UK

MoneySuperMarket Credit Monitor full review: Free score!

Read our MoneySuperMarket Credit Monitor review to learn how to save money and improve your score in one easy package!

MoneySuperMarket Credit Monitor: Get tips to increase your score!

Are you looking to make managing your finances easier, save money, and boost your credit score? If so, you can read our MoneySuperMarket Credit Monitor review!

How to join the MoneySuperMarket Credit Monitor?

Do you need to save money and improve your credit score? If so, you can read on to learn how to join MoneySuperMarket Credit Monitor!

Also, MoneySuperMarket Credit Monitor is an invaluable tool for anyone wanting a better handle on his or her financial situation.

Moreover, you can even use this tool to check the best credit cards and lenders. Also, you’ll be able to download the app to check your credit score and get alerts each month!

Therefore, keep reading our MoneySuperMarket Credit Monitor review to learn this platform’s pros and cons!

How does the MoneySuperMarket Credit Monitor work?

This platform offers the best perks for those looking for new financial products. Also, if you want to improve your score, you can also get benefits!

Also, this free service provides UK citizens with the information and resources necessary for staying in control of their financial future.

Moreover, with access to personalized reports that show how lenders see them, customers are able to track their scores from wherever they are at any time.

In addition, MoneySuperMarket Credit Monitor users receive practical advice and tips on how best to improve their standing in the eyes of potential creditors.

Plus, you can use their compare and save feature to compare over 40 ways to super save on bills and others!

Also, they have an energy monitor for your phone and even a car monitor to give you good reminders! With this, you’ll be able to get alerts for when you need to renew your insurance and much more!

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

MoneySuperMarket Credit Monitor benefits

As we mentioned, MoneySuperMarket Credit Monitor offers more than just credit monitoring. Therefore, you’ll be able to get information regarding financial products that best suits your needs!

Moreover, you can even use this platform to get the app and save phone energy! And there can be much more!

However, there are also some downsides, as with any other platform. Therefore, read our pros and cons list below to learn more!

Pros

- You’ll be able to get information regarding different loans, credit cards, and other financial products;

- There is the chance to check your credit score and report for free once a month.

Cons

- You can only get access to your credit score with alerts once a month.

Should you join the MoneySuperMarket Credit Monitor?

If you’re looking for more than just a credit monitoring tool, you can enjoy the MoneySuperMarket features! Also, this platform allows you to get information regarding different types of products.

Therefore, for example, you can find information regarding credit cards, loans, and much more!

So, if this is what you’re looking for, you’ll love to use this free platform to check your credit score too!

How to join the MoneySuperMarket Credit Monitor?

You can easily create your login to use the MoneySuperMarket Credit Monitoring tool! Moreover, you’ll only need to create your log in and password!

How to join the MoneySuperMarket Credit Monitor?

Do you need to save money and improve your credit score? If so, you can read on to learn how to join MoneySuperMarket Credit Monitor!

About the author / Victória Lourenço

Reviewed by / Aline Barbosa

Senior Editor

Trending Topics

Should you be scared to take out a Home Equity Loan?

Do you need to find equity for your home to pay a debt? If so, you can read our post to understand more about how to take out a home loan!

Keep Reading

How do you get the Discover it® Cash Back Card?

Are you ready to earn cash back on your daily purchases? Then learn how to easily apply for the Discover it® Cash Back Card!

Keep Reading

Walmart MoneyCard review – Overdraft protection up to $200!

Get all the facts about Walmart Moneycard in this comprehensive review. Learn about features and fees, ratings, security measures, and more!

Keep ReadingYou may also like

Child and Adult Care Food Program (CACFP): see how to apply

Get the scoop on what it takes to apply for ACFP! Get support to provide nutritious food for those who need it! Read on and learn more!

Keep Reading

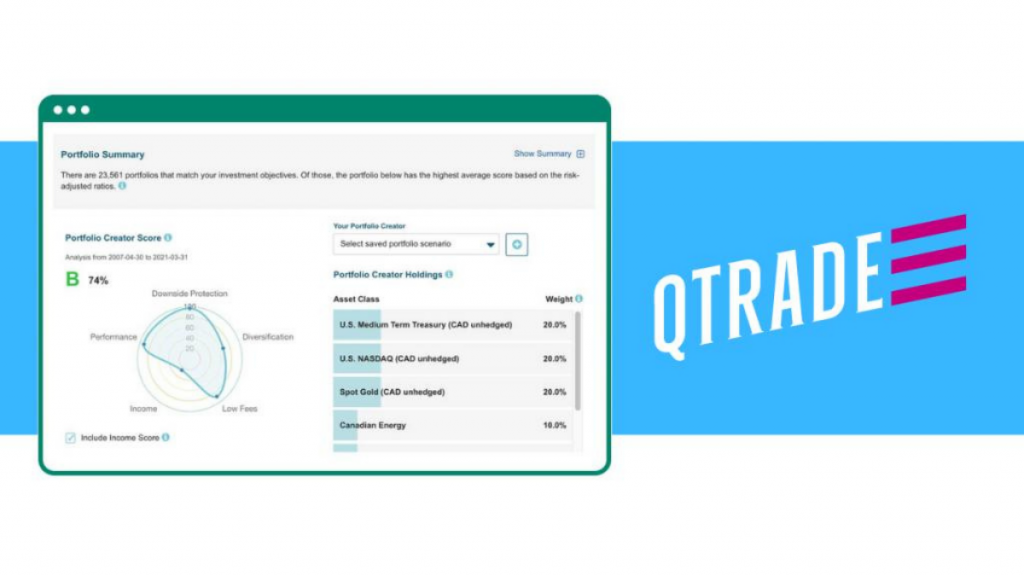

How to invest with Qtrade Direct Investing: Maximize Returns

Begin your investment journey with Qtrade Direct Investing. Our guide covers the essentials, from setting up your account to using their intuitive platform and diverse investment tools for financial growth.

Keep Reading

Citi® / AAdvantage® Platinum Select® World Elite Mastercard® application: how does it work?

Are you wondering how to apply for the Citi® / AAdvantage® Platinum Select® World Elite Mastercard® and what you can expect along the way? We've got you covered. Read on to learn more!

Keep Reading