Loans (US)

NetCredit full review: Borrow up to $10,000!

If you have a low score and need an easy loan with flexible repayment options, read our NetCredit review to learn more!

NetCredit review: Find flexible payment options!

Are you among the many people with a low credit score who need a financial help? You can read our NetCredit review to see how it can provide you with relief through its personalized loan products!

How to apply for NetCredit?

Looking for a lender to give you flexible loan options and up to $10,000? If so, read on to learn how to apply for NetCredit!

| APR | 34.00% to 155.00% variable APR. |

| Loan Purpose | Almost all types of personal loans. |

| Loan Amounts | $1,000 to $10,000. |

| Credit Needed | There is no minimum credit score. |

| Terms | 6 to 60 months (it varies by state). |

| Origination Fee | The interest rate will depend on the state. |

| Late Fee | You may pay a late-áyment fee of up to $25. Also, you may need to pay 5% of the late amount. *Terms apply. |

| Early Payoff Penalty | There are no prepayment fees. |

Also, this lender offers features to assist you in getting the loan you need, even with a low score.

Moreover, you can find flexible loan payment terms that are good for your finances!

Therefore, read our complete NetCredit review to see if this is the right option for your personal finance needs! You’ll see how it can help you regain control of your finances!

How does NetCredit work?

NetCredit can provide you with relief through their personalized loan products to assist in covering expenses or consolidating debt.

Moreover, with flexible payment plans and affordable repayment terms, this lender makes it easier than ever for those looking for easy loans for bad credit.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

NetCredit benefits review

As we mentioned, this lender can offer a range of benefits to its clients. Moreover, you can even get fast loans for your most urgent needs!

Also, you can find that the application process is easy and quick. However, this lender also has some downsides. For example, you won’t be able to get a loan with co-signers.

Therefore, read our pros and cons list below to learn more about this lender’s features and see if it’s the best option for you!

Pros

- You can find flexible loan terms;

- There is a chance for your to get your loan in as little as one business day after approval;

- You can get loan options even with a not-so-good credit score.

Cons

- The APRs can be relatively high;

- You don’t have the chance to get co-signers;

- The loans can have different fees depending on the state;

- Also, this lender may not be available in your state.

How good does your credit score need to be?

You don’t need to have a good credit score to have a chance to qualify for this lender, even with a low credit score.

Moreover, you can check if you pre-qualify for this loan before you complete the official application process. Therefore, you won’t need to harm your score.

How to apply for NetCredit?

You can easily apply for a loan through this lender. Also, you’ll need to provide some personal information and documents during the application.

How to apply for NetCredit?

Looking for a lender to give you flexible loan options and up to $10,000? If so, read on to learn how to apply for NetCredit!

About the author / Victória Lourenço

Reviewed by / Aline Barbosa

Senior Editor

Trending Topics

How to apply for Next Day Personal Loan?

Next Day Personal Loan offers a free service that doesn’t affect your credit score. Check out how to apply and get your funds right away!

Keep Reading

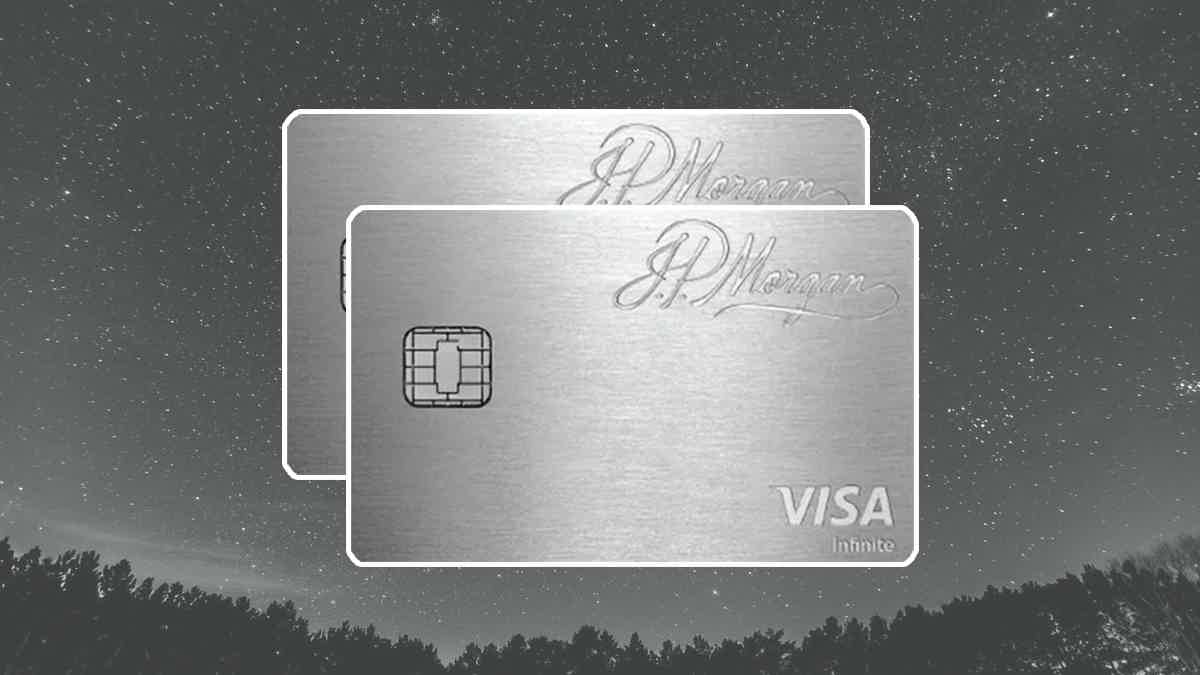

JP Morgan Reserve overview

Do you want to know how an exclusive Chase card works and learn about its benefits? Read our overview of the JP Morgan Reserve credit card!

Keep Reading

How to apply for the Unique Platinum card?

The Unique Platinum card offers benefits while you shop at My Unique Outlet. So, learn how to apply for one and enjoy its perks!

Keep ReadingYou may also like

Choose the best flight deal for your next trip

Do you need to find the best flight deal for your next trip? Check out our tips on how to get the cheapest flights possible. Keep reading!

Keep Reading

Petal® 1 "No Annual Fee" Visa® Credit Card review: is it legit and worth it?

So you're wondering if the Petal® 1 "No Annual Fee" Visa® Credit Card is legit and worth it? In this article, we'll take a look at the pros and cons of this card so you can make an informed decision.

Keep Reading

Capital One Quicksilver Student Cash Rewards Credit Card application

A student credit card can help you build credit and earn cash back. Keep reading to understand how to apply for the Capital One Quicksilver Student Cash Rewards Credit Card!

Keep Reading