;

- Have an active checking or saving account;

- No bankruptcy in the past year;

- Earn more than $0 as annual income;

- Have a debt-to-income ratio of less than 50%;

- Have at least 3 open trades and no more than 5 inquiries in the past 6 months on the credit report.

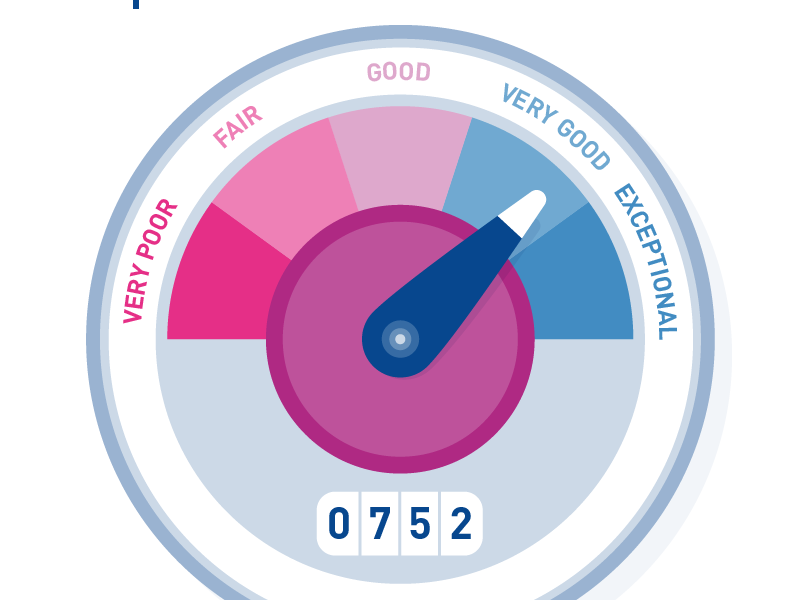

Credit score recommended

The credit score recommended for the application starts at a fair (about 600).

Learn how to apply for Prosper Loans

If you accomplish all the requirements above, you can apply for a loan at Prosper. Then, check out how to do it now!

How to apply for Prosper Personal Loans?

The Prosper Personal Loans make it possible for you to improve your home or pay off medical expenses. See how to apply for it!

About the author / Aline Augusto

Reviewed by / Aline Barbosa

Senior Editor

Trending Topics

How to start banking with Capital One Bank?

Capital One Bank offers many financial products and services with low fees and competitive rates. Check out how to start banking with it!

Keep Reading

How to increase your credit score

Know all the advantages, percentages, how to use it correctly and what you need to increase your credit score!

Keep Reading

Marriott Bonvoy Boundless® Credit Card full review: Free night award!

Are you looking for a card with travel perks and luxury benefits? If so, read our Marriott Bonvoy Boundless® Credit Card review!

Keep ReadingYou may also like

The easiest way to improve your credit score: a quick guide

Want to know the easiest way to improve your credit score? Check out our guide for the quick and easy steps you can take today!

Keep Reading

The most common myths about your credit score

Do you know what affects your credit score? Here are the most common credit score myths debunked to help you understand it and deal better with it. Keep reading!

Keep Reading

How to make $5000 a month: 10 simple strategies anyone can use

Looking to achieve your financial goals? Read on for simple yet effective strategies that anyone can use. Learn how to make $5,000 a month!

Keep Reading