Comparison (US)

J.P. Morgan Self-Directed vs Robinhood: Which is the best to invest in?

There are a few different options when it comes to online brokers. So, if you want to know about two great brokers, keep reading to find out which one is best: J.P. Morgan Self-Directed or Robinhood!

J.P. Morgan Self-Directed or Robinhood Investing: comparison for investors

When it comes to investing, there are many options available to you. Between self-directed and robo-advisors, it can be hard to decide which is the best option for you. In this blog post, we’re going to compare J.P. Morgan Self-Directed investment options against Robinhood, an online broker that offers free stock trading. By the end of this post, you should have a good idea of which option is better for you: J.P. Morgan Self-Directed or Robinhood. So, read on!

How to join Robinhood Investment?

Robinhood is a self-directed investment account with low costs, no account minimum required and more! So, learn how to join today!

How to join J.P. Morgan Self-Directed Investing?

With J.P. Morgan Self-Directed Investing, you can start investing with a free commission and no account minimum required. Apply now!

| J.P. Morgan Self-Directed | Robinhood | |

| Trading fees | There are no trading fees. | You do not have to pay trading fees for trading stocks, options, and ETFs. |

| Account minimum | This broker does not require an account minimum. | This broker does not require an account minimum. |

| Promotion | There are no promotions available. | You can get 1 free stock after connecting to your banking account. |

| Investment choices | Stocks, ETFs, mutual funds, bonds, and options. | Stocks, ETFs, cryptocurrency, ADRs, options, fractional shares, and more. |

J.P. Morgan Self-Directed

This online broker can help you trade with low-cost investment options. Also, Self-Directed Investing is one of the two investing options offered by J.P. Morgan. Moreover, this broker can be an excellent choice for those who are Chase customers. Therefore, if you have a bank account with Chase, you can start investing with J.P. Morgan Self-Directed Investing in no time!

In addition, this online broker allows you to make unlimited trades and charges no commissions. Moreover, this broker can be an excellent choice for those looking to trade with no commission fees and in a more independent way. Also, if you like a more traditional way of investing, you can access a self-directed account. On the other hand, if you want a quick response from automated robots, you can have it too.

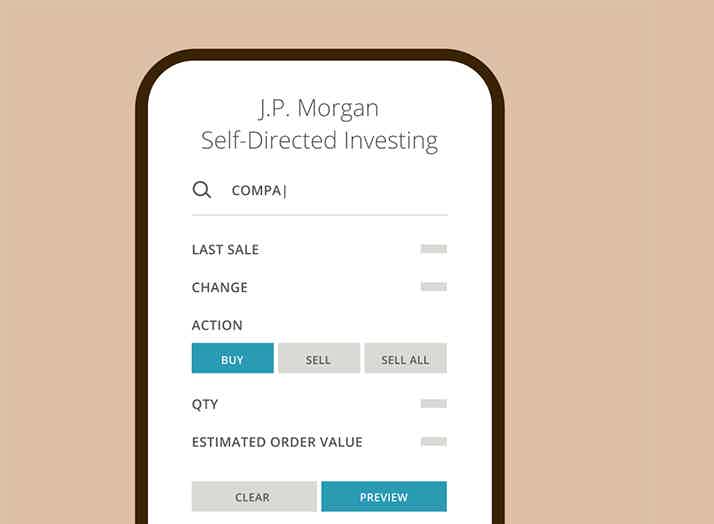

With this broker, you will have access to unlimited and commission-free stocks, ETFs, mutual funds, and more. Also, this broker does not require a minimum initial investment for you to start investing. Moreover, there is an excellent mobile app available to make your investments even more manageable.

In addition, if you want to invest using J.P. Morgan’s robo-advisor, you will need to pay a fee. Moreover, there is a $500 minimum to invest with the robo-advisor. Plus, an annual advisory fee of 0.35%.

Finally, the account types offered by this broker are retirement accounts, both traditional IRA and Roth IRA, and general investment account. So, with this online broker, you can build your online investing portfolio with unlimited $0 fees.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Robinhood Investing

Robinhood is an online broker that started very well in the brokerage market. Moreover, it still has some great advantages for beginner or experienced traders. Also, this online broker does not charge commissions for cryptocurrency, options, and stocks. Plus, you can buy fractional shares for as little as $1.

In addition, this online broker offers an easy-to-use interface. So, you can easily find what you need to manage your investments and learn about this market. Also, the mobile app and web platform interface are both fantastic for those starting to invest. Plus, experienced investors can also make great use of this online broker’s platforms.

Moreover, you can join the Robinhood Gold program, which allows traders to trade on margin. However, there is a monthly fee of $5. Also, if you are a beginner investor, it may be best to earn some experience before trying to trade on margin. This way, you will not fall into some complex problems. So, it can be pretty risky to trade on margin because you will be trading money that belongs to the broker. This way, you can have significant losses.

However, before you start investing with Robinhood, it would be best to know about some of its drawbacks. For example, this online broker has been involved with several lawsuits over the years. It can be a pretty common thing for brokers. But it is best to be aware of as much as possible.

Also, this broker does not offer the option of retirement accounts. And there is very limited customer support because you cannot solve your problems with phone calls. It all has to be done with text messages, and it can be challenging for some people to solve their issues like this.

Benefits of J.P. Morgan Self-Directed

- There are no commissions for trading.

- You can trade mutual funds with no transaction fees.

- This broker offers an investing and banking app (as you need an account to trade).

- You can easily open your account online.

Benefits of Robinhood

- Very well-structured cryptocurrency trading.

- It offers very basic and straightforward platforms.

- This broker offers excellent low commissions for trading.

- The mobile app and web-based platforms are easy to use and can make it easier for you to manage your cash.

Disadvantages of J.P. Morgan Self-Directed

- This broker is only available to United States residents.

- There could be a more extensive product portfolio available.

- You need to pay fees to access the robot advice.

Disadvantages of Robinhood

- There are no retirement accounts available.

- The customer support can be pretty limited because there is no support over the phone.

- Robinhood has faced many lawsuits over the years, which can be a significant drawback for some.

- There are not many good educational resources available.

- You cannot trade mutual funds.

J.P. Morgan Self-Directed or Robinhood: which you should choose?

Let’s remember some of the main features of these two brokers. J.P. Morgan offers a wide range of investments, including bonds, mutual funds, options, stocks, and more. On the other hand, Robinhood does not offer mutual funds or fixed-income assets. Plus, you can buy fractional shares for as little as $1. However, both brokers have low commissions.

Also, J.P. Morgan only has a simple web-based trading platform. In contrast, Robinhood offers a very easy-to-use mobile platform and a web-based platform. However, it is best to consider some of the drawbacks of these two online brokers.

For example, remember that Robinhood has faced some lawsuits over the years. So, it is essential to pay attention to which were the problems involved before you decide to join this broker. Also, there are not many good educational resources.

On the other hand, J.P. Morgan has limited research and tools for trading. Moreover, there are no educational savings accounts, joint accounts, or trust accounts. So, if any of these are crucial to you, you might have to consider joining another online broker. However, both these brokers have excellent features, so it is up to you to analyze what is best and crucial to you in an online broker.

Moreover, if you want to continue searching for the best online broker for you, we can help you. TD Ameritrade is an online broker that has excellent features and trading options for beginners. Also, you can find a good platform for more experienced investors. So, if you want to learn a lot more about this online broker, read our post below with a full review of TD Ameritrade!

Ameritrade Investing app full review

Do you need a good online broker for beginners? The Ameritrade Investing app can be your choice. Keep reading our full review to know more!

About the author / Victória Lourenço

Reviewed by / Aline Barbosa

Senior Editor

Trending Topics

5 easy steps to pick the best credit card for you

Learn here step by step which factors you should consider when choosing the best credit card for you, according to your lifestyle and needs.

Keep Reading

RoadLoans review: get the auto loan you need!

Looking for a new or used car? If so, our RoadLoans review post can be useful! So, read on to learn more about this auto lending platform!

Keep Reading

How to apply for the CitiBusiness® / AAdvantage® Platinum Select® Mastercard®?

Check out how simple it is to apply for a CitiBusiness® / AAdvantage® Platinum Select® Mastercard® and enjoy endless miles to travel abroad!

Keep ReadingYou may also like

Chase Secure Banking℠ review: How is this account different from the others?

Ready to take control of your finances and earn a $100 sign-up bonus? Then, join us for a Chase Secure Banking℠ review!

Keep Reading

Mortgage statement: what it means and how to read it

Unsure of what all the numbers and terms on your mortgage statement mean? We're here to help! This article explains everything you need to know.

Keep Reading

Merrick Bank Personal Loan review: how does it work and is it good?

If you can’t afford another hard pull to your credit score, this lender will only do it when you say you’re ready. Check our Merrick Bank Personal Loan review and learn more!

Keep Reading