Credit Cards (US)

New Chase Sapphire Reserve® benefits: Is it worth keeping it?

If you're a Chase Sapphire cardholder looking for more information on the card, read our post to see the new Chase Sapphire Reserve® benefits!

Find out if you should keep the Chase Sapphire Reserve® with its new benefits!

Are you a Chase Sapphire Reserve® cardholder? If so, you’ll be excited to know that the bank recently announced several new Chase Sapphire benefits! You can learn if you should keep this great credit card!

Moreover, this exclusive and popular rewards card can offer improved airport lounge access to expanded travel credits and more.

Also, there are lots of exciting changes that come with the new benefits – but is it worth keeping your Reserve card?

Therefore, in this blog post, we’ll explore all the latest perks of having a Chase Sapphire Reserve®, as well as potential drawbacks, to help determine if it’s worth it for your lifestyle.

So, read on to find out everything you need to know before deciding whether or not this valuable credit card is right for you! And see the new Chase Sapphire Reserve® benefits!

Best credit cards for travelers in 2023

Check out the best credit cards for travelers in 2023 we have selected for you. Choose yours and start planning your next vacation while earning rewards and saving money!

What rewards does the Chase Sapphire Reserve® card offer?

Besides the incredible perks you can get with this card, you can also find great rewards. And you can see a summary of some of the main rewards you can get with this card in our list below. Read on!

- 5x points on flights when you purchase travel with Chase Ultimate Rewards® after the first $300 is spent on travel purchases annually;

- 10x points on hotels and car rentals when you purchase travel through Chase Ultimate Rewards® (valid after you spend your first $300 on travel purchases annually);

- 3x points on other travel worldwide (valid after your first $300 are spent on travel purchases annually);

- 10x points on Chase Dining purchases (Ultimate Rewards®);

- 3x points on another dining at restaurants (includes eligible delivery services, takeout, and dining out);

- Also, earn 1 point for each dollar you spend on all other purchases;

- Terms apply.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

See the new Chase Sapphire Reserve® card benefits

You can find many incredible benefits when applying for the Chase Sapphire Reserve®. Also, if you already have this card, you should understand the updated perks you can keep getting!

Moreover, you can even earn a welcome bonus of 60,000 points after you spend $4,000 on purchases in your first three months from your account opening (terms apply)!

In addition, you can get incredible travel and rewards perks! Therefore, read our list below with the main perks you can get as a cardholder of this Chase card:

- $300 annual travel credit in statement credits as reimbursement for travel purchases you make each account anniversary year;

- 50% more value when you redeem your flight at one of the more than 1,300 VIP lounges you can find in over 500 cities worldwide (valid after one-time enrollment in Priority Pass™ Select);

- You can earn one statement credit of up to $100 each four years (Global Entry or TSA PreCheck® or NEXUS Fee Credit);

- Access room upgrades and daily breakfast at over 1,000 properties when booking with the Luxury Hotel & Resort Collection;

- 24/7 access to customer service;

- Terms apply.

Also, you can find many other benefits and perks when using this Chase Sapphire card!

What travel coverage can I get with this Chase card?

You’ll be able to get incredible travel protection with this credit card. For example, you can get access to purchase protection that covers your new purchases for 120 days (valid against damage or theft). Terms apply.

Moreover, you can even access Extended Warranty Protection and return protection to be reimbursed for eligible items at stores (terms apply).

How to get airport lounge access?

Are you looking for a way to make your travel experiences easier and more comfortable? If so, read our post to learn how to get airport lounge access!

In addition, with this Chase card, you can get some other travel perks, such as the ones below:

- Trip Cancellation/Interruption Insurance;

- Auto Rental Collision Damage Waiver;

- Lost Luggage Reimbursement;

- Emergency Evacuation & Transportation;

- Trip Delay Reimbursement;

- Terms apply.

What are the fees you need to pay to use this Chase card?

Even though this Chase card offers incredible perks and rewards to its cardholders, there are also some fees you’ll need to pay to enjoy the new Chase Sapphire benefits. So, here is a list of the most common fees this card can charge:

- You’ll need to pay a $550 annual fee;

- $75 annual fee for each authorized user;

- 5% or $5 fee for each balance transfer amount, whichever is greater;

- $10 or 5% of each cash advance transaction amount, whichever is greater;

- Up to $40 late payment fee and return payment fee;

- There are no foreign transaction fees.

These are just some of the fees you’ll need to be ready to pay when you start using this Chase card.

What is the credit limit for the Chase Sapphire Reserve® card?

Cardholders of the Chase Sapphire Reserve have access to a high $10,000 minimum credit limit.

However, the maximum credit limit for this premium travel rewards card has not been officially announced.

But the credit limit is likely over $100,000, just like the highest limit on the Chase Sapphire Preferred.

What do I need to qualify for a Chase Sapphire Reserve® card?

There are no official requirements to get this Chase card. However, we recommend you have a high credit score and annual income for better chances, especially with the new Chase Sapphire benefits.

Moreover, it can be good to know if you can pay the fees related to this credit card before you start the application process.

What credit score do you need to get a Chase Sapphire Reserve® card?

Chase does not specify a minimum or maximum credit score for approval of any of its credit cards.

However, applicants should have outstanding credit. Therefore, a credit score of 750 is not required to apply for the Chase Sapphire Reserve, but it is strongly recommended.

In addition, you should be aware that the application process to get this card can impact your credit score. Therefore, be sure to know your score before you complete the application.

Moreover, if you already have this Chase card, you can see if you want to keep it. However, the best choice can be to keep it due to its great benefits!

Now that you’ve learned more about the new Chase Sapphire Reserve® benefits, you can see if this is the card for you. the following link will show you everything about the application process.

How do you get the Chase Sapphire Reserve® Card?

Do you want incredible travel and dining perks in one credit card? Then, read more to know how to apply for the Chase Sapphire Reserve card!

About the author / Victória Lourenço

Reviewed by / Aline Barbosa

Senior Editor

Trending Topics

How to apply for the Merrick Bank Secured Visa® card?

Merrick Bank Secured Visa® card allows you to build or rebuild your credit history with confidence and convenience. Apply for it right away!

Keep Reading

The Centurion® Card from American Express review

Ever wondered what it's like to have the world's best credit card? Read our The Centurion® Card from American Express review and find out!

Keep Reading

The best cards if you have a low credit score

Don't let bad credit keep you from getting the card you need. Check out these top picks for the best credit cards for a low credit score!

Keep ReadingYou may also like

Metaverse investors are losing money to phishing scams

In a recent spate of cybercrime, investors in the metaverse are losing their money to phishing scams. Find out what you can do to protect yourself and your assets.

Keep Reading

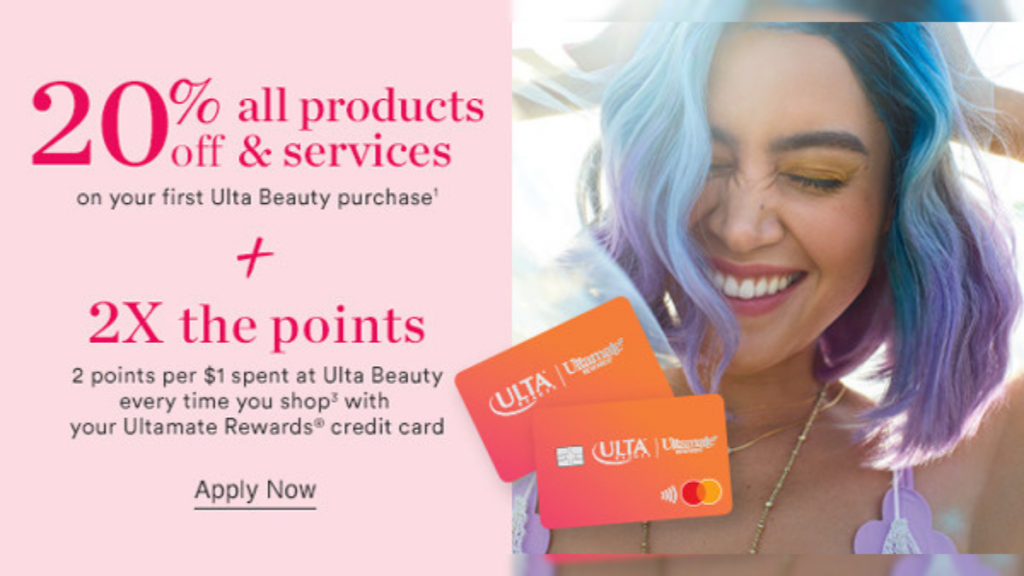

Get the Ulta Credit Card: A Simple Way to Apply Today!

You can now get your cherished beauty products from Ulta while earning points that can be converted into discounts. Read on and learn more!

Keep Reading

How to travel for free using miles: a guide for beginners

Find out how to travel for free using miles. Accumulating points and miles can be easy and rewarding. Read on to find out how to get started traveling the world for free!

Keep Reading