Finances (UK)

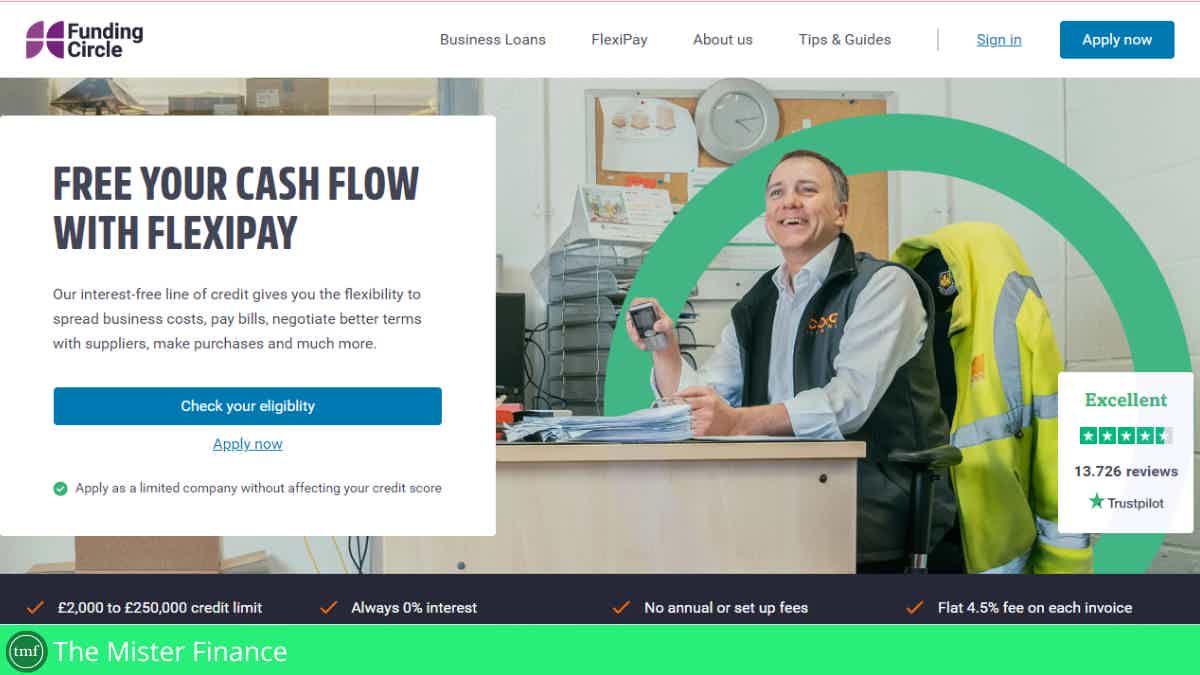

FlexiPay Line of Credit review: credit solution for businesses

Check out the FlexiPay Line of Credit review to learn how this credit solution can help your business to succeed.

FlexiPay Line of Credit: 0% interest and no fees

If you own or manage a business, this FlexiPay Line of Credit review is worth checking.

It can be challenging to free the cash flow in order to spread costs, pay bills, make purchases, and negotiate with suppliers at reasonable terms and conditions.

How to apply for the FlexiPay Line of Credit?

Check out how simple it is to apply for the FlexiPay Line of Credit and enjoy having a good credit limit to spread costs and finally grow!

So, getting a line of credit might be worth considering.

However, you must check the pros and cons before signing up for a credit solution since if you cannot manage that; your business may be in danger regarding debt.

Thus, take a look at this article to discover the details about FlexiPay.

How does the FlexiPay Line of Credit work?

A line of credit might be a great deal when it comes to small businesses. Most of them must have free cash flow to grow but don’t have enough capital to do it.

As mentioned before in this FlexiPay Line of Credit review, a credit solution like this one may help you to spread costs, pay bills, make purchases, and negotiate with suppliers at reasonable terms and conditions.

On the other hand, it is essential to understand how it works and be in full control of your debt. Otherwise, your business may face serious debt in the near future.

Essentially, the line of credit offered by FlexiPay offers amazing terms and conditions. In fact, it is a pretty low-cost option.

To sum up, it features limits ranging from £2,000 to £250,000 at no annual or set-up fees whatsoever. Additionally, it is 0% interest. But you must be wondering, how does it work then?

Basically, every time you have an invoice to pay, you will enter the details online, and FlexiPay will pay the bill on your behalf. Then, you will have up to three months to repay for a flat 4.5% fee.

You will be able to pay energy, VAT, and other business bills, purchase stock or equipment, negotiate better conditions with suppliers, and more while spreading costs at a reasonable fee.

Lastly, the company offers an eligibility check with no harm to your credit score.

You will be redirected to another website

FlexiPay Line of Credit benefits

As shown on the FlexiPay Line of Credit review, this solution may be an amazing deal for businesses.

If you need to spread costs at a very low cost in order to grow, FlexiPay offers credit limits that range from £2,000 to £250,000 at a 0% interest and no annual or set-up fees.

Pros

- Credit limits range from £2,000 to £250,000;

- There are no annual or set-up fees;

- You can check your eligibility with no harm to your credit score;

- The online account is easy to use, and you can add an invoice to repay in up to three months at a flat fee of only 4.5%.

Cons

- Disadvantages weren’t found.

How good does your credit score need to be?

Certainly, a good credit rating might be required since the credit solution is offered for businesses.

However, you can check your eligibility before going through with an application.

How to apply for a FlexiPay Line of Credit?

If you own or manage a business, learn how to apply for a FlexiPay Line of Credit and free your cash flow to grow!

How to apply for the FlexiPay Line of Credit?

Check out how simple it is to apply for the FlexiPay Line of Credit and enjoy having a good credit limit to spread costs and finally grow!

About the author / Aline Augusto

Reviewed by / Aline Barbosa

Senior Editor

Trending Topics

How to apply for the Virgin Atlantic Reward Credit Card?

If you need a card to get travel points with no annual fee, read on to apply for the Virgin Atlantic Reward Credit Card!

Keep Reading

Tesco Bank Balance Transfer Credit Card review: the longest 0% period

Read the Tesco Bank Balance Transfer Credit Card review article and check if a balance transfer card with a long 0% period would suit you.

Keep Reading

How to apply for the Tesco Bank Purchases Credit Card?

Check out how easy and fast it is to apply for the Tesco Bank Purchases Credit Card and enjoy up to 14 months of 0% interest on purchases.

Keep ReadingYou may also like

Metaverse investors are losing money to phishing scams

In a recent spate of cybercrime, investors in the metaverse are losing their money to phishing scams. Find out what you can do to protect yourself and your assets.

Keep Reading

Choose the perfect credit card and apply in just a couple of minutes

We've selected the best options based on your credit score. Choose an option below and learn how to apply.

Keep Reading

Refinancing a car: learn the pros and cons

Read our full article and learn the ins and outs of card refinancing. We'll give you the best tips!

Keep Reading