Credit Cards (US)

How to apply for the Merrick Bank Secured Visa® card?

Merrick Bank Secured Visa® card helps you build or rebuild your credit history when you use it responsibly. Learn how to get yours and work on your stability for the future!

Merrick Bank Secured Visa® application: build or rebuild your credit history!

Merrick Bank specializes in delivering solutions for people who need help to get back on their financial track. And today, we will present to you the application process for a Merrick Bank Secured Visa® card.

This card is a secured card, which means that you need to make an initial security deposit that will work as your credit line.

Also, it ranges from $200 to $3,000.

Plus, as a new cardholder, you get free monthly access to FICO® Score, exclusive deals on travel, shopping, entertainment, $0 Fraud Liability, and more.

In addition, your credit line can be reviewed if you use the card responsibly.

So, check out now how to apply for it!

Apply online

Access the Merrick Bank website and click on Products. Then, select Our Cards and choose the Merrick Bank Secured Visa®.

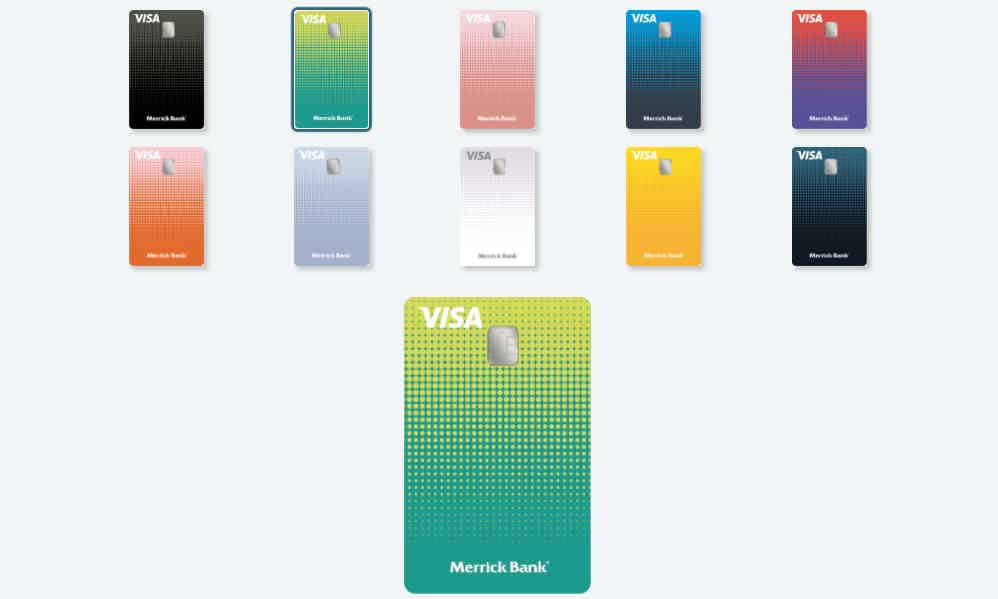

After that, click on Apply Now and choose your card design.

Fill in the forms with the required information, as follows:

- Personal details;

- Financial information.

Then, read the terms and conditions, and pay the initial deposit.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Apply using the app

After getting approved, you can download the Merrick Bank mobile app to manage your financial information.

Merrick Bank Secured Visa® vs. Merrick Bank Double Your Line Secured Visa®

Both cards help you build or rebuild your credit history. Also, both of them are secured cards, which means that a security deposit is required and used as your credit line.

However, the Merrick Bank Secured Visa® card allows you to choose the initial deposit from $200 to $3,000.

On the other hand, the Merrick Bank Double Your Line Secured Visa® requires a $200 initial security deposit that is doubled to $400 when you make at least a minimum payment on time each month for the first seven months.

| Merrick Bank Secured Visa® | Merrick Bank Double Your Line Secured Visa® | |

| Credit Score | Bad | Bad |

| Annual Fee | $36 | $36 |

| Regular APR | 17.45% – Variable | 17.45% – Variable |

| Welcome bonus | None | None |

| Rewards | None | None |

How to get Merrick Bank Double Your Line® Secured?

Get your Merrick Bank Double Your Line® Secured Visa® without a credit check. See how to apply for it!

About the author / Aline Augusto

Reviewed by / Aline Barbosa

Senior Editor

Trending Topics

5 best 0% purchase credit cards

Do you need a card with a 0% interest period on purchases and balance transfers? If so, read on to see the best 0% purchase cards!

Keep Reading

How to apply for the Nash crypto wallet?

The Nash crypto wallet application only takes a few minutes. Read more to know how to get this crypto wallet and make the best of it!

Keep Reading

American Express® High Yield Savings account full review

American Express® features an account with a high rate for your savings. Check out the American Express® High Yield Savings account review!

Keep ReadingYou may also like

PREMIER Bankcard® Card Application: how does it work?

Applying for a credit card with a poor credit score can be intimidating. But not with the PREMIER Bankcard® Card. Learn how to apply with any credit score.

Keep Reading

What is a mortgage and how does it work?

When buying a house, it's important to know "what is a mortgage," so we are here to help. This post will explore this kind of loan and how it can be useful when purchasing real estate. Keep reading!

Keep Reading

Mortgage statement: what it means and how to read it

Unsure of what all the numbers and terms on your mortgage statement mean? We're here to help! This article explains everything you need to know.

Keep Reading