Loans (US)

Marcus Personal Loans by Goldman Sachs review: flexibility and affordability

Check out the Marcus Personal Loans by Goldman Sachs review and learn how to consolidate debt with affordability and flexibility.

Marcus Personal Loans by Goldman Sachs: up to $40,000 with no fees

Marcus Personal Loans by Goldman Sachs offers loans with no origination, late or early payoff penalty fees.

Also, it provides flexible and customizable terms of up to six years.

Keep reading to find out how it works!

How to apply for the Marcus Personal Loans?

Check out how the Marcus Personal Loans by Goldman Sachs application works so you can get access to affordable loans to consolidate debt.

| APR | Approximately from 6.99 to 24.99% |

| Loan Purpose | Personal (especially for those who want to consolidate debt) |

| Loan Amounts | From $3,500 to $40,000 |

| Credit Needed | Fair |

| Terms | Flexible and customizable (usually from 3 to 6 years) |

| Origination Fee | None |

| Late Fee | None |

| Early Payoff Penalty | None |

Loans from Marcus by Goldman Sachs are usually best for consolidating debt. The amounts range from $3,500 to $40,000, and you can apply with less-than-perfect credit.

How does the Marcus Personal Loans by Goldman Sachs work?

Marcus Personal Loans by Goldman Sachs offers a fantastic deal for those who want to consolidate debt at a very low cost.

Besides the fact that it doesn’t have origination, late, or prepayment fees, a loan from Marcus offers rate discounts when you choose an autopay option.

Also, it considers less-than-perfect credit scores in the application process. In addition, it provides a prequalification option with no hard inquiry on your credit.

Although it doesn’t offer a joint loan or co-sign, it provides a direct payment feature to creditors for those who choose a personal loan for debt consolidation.

The amounts vary from $3,500 to $40,000 and rates from 6.99 to 24.99%. That’s, you access affordable costs with a good range of amounts.

Furthermore, the terms are flexible and customizable, varying from three to six years.

And in case you need the money right away, funding is fast at Marcus by Goldman Sachs. Usually, it takes from one to four business days after approval for the money to be funded into your account.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Marcus Personal Loans by Goldman Sachs benefits

Marcus Personal Loans by Goldman Sachs provides everything you need in terms of lending options, especially if you need money to consolidate debt.

It provides autopay rate discounts, a good range of amounts, flexible terms, reasonable rates, and fast funding with no fees.

Pros

- It considers less-than-perfect credit score applicants;

- It offers prequalification with no hard inquiry;

- It provides an autopay option with rate discounts;

- It features flexible terms and a good range of amounts;

- It provides direct payment to creditors for those who want to consolidate debt;

- It offers fast funding.

Cons

- It doesn’t offer a joint loan or co-sign option;

- It lacks more customer service channels.

How good does your credit score need to be?

Applying for a loan at Marcus Personal Loans by Goldman Sachs doesn’t require you to have a perfect credit score. It is recommended that you have at least fair credit.

How to apply for Marcus Personal Loans by Goldman Sachs?

If you are interested in consolidating debt, you should take a look at how easy it is to apply for a loan at Marcus Personal Loans by Goldman Sachs. Keep reading to find out more!

How to apply for the Marcus Personal Loans?

Check out how the Marcus Personal Loans by Goldman Sachs application works so you can get access to affordable loans to consolidate debt.

About the author / Aline Augusto

Reviewed by / Aline Barbosa

Senior Editor

Trending Topics

Find the Best Visa Credit Cards and enjoy benefits!

Check our Best Visa Credit Cards; Visa credit card reviews and pick your next globally accepted credit card today with reliable information!

Keep Reading

Nexo crypto wallet full review: how does it work?

The Nexo crypto wallet is quick and easy to set up, making it perfect for beginners. Keep reading our Nexo crypto wallet review to know more!

Keep Reading

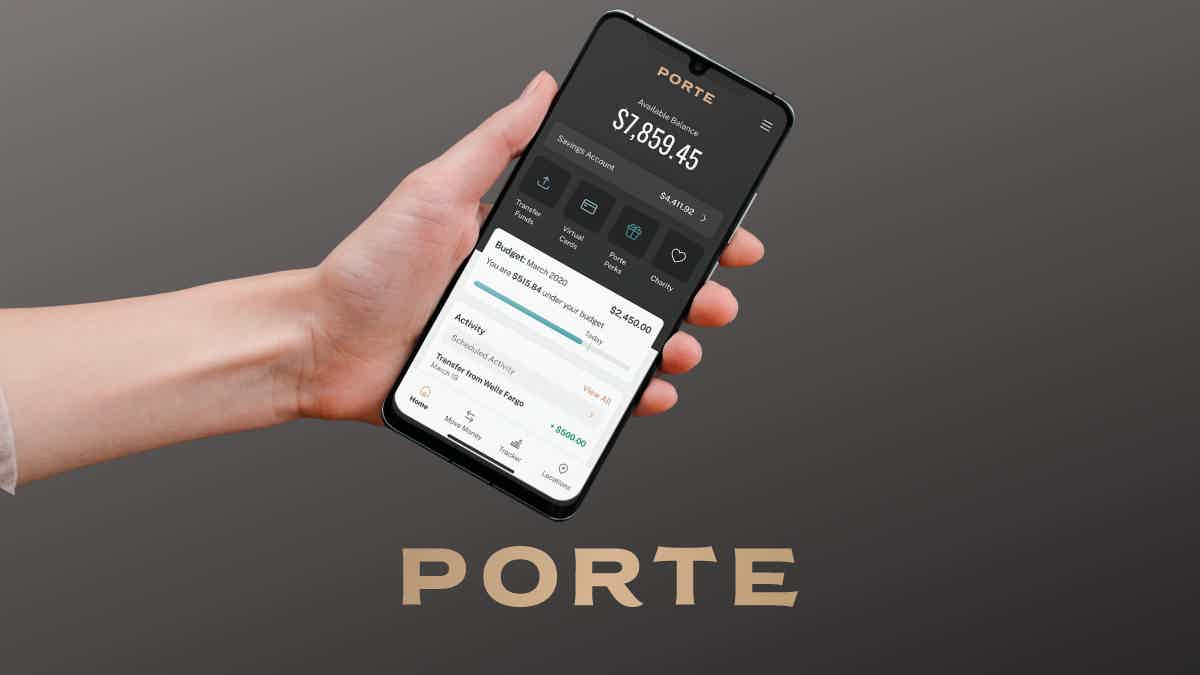

Porte Savings Account full review

Check out the Porte Savings Account review and learn how to build your finances through one of the most affordable mobile banking services.

Keep ReadingYou may also like

Chase Freedom Flex℠ review: is it worth it?

A good credit card is not just for spending money but to get valuable benefits. Chase Freedom Flex℠ is an excellent credit card. We'll tell you more about it in this review.

Keep Reading

Navy Federal More Rewards American Express® Card Full Review

Experience the unparalleled rewards of the Navy Federal More Rewards American Express® Card- up to 3X points on purchases and more!

Keep Reading

Wells Fargo Reflect® Card - The Low APR credit card you were looking for

Ready to tackle your debt? The Wells Fargo Reflect® Card could be the perfect solution. This card offers a generous introductory APR period and no extra expenses!

Keep Reading