Credit Cards (US)

myWalgreens Mastercard review: Access your score!

Do you need a card to get benefits and rewards for Walgreens purchases and other purchases? If so, read our myWalgreens Mastercard review to learn more!

myWalgreens Mastercard: Get rewards outside of Walgreens!

Are you looking for a great rewards card that offers extra benefits when you make purchases at Walgreens? If so, you can read our myWalgreens Mastercard review to learn more!

How to apply for myWalgreens Mastercard?

Looking for a credit card to help you get perks at Walgreens and other purchases? If so, read on to apply for the myWalgreens Mastercard!

| Credit Score | Good (you can access your credit score for free). |

| APR | 22.49%, 28.49%, and 31.49% variable APR for purchases. |

| Annual Fee | There are no annual fees. |

| Fees | $2 minimum interest charge. *Terms apply. |

| Welcome bonus | Earn $35 Walgreens cash rewards by making your first purchase within 45 days (limited offer). *Terms apply. |

| Rewards | 10% rewards on Walgreens branded products; 5% rewards on all other brands at Walgreens; 3% rewards on grocery and health & wellness purchases outside of Walgreens; 1% rewards on other purchases everywhere Mastercard is accepted. *Terms apply. |

Also, this easy-to-use card allows customers to get extra rewards and exclusive discounts on their purchases both in stores as well as outside of Walgreens.

Moreover, there is no annual fee, so that makes it even better! In this blog post, we will be doing an in-depth review of the myWalgreens Mastercard!

In addition, we’ll be going over its generous rewards program, ease of use, and much more!

So, keep reading our today.myWalgreens Mastercard review to learn more about this card!

How does myWalgreens Mastercard work?

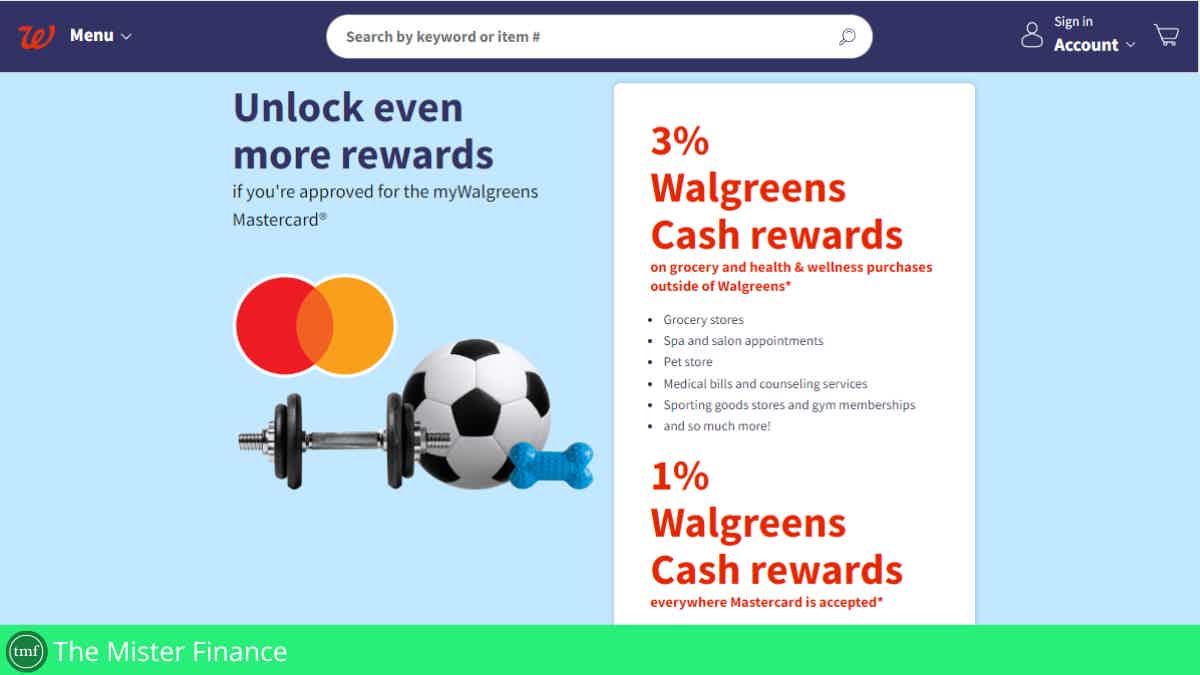

You can use this card to get incredible perks at Walgreens. Moreover, you’ll be able to get 10% rewards on Walgreens branded products.

Also, you won’t need to get perks only at Walgreens; you’ll be able to get rewards for other purchases!

Therefore, you’ll be able to get up to 3 rewards on grocery and health & wellness purchases outside of Walgreens.

Also, you’ll be able to get 1% rewards on other purchases anywhere Mastercard is accepted!

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

myWalgreens Mastercard benefits

As you know, this credit card offers great perks to its users. Moreover, besides getting rewards at Walgreens, you’ll be able to get rewards for purchases outside of Walgreens!

Moreover, you’ll be able to get access to $0 fraud liability perks! Also, you’ll be able to get all these perks for no annual fee! Therefore, you can learn more about this card in our pros and cons list below!

Pros

- You can get this card’s perks for no annual fee;

- You’ll get access to $0 fraud liability;

- You can earn rewards on eligible Walgreens purchases;

- You’ll be able to get rewards for purchases you make outside of Walgreens, where Mastercard is accepted.

Cons

- The APR for this credit card can be relatively high for some people;

- The signup bonus is only a limited-time offer.

How good does your credit score need to be?

You don’t need to have an excellent credit score to get this credit card. However, you may be needed to have at least a good credit score level to get this card.

Moreover, you’ll be able to prequalify for this card with no harm to your credit score!

How to apply for myWalgreens Mastercard?

You’ll be able to apply for this card easily through the official website. Moreover, you can apply for this card online or in a physical branch. Also, you’ll be able to prequalify with no credit score harm!

How to apply for myWalgreens Mastercard?

Looking for a credit card to help you get perks at Walgreens and other purchases? If so, read on to apply for the myWalgreens Mastercard!

About the author / Victória Lourenço

Reviewed by / Aline Barbosa

Senior Editor

Trending Topics

How to apply for the TJX Rewards® Platinum Mastercard®?

Looking for a card with incredible Mastercard perks and much more? If so, learn how to apply for the TJX Rewards® Platinum Mastercard®!

Keep Reading

How to apply for the PCB Secured Card?

Check out how the PCB Secured Card application process works and how you can easily request yours to work on your credit score!

Keep Reading

How to choose a mortgage for first-time buyers!

You probably have questions if you’re about to get your first home. So, read on to learn about mortgage for first-time buyers!

Keep ReadingYou may also like

First Citizens Bank Cash Rewards Card Review: $0 annual fee

Do you need a credit card to transfer your balance with rewards? Check out our honest review of the First Citizens Bank Cash Rewards Credit Card to learn about its 0% intro APR period, fees, and perks. Stay tuned!

Keep Reading

BOOST Platinum Card Review: Is it worth it?

Discover shopping freedom with the BOOST Platinum Card. Access $750 in merchandise credit instantly, no credit checks required. Ideal for low scores, offering a seamless way to shop.

Keep Reading

Learn to apply for the Achieve Personal Loan (formerly FreedomPlus)

Need access to quick, reliable funds? Find out how easy it is to apply for the Achieve Personal Loan! Borrow up to $50,000 in no time!

Keep Reading