CA

Mogo Prepaid card full review

Wondering how to help the planet while spending? You can use the Mogo card to help plant trees. Read our Mogo Prepaid card review to learn more!

Mogo Prepaid card: learn all about this green and sustainable card

If you’re looking for a prepaid card, Mogo may be a good option for you. In this full review, we’ll go over all the features of the Mogo Prepaid card and help you decide if it’s the right choice. Plus, we’ll give you some tips on using it effectively. Keep reading our Mogo Prepaid card review to find out more!

| Credit Score | No credit score is required. |

| Bank and ATM Fees* | There are no monthly fees and no purchase transaction fees. $1.50 fee for domestic ATMs. $3.00 for international ATMs. *Terms apply. |

| Cash Withdrawals* | There is a $500 limit per cash withdrawal in 24 hours. *Terms apply. |

| Welcome bonus | No welcome bonus. |

| Rewards* | You can earn 50 green satoshi rewards using your Mogo card. *Terms apply. |

How to apply for the Mogo Prepaid card?

Do you need a card that can help you control your finances? Read our post about the Mogo Prepaid card application and learn more!

How does the Mogo Prepaid card work?

The Mogo prepaid card offers great perks for those who love to save the planet. For example, as a cardholder, you can help plant a tree every time you spend. Also, you can invest in sustainable bitcoin every time you use your card. Moreover, you don’t need to follow a minimum annual income to qualify. Plus, you can control your finances with the card’s features.

You can also get a free credit score every month. As a cardholder, you will also get free identity theft protection! Plus, there are no monthly or purchase transaction fees. You can also add money to your card online for free. However, using domestic ATMs costs $1.50, and international ATMs costs $3.00. A $1.90 inactivity fee is also charged if you don’t use your card for a year. Moreover, foreign transactions cost 2.5%.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Mogo Prepaid card benefits

The Mogo card is one of the best Canadian prepaid cards in the market. Also, it offers great benefits for those who need to save money and need to use cards. For example, you don’t have the option to overdraft, so you can only load the amount you will use. However, this card also has some downsides. So check out our list below and see the pros and cons of this excellent prepaid card!

Pros

- No monthly fees.

- There are no purchase transaction fees.

- You can access identity fraud protection for free.

- There is access to your credit score monthly for free.

Cons

- There is no welcome bonus.

- You won’t have access to an extended warranty.

How good does your credit score need to be?

Since Mogo is a prepaid card, you don’t need a credit score to apply. Therefore, you can get this card with no impact on your current score as well.

How to apply for a Mogo Prepaid card?

It is very easy to get your Mogo prepaid card. All you need is a computer and internet access. Therefore, you can go to our post below and find out everything about how to get this excellent card!

How to apply for the Mogo Prepaid card

Do you need a card to control your finances and help the planet? Read our post about the Mogo Prepaid card application and learn more!

About the author / Victória Lourenço

Reviewed by / Aline Barbosa

Senior Editor

Trending Topics

Scotia Momentum® No-Fee Visa card full review

Do you need a card to help you save money on car rentals and give you cash back? If so, read our Scotia Momentum® No-Fee Visa card review!

Keep Reading

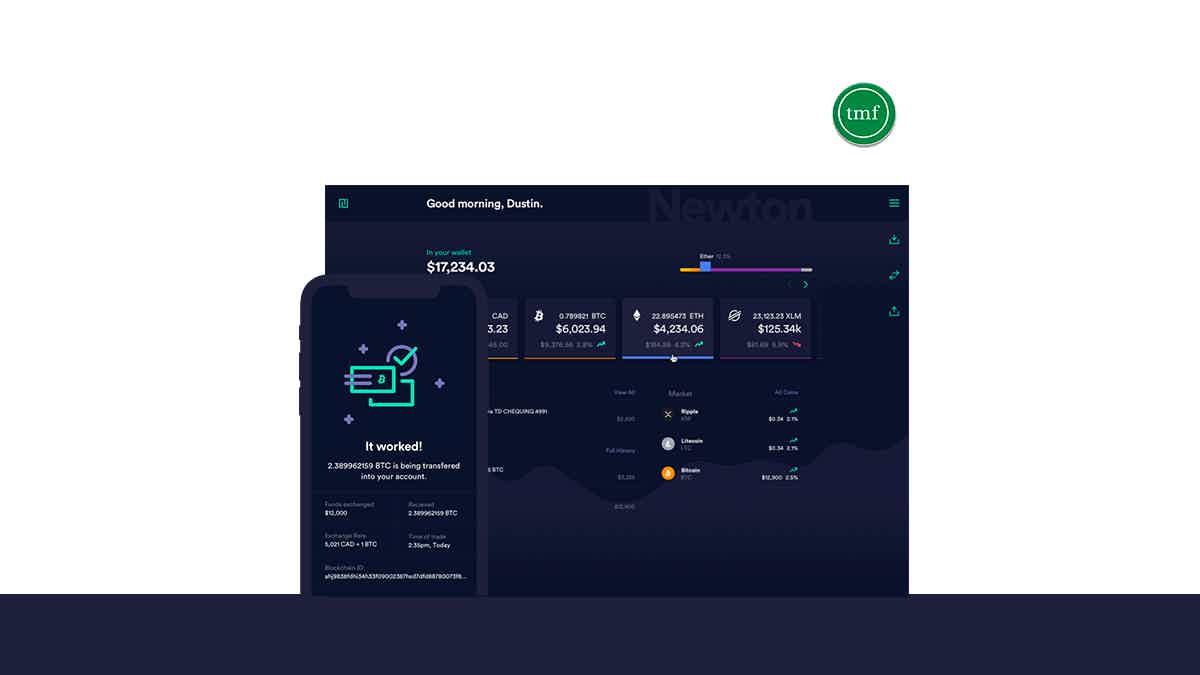

Newton crypto wallet full review: is it safe?

If you are a Canadian looking for a low-cost crypto wallet, you have come to the right place. Check out the Newton crypto wallet review post!

Keep Reading

MomentumPLUS Savings Account full review

Check out this MomentumPLUS Savings Account review article and learn how to earn a savings rate of up to 1.50% with a special welcome offer!

Keep ReadingYou may also like

How to request US Bank Altitude® Go Visa Signature® Card

Check out how to apply for the US Bank Altitude® Go Visa Signature® card and start earning rewards and cash back today! Plus, you don't have to worry about annual or foreign transaction fees.

Keep Reading

The best credit cards in the US for 2022

Today you'll find out the best credit cards in the US. That way, you can choose the one that fits your profile better and enjoy many benefits and rewards in 2022!

Keep Reading

Navy Federal More Rewards American Express® Card Full Review

Experience the unparalleled rewards of the Navy Federal More Rewards American Express® Card- up to 3X points on purchases and more!

Keep Reading