Uncategorized

Opus Credit Card full review: transfer money easily and build credit

Read the Opus Credit Card review to find out how this card works and discover if it could be a great ally on your financial path.

Opus Credit Card: credit essentials at no fees

An Opus Credit Card might be great for those looking for convenience, as shown in this review.

The card has no fees. Although the APR might be quite high, you can access money transfers less expensive than taking money from a cash machine.

How to apply for the Opus Credit Card?

Learn how to apply for an Opus Credit Card and move money as you want at reasonable costs. It is simple, and you can check your eligibility.

| Credit Score | Not disclosed |

| APR | 49.9% (representative and variable) |

| Annual Fee | £0 |

| Fees | Balance transfers: up to 3% of the transaction (minimum £3); Money transfers: up to 3% of the transaction (minimum £3); Cash transactions: 5% of the transaction (minimum £4); Paper copies of statements: Foreign exchange conversion charge: 2.95%; Late payment: £12; Returned payment: £12; Overlimit fee: £12; Trace fee: £20 |

| Welcome bonus | None |

| Rewards | None |

Unfortunately, there are no rewards or welcome bonuses. But from time to time, Opus features promotional offers. Then, continue reading to learn the details.

How does the Opus Credit Card work?

An Opus card is suitable for those looking for the following benefits:

- Money transfers;

- Credit building;

- Flexibility and convenience.

To sum up, you can get access to an amazing card that allows you to easily move money in a cheaper way to avoid expensive cash machine fees.

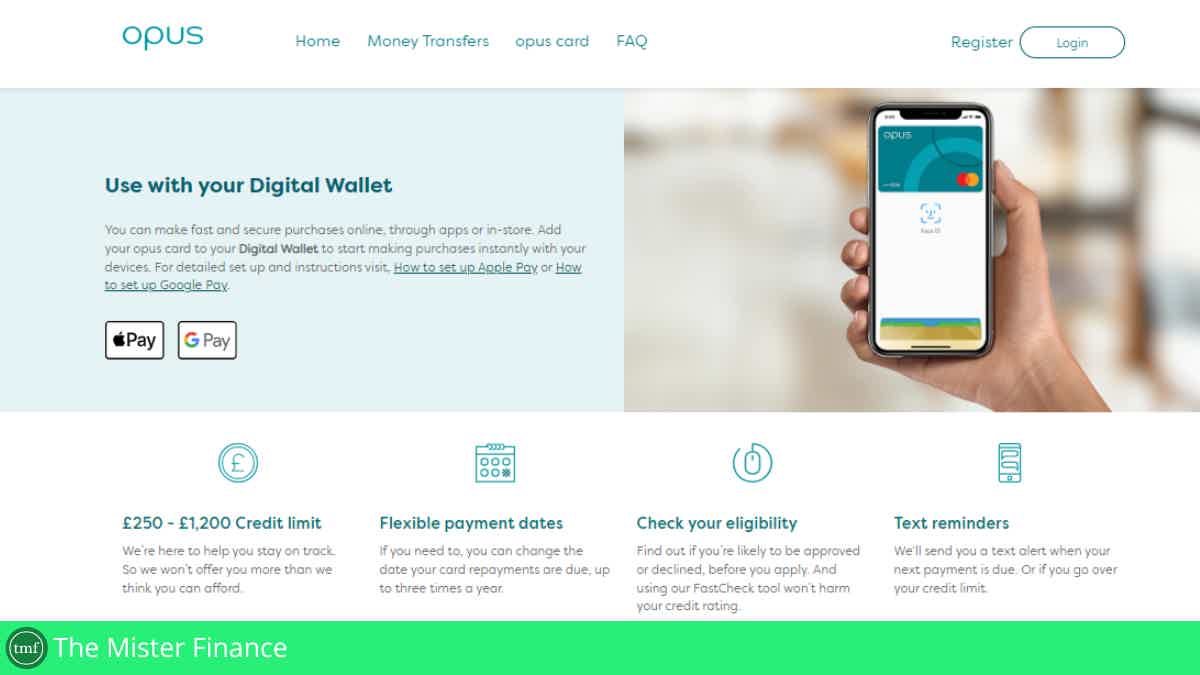

Also, the card offers an eligibility check with no impact on your credit rating. So, less-than-perfect applicants may get easier approval than when applying to other credit card options available on the market.

As shown on the Opus Credit Card review, the card has no fees. Although the APR is quite high, you may enjoy the fact that Opus gives you the flexibility you need at reasonable costs.

Plus, you must be careful about not delaying when paying your bills, as you would do with any other credit card, no matter how low the APR is.

Besides, you can change the due dates up to three times per year. Flexible enough to help you with your finances, then!

This card offers a good range of credit limits, from £250 to £1,200.

Not to mention that it allows you to use your Digital Wallet, as well as sends alerts so that you won’t forget to manage your account.

You will be redirected to another website

Opus Credit Card benefits

As mentioned before on the Opus Credit Card review, this card suits applicants needing to move money directly into their bank accounts easily and flexibly.

Additionally, there are no annual fees, and you can build credit while managing your card through an amazing app.

Pros

- It doesn’t charge an annual fee;

- It offers an eligibility check;

- Credit limits range from £250 to £1,200;

- Promotional offers are featured from time to time;

- It features an amazing app;

- It offers flexible payment dates plus allows you to use your digital wallet.

Cons

- APRs are quite high.

How good does your credit score need to be?

Even though this information is not fully disclosed, you don’t need to have a perfect credit score since this card helps you build credit if you use it responsibly.

How to apply for an Opus Credit Card?

If you want to move cash at reasonable costs, learn how to apply for an Opus Credit Card in the following post!

How to apply for the Opus Credit Card?

Learn how to apply for an Opus Credit Card and move money as you want at reasonable costs. It is simple, and you can check your eligibility.

About the author / Aline Augusto

Reviewed by / Aline Barbosa

Senior Editor

Trending Topics

The Mister Finance recommendation – Virgin Money 5-Year Everyday Fixed Cashback Mortgage review

With the Virgin Money 5-Year Everyday Fixed Cashback Mortgage, you'll be able to prequalify with no credit harm and earn cashback!

Keep Reading

Tesco Bank Balance Transfer Credit Card review: the longest 0% period

Read the Tesco Bank Balance Transfer Credit Card review article and check if a balance transfer card with a long 0% period would suit you.

Keep Reading

FlexiPay Line of Credit review: credit solution for businesses

Read the FlexiPay Line of Credit review article to learn how it could help you with your business cash flow and more at no interest or fees.

Keep ReadingYou may also like

What is a balance transfer credit card: is it a good idea?

Are you looking for a way to reduce your credit card debt? You may want to consider a balance transfer credit card. This product allows you to move your outstanding balance from one card to another, typically with a lower interest rate. Keep reading if you want to learn more!

Keep Reading

Cheap WestJet flights: low fares from $49.99

Keep reading and learn how to save big on your next flight with Westjet airlines! Enjoy the Lower Fare finder and save a lot on your next trip!

Keep Reading

NetCredit Personal Loan review: how does it work and is it good?

NetCredit Personal Loan review: Is it worthy? Offering up to $10K with adjustable repayment plans might be tempting! Keep reading to learn more!

Keep Reading