Loans (US)

Oportun Personal Loans review: what you need to know before applying

Check out the Oportun Personal Loans review article to learn all there is about it and decide if it could help you with your car repair, home improvement, or any other unexpected expense you might have.

Oportun Personal Loans: affordable, fast, and easy funds for personal purposes

Oportun is a company that focuses on helping people get credit. Besides the personal loans offered, it features credit cards, savings & investments options, tools, and educational articles. It considers all credit scores in the application process, and it offers fast prequalification with no impact on credit. The loans are affordable, and the funding is quick. So keep reading our Oportun Personal Loans review to learn how everything works!

| APR | Less than 35.99% |

| Loan Purpose | Personal (for repairs, bill payments, vacations, and more) |

| Loan Amounts | From $300 to $10,000 |

| Credit Needed | All credit are considered |

| Terms | It varies |

| Origination Fee | It varies according to the State, terms, amount, and interest rate |

| Late Fee | Not disclosed |

| Early Payoff Penalty | $0 |

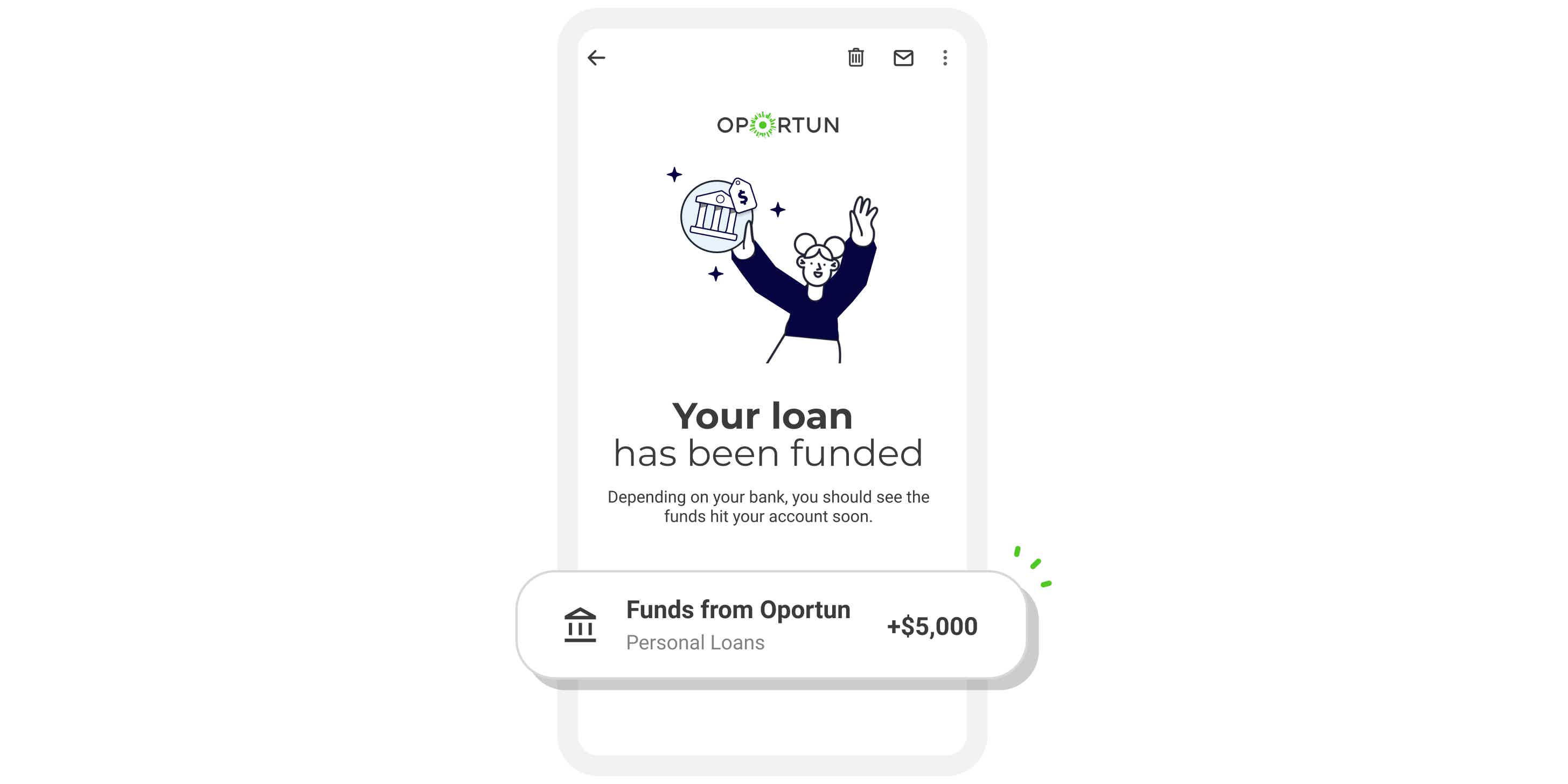

How to apply for Oportun Personal Loans?

If you need quick funds to cover unexpected expenses, learn how to apply for an Oportun Personal Loan.

How does the Oportun Personal Loans work and its benefits?

Oportun offers personal loans for all types of purposes and credit. The application is simple and secure, and the funding process is fast.

The amounts vary from $300 to $10,000, and you can use it for home improvements, car repairs, rental deposits, medical bills, vacations, and any other unexpected expenses you might have on your way.

The APRs are no higher than 35.99%. And the terms and fees applied to vary according to the State you live in, as well as other factors.

Furthermore, it doesn’t charge any early payoff penalty. Origination and late fees are charged, though.

Unfortunately, the official website lacks further information about the terms and all fees associated with the loans offered.

Also, some loan amounts are unavailable in some States. For example, unsecured loans above $6,000 are not available in Florida. Plus, loans below $3,100 are not available in Georgia, and below $1,600 in Hawaii.

Other terms and conditions also vary according to the State. In Texas, secured loans are limited to $18,000.

So, check out the conditions before applying.

In addition to all, Oportun offers tools and educational articles for you to start getting credit, saving money, and using it responsibly.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Pros

- Oportun offers quick loans for personal purposes;

- The loans are affordable and easy to get;

- All credit scores are considered;

- It offers prequalification with no impact on credit;

- It doesn’t charge a prepayment fee;

- Also, it allows you to add a co-signer;

- It provides tools and educational resources;

- It has good customer service.

Cons

- It doesn’t disclose all fees;

- Fees and interest rates vary according to many factors, which might end up being high;

- The service is not available in some States or is limited depending on the State.

What credit score do you need for Oportun Personal Loans?

All credit scores are considered. So, if you have a limited credit history, an Oportun Personal Loan might be excellent for you.

How to apply for Oportun Personal Loans?

Follow the link below to learn how to apply for an Oportun Personal Loan and get the funds you need right away.

How to apply for Oportun Personal Loans?

If you need quick funds to cover unexpected expenses, learn how to apply for an Oportun Personal Loan.

About the author / Aline Augusto

Reviewed by / Aline Barbosa

Senior Editor

Trending Topics

Athleta Rewards Mastercard® full review

This Athleta Rewards Mastercard® review article will show you how much the card costs while offering points at Gap Inc.'s family of brands.

Keep Reading

New Chase Sapphire Reserve® benefits: Is it worth keeping it?

Do you want to learn about the new Chase Sapphire Reserve® benefits? If so, we can help you learn more about this card. Read on!

Keep Reading

Start using an e-wallet: what is it and how does it work?

What is an e-wallet or digital wallets? They can make your online life a lot safer and easier. So, read more to know all about them!

Keep ReadingYou may also like

Application for the Old Navy card: how does it work?

It is easy to apply for the Old Navy credit card. If you want to make the best out of your purchases at GAP Inc. brand stores, keep reading to learn how to get your card.

Keep Reading

Achieve your goals easily: Avant Credit Card review

Do you have fair credit and need a simple solution to improve your score? The Avant Credit Card could be the answer! Read on and learn!

Keep Reading

Aeroplan® Credit Card review: Up to 60,000 bonus points

Get an Air Canada's Aeroplan® Credit Card review. Earn up to 3X points on all purchasesa and 500 bonus points for every $2k spent in a calendar month!

Keep Reading