Credit Cards (US)

10 best premium and luxury cards of 2021

Do you want to choose a great premium credit card for 2021? Then read more to see the best premium cards 2021!

Find out the best premium credit cards of 2021

If you are looking for a new premium credit card, we are here to show you some information about the 10 best premium cards 2021. Check out our post to learn a bit more about premium and luxury cards. Maybe you will even choose one for yourself this year. Keep reading to see information about annual fees, rewards, and card perks.

10 best premium cards 2021

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Chase Sapphire Reserve Card

The Chase Sapphire Reserve card is the first on our list of the best premium cards 2021. It has many premium dining and travel rewards. The card’s annual fee is hefty, but you can get a large portion of it back once you use the $300 in yearly travel credits. See below for some more information about the card.

| Credit Score | Excellent |

| Annual Fee | $550 |

| Regular APR* | 16.99% – 23.99% variable APR *Terms apply |

| Welcome bonus* | Get 60,000 points after you spend $4,000 within the first 3 months *Terms apply |

| Rewards* | Travel statement credit of $300 per year 3X points on dining for eligible delivery services, takeout as well as travel Spending on any other purchase earns you 1 point per dollar *Terms apply |

How do you get the Chase Sapphire Reserve card?

Do you want incredible travel and dining perks in one credit card? Then, read more to know how to apply for the Chase Sapphire Reserve card!

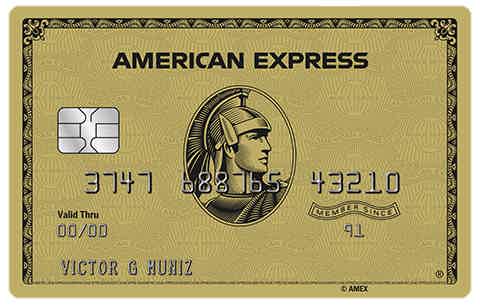

American Express Gold Card

The American Express Gold card is a great card with amazing dining rewards. It also has travel rewards and perks. You can get a great welcome bonus, and some of the other rewards and information about this card are in the table below!

| Credit Score | Good to excellent |

| Annual Fee | $250 |

| Regular APR | 15.99% – 22.99% variable APR |

| Welcome bonus | After you spend $4,000 on qualifying purchases in the first six months, you will get 60,000 MR points *Terms apply |

| Rewards | You can get 3 points for every dollar spent on flights booked with airline or American Express Travel 4 MR points for every dollar spent at restaurants 4 points for every dollar spent at supermarkets in the U.S. on $25,000 in purchases/year. 1 point for every dollar spent on every other eligible purchase $120 Uber Cash on Amex Gold $120 on dining credit * Terms apply |

How do you get the American Express Gold card?

If you fit the profile and want to know how to get your American Express Gold card, here is some important information to guide you!

Citi Prestige Card

The Citi Prestige card is a very premium black card. It offers great rewards and perks. This Citi card also offers great technology features to its cardholders. Learn more about this card’s perks and information below.

| Credit Score | Excellent |

| Annual Fee | $495 |

| Regular APR | 16.99% – 23.99% variable APR on spendings and balance transfers |

| Welcome Bonus* | 62,500 Citi ThankYouSM Points (25,000 Miles) Gadget Welcome Gift *Terms apply |

| Rewards* | Every five years, get up to $100 toward Global Entry or TSA Pre✓® Free annual hotel stay (4th night) Transfer points to many travel loyalty programs 5X points on air travel and dining 3X points on hotels and cruises 1X points on other purchases *Terms apply |

How to apply for a Citi Prestige Card credit card

The Citi Prestige card from Citibank offers great welcome bonuses, in addition to having a simple signup process. Discover how to apply!

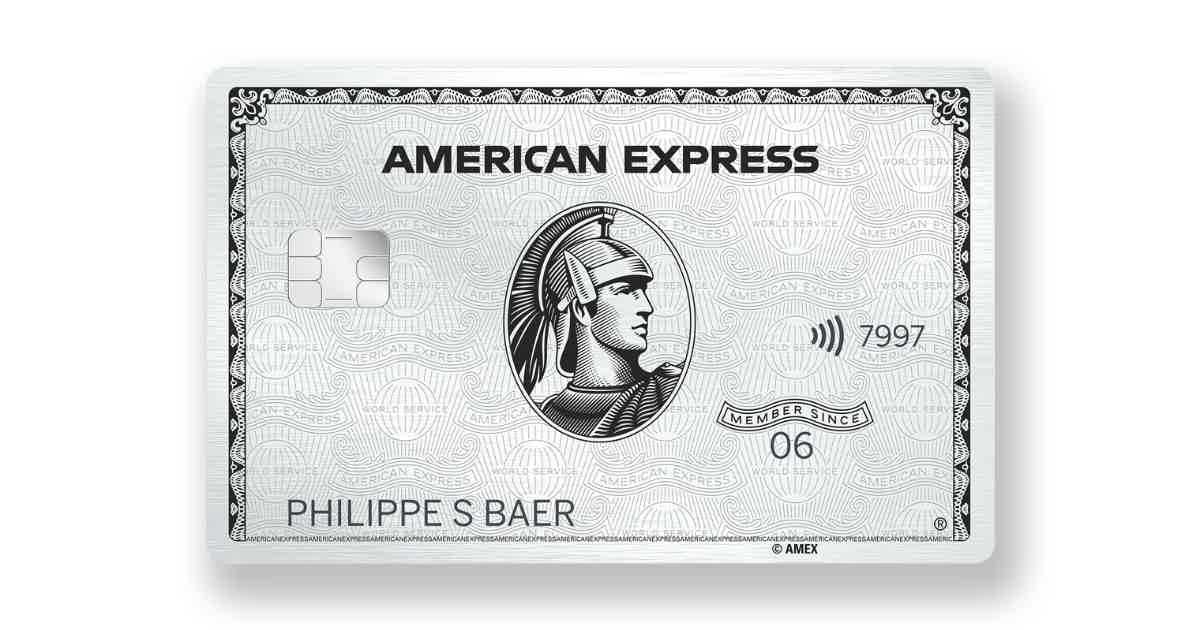

American Express Platinum card

The American Express Platinum card is one of the most premium cards there are. Even though it has a hefty annual fee, you can get many great and premium dining and travel perks. See a little bit more about this amazing Amex card in our table below.

| Credit Score | Good to excellent |

| Annual Fee | $695 |

| Regular APR | 15.99% – 22.99% variable APR on eligible charges |

| Welcome bonus* | 100K MR points 10x points on qualifying purchases *Terms apply |

| Rewards* | 10 MR points at gas stations and supermarkets 5 MR points for every dollar spent on flights 5 MR points for every dollar spent on prepaid hotel purchases 2 MR points for every dollar spent on other travel expenses 1 MR point for every dollar spent on all other purchases Uber Rides with the Amex Platinum card, also Shop Saks with Platinum *Terms apply |

How do you get the American Express Platinum card?

If you are ready to obtain your American Express Platinum card, here are some information that can guide you through the process. Check it out

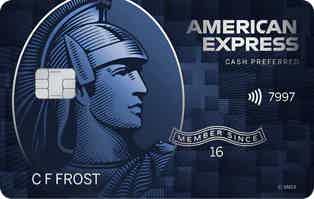

Blue Cash Preferred Card

The Blue Cash Preferred Card is great for those who want to buy at U.S. supermarkets. This card can be great for individual purchases. You can even get the offer of $0 for the annual fee in the first year. Check out below more about this great card!

| Credit Score | Good – Excellent |

| Annual Fee | $0 in the first year. After that, the annual fee is $95 |

| Regular APR* | 13.99% to 23.99% variable APR *Terms apply |

| Welcome bonus* | 20% cash back for Amazon purchases in the first six months *Terms apply |

| Rewards* | 6% cash back available for U.S. supermarkets 6% cash back on U.S. streaming 1% cash back on any other spendings *Terms apply |

How do you get the Blue Cash Preferred card?

The Blue Cash Preferred card is an amazing option for everyday spending. Read more to know how to apply for this great rewarding card!

United Club Infinite Card

The United Club infinite card is a great premium card. it has benefits and rewards for dining and travel. You can get 4X points when spending with eligible purchases and get 2X points on dining and travel. As with other Chase cards, this card is a very rewarding premium card. So, check out our table below with some more information on the card.

| Credit Score | Excellent |

| Annual fee | $525 |

| Regular APR | 16.49% – 23.49% variable APR |

| Welcome bonus* | After spending $3,000 in the first three months after creating your account, you will get 75,000 bonus miles *Terms apply |

| Rewards* | 4X on eligible purchases 2X on dining and travel *Terms apply |

Hilton Honors American Express Aspire Card

The Hilton Honors American Express Aspire Card is one of the top-tier cards of American Express. You get a very high welcome bonus, and this card is also amazing for travelers. Check out more about this great premium card in our table below!

| Credit Score | Good – Excellent |

| Annual fee | $450 |

| Regular APR | 15.74% – 24.74% variable APR |

| Welcome bonus* | After spending $4,000 in the first three months of creating your account, you will get 150,000 points *Terms apply |

| Rewards* | 14X points on eligible purchases 7X points for flights booked with airlines or American Express Travel 7X points on eligible restaurants in the United States 3X points on all other qualifying purchases * Terms apply |

Delta SkyMiles Reserve American Express Card

This Amex card is a great card for travelers, and it has access to American Express’s Centurion Lounges every time you fly with Delta airlines. There are many other great benefits offered by the Delta SkyMiles Reserve Amex card. Check some of them in our table below.

| Credit Score | Good – Excellent |

| Annual fee | $550 |

| Regular APR | 15.74% – 24.74% variable APR |

| Welcome bonus* | After spending $3,000 in your first three months, you will get 50,000 bonus miles and 10,000 Medallion Qualification Miles *Terms apply |

| Rewards* | 3X Miles on purchases made with Delta 1X mile on every other qualifying purchase Complimentary access to The Centurion Lounge (when booking with Delta Airlines) and more *Terms apply |

American Express Business Platinum

If you travel a lot, the American Express Business Platinum card can be great for you. You can get many travel perks even if the annual fee is $595. So, if you are a frequent business traveler, check out some more information about this amazing Amex travel card in our table below!

| Credit score | Good – Excellent |

| Annual fee | $595 |

| Regular APR | 14.24% 22.24% variable APR |

| Welcome bonus | After spending $15,000 on qualifying purchases in the first three months, earn 100,000 MR points |

| Rewards* | 5X MR points for flights and prepaid hotel stays made on Amex Travel Earn u to $200 in statement credits per year and more *Terms apply |

Citi AAdvantage Platinum Select World Elite

The Citi AAdvantage Platinum Select World Elite card has many rewards for dining and travel. This is a great air travel card for people who travel within the United States. And for people who are able to spend money enough so they can maximize the card’s bonus offers. See more information about this card in our table below!

| Credit score | Good – Excellent |

| Annual fee | $99 |

| Regular APR* | 15.99% to 24.99% variable APR *Terms apply |

| Welcome bonus | After spending $2,500 in the first 3 months, you will get 50,000 bonus miles |

| Rewards* | 2X miles for spendings related to dining, gas stations, and American Airlines 1X miles on any other spending *Terms apply |

But if you still want to know more about incredible credit cards with great benefits, check our list with the best options of 2021 next!

Best credit cards of 2021: reviews

Does your credit card rank among the best credit cards 2021 presented us with? We have come up with a shortlist with some amazing cards.

About the author / Victória Lourenço

Reviewed by / Aline Barbosa

Senior Editor

Trending Topics

How to apply for the Milestone® Mastercard® – Unsecured For Less Than Perfect Credit?

The Milestone® Mastercard® - Unsecured For Less Than Perfect Credit Card accepts people with low scores! Keep reading to know how to apply!

Keep Reading

OneMain Financial Personal Loan review

Looking for easy and fast funding? Check out our OneMain Financial Personal Loan review to see if it's the right lender for your needs.

Keep Reading

OakStone Platinum Secured Mastercard® credit card full review

OakStone offers a card that helps rebuild your credit score. Read the OakStone Platinum Secured Mastercard® credit card review!

Keep ReadingYou may also like

HSBC Cash Rewards Mastercard® credit card review: is it worth it?

Would you like to have a card with no annual fee that gives you rewards every time you use it? Your wish has been granted. The HSBC Cash Rewards Mastercard® will give you this and more. Please, keep reading this article to find out more about its benefits!

Keep Reading

Application for the Bank of America Customized Cash Rewards card: how does it work?

Learn how to apply for the Bank of America Customized Cash Rewards card and get yourself a credit card with a rewards program that you can tailor to your spending habits.

Keep Reading

How to buy cheap Southwest Airlines flights

Discounted tickets are available online, and in this post, you'll find out how to buy cheap Southwest Airlines flights. With our help, you can ensure you're using the right steps when booking to get a great deal. Keep reading!

Keep Reading