Credit Cards (US)

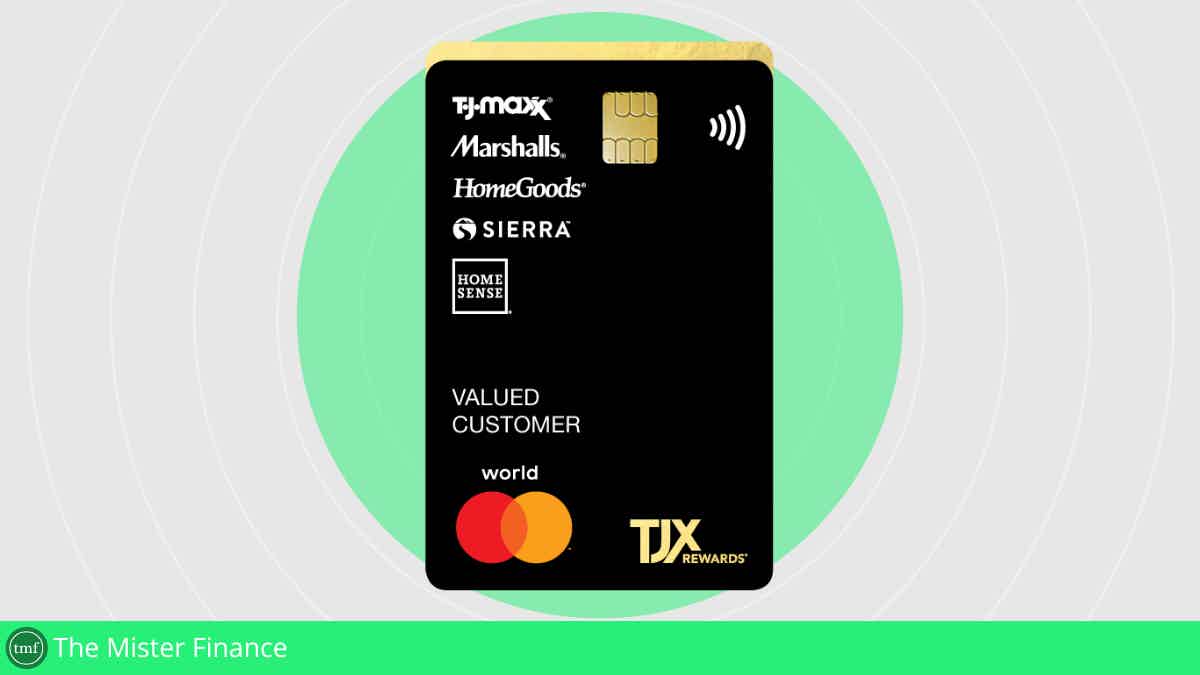

How to apply for the TJX Rewards® Platinum Mastercard®?

If you need a card with Mastercard benefits and more for no annual fee, read on to learn how to apply for the TJX Rewards® Platinum Mastercard®!

TJX Rewards® Platinum Mastercard® application: Get shopping invites!

Are you looking for plentiful rewards and exclusive shopping opportunities? If so, you can learn how to apply for the TJX Rewards® Platinum Mastercard®!

Also, this card offers endless possibilities with every purchase! With this card, your spending can earn you much more than just point accumulations.

From special invitations to private sales and events to generous rebates on purchases at TJ Maxx, you’ll find a reason to shop more with the added benefits of this fantastic card.

And best of all, all these incredible offers are backed by the name-brand reputation of Mastercard’s secure payment services – giving you peace of mind that your credit line is safe while it works hard for you!

Online Application Process

Before you apply online for this credit card, you need to understand that you need to meet some of the requirements.

So, for example, you’ll need to create or already have a TJ Maxx bank account. Therefore, you’ll need to provide personal information and documents to open your account.

In addition, after this, you’ll need to qualify for the TJX Rewards® Platinum Mastercard®.

However, you should know that there is no prequalification process. Therefore, you may harm your credit score during the application.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Application Process using the app

You can use the TJ Maxx mobile app to manage all your credit card rewards and features. However, the best way to apply for TJX Rewards® Platinum Mastercard® is online through the official website.

TJX Rewards® Platinum Mastercard® vs. Ollo Rewards Mastercard®

Are you not so sure about getting the TJX Rewards® Platinum Mastercard®? If so, the case, you can try applying for the Ollo Rewards Mastercard®!

Also, with this credit card option, you’ll be able to earn incredible rewards for your everyday spending!

Moreover, you can find reasonable and low fees compared to other similar credit cards! Therefore, you can read our comparison table below to learn more and see which is the best option!

| TJX Rewards® Platinum Mastercard® | Ollo Rewards Mastercard® | |

| Credit Score | Fair to good. | Fair to excellent. |

| APR* | 31.49% variable APR for purchases; Also, 29.99% variable APR for cash advances. *Terms apply. | 23.99% to 28.99% variable APR for purchases, balance transfers, and cash advances. *Terms apply. |

| Annual Fee* | No annual fee. | From $0 to $39. *Terms apply. |

| Fees* | There are no foreign transaction fees; Cash advance fee: $10 or 4% of the amount of each cash advance, whichever is greater; Also, late payment fee: Up to $38. *Terms apply. | The cash advance fee can be 5% or $10, whichever is greater; And the balance transfer fee can be 4% or $5, whichever is greater; Also, there is a minimum interest charge of $1.50. *Terms apply. |

| Welcome bonus* | You can have the chance to get 10% off on your first purchase if you apply (limited offer). *Terms apply. | There is no welcome bonus. |

| Rewards* | 5% back rewards when shopping their family of brands with your card; Also, you can get exclusive shopping invites. *Terms apply. | 2% cash back on all purchases made at gas stations, grocery stores, and drugstores; Also, 1% cash back on all other purchases. *Terms apply. |

Are you interested in everything the Ollo Rewards Mastercard® has to offer? So read the following post and apply for this credit card!

How to apply for the Ollo Rewards Mastercard®?

Do you need a rewarding card to help you get cashback with low fees? If so, read on to learn how to apply for the Ollo Rewards Mastercard®!

About the author / Victória Lourenço

Reviewed by / Aline Barbosa

Senior Editor

Trending Topics

10 best premium and luxury cards of 2021

If you want to know which card with great benefits to get this year of 2021, keep reading our post about the 10 best premium cards 2021!

Keep Reading

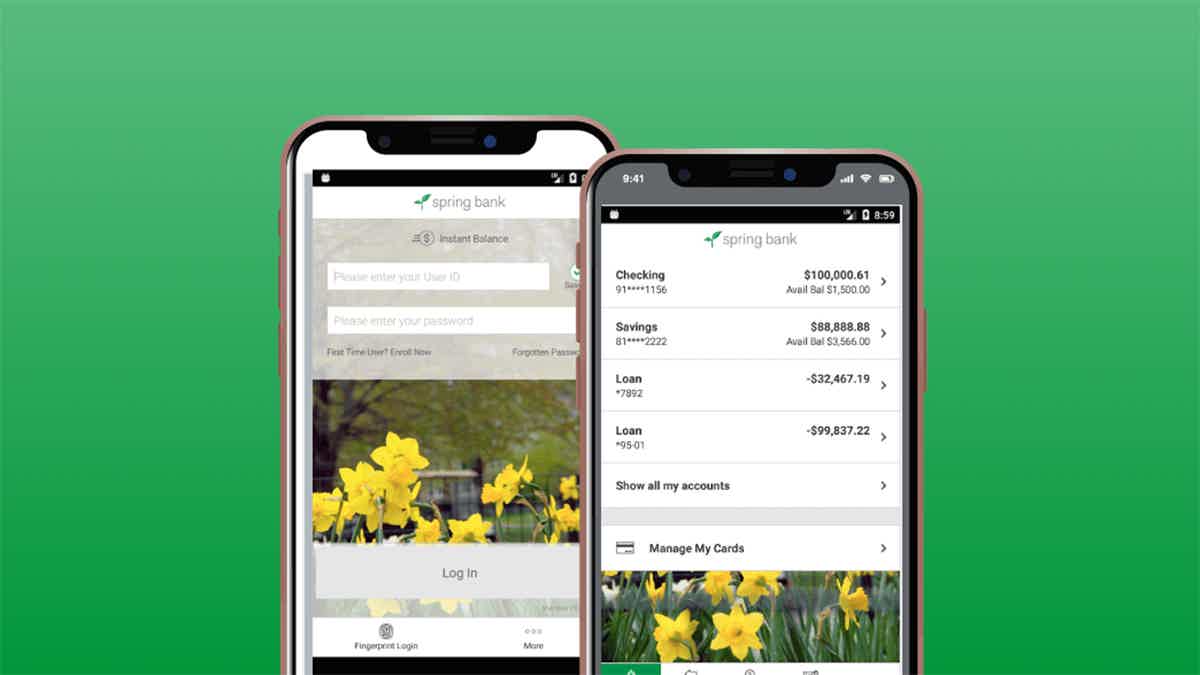

Spring Bank Review: is it trustworthy?

The Spring Bank review shows you how it can help you achieve sustainable financial health with services for personal and business banking.

Keep Reading

Government Assistance Texas: see your options!

There are several Government assistance programs in Texas for you to get the help you need in times of trouble. Read on to learn more!

Keep ReadingYou may also like

What is credit card stacking and how to do it?

Would you like to optimize your credit cards rewards? You can do it with the credit card stacking method. Learn more about it by reading this article.

Keep Reading

Aspire® Cash Back Reward Card application: how does it work?

Are you wondering if you qualify for an Aspire® Cash Back Reward Card? You've come to the right place. Learn the ins and outs to apply for this card. Read on!

Keep Reading

Learn how to download the Capitec Bank App

Need help with the Capitec Bank App download? This quick guide will show you how! Keep reading!

Keep Reading