Investing (US)

How to join J.P. Morgan Self-Directed Investing?

Learn how to join J.P. Morgan Self-Directed Investing and enjoy its portfolio options, including Stocks, ETFs, Mutual funds, and more!

Opening an account at J.P. Morgan Self-Directed Investing

The JP Morgan Self-Directed Investing platform is a great place for investors to learn about investing and how it can be used to take control of their financial future. The team at J.P. Morgan has put together resources that teach the basics of investing, strategies for risk management, retirement planning and more!

Plus, this investment account allows you to invest in stocks, ETFs, mutual funds, bonds, and options.

With no account minimum required and no commission fees on stocks and ETFs, J.P. Morgan Self-Directed Investing account is good for beginners and Chase customers.

Check out how to open it now.

Open account online

Access the Chase website at https://www.chase.com/ and choose personal investment products. Then, click on Open an account.

At this point, you can choose between trade on your own or invest with their robo-advisor.

Then, choose General Investment, Traditional IRA, or Roth IRA. Note that Traditional or Roth IRA accounts may apply some fees.

After choosing that, you have to fill in some personal information, e-sign documents, and select the source of funds.

Finally, submit it and wait for approval.

You can also ask for help through its customer service.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

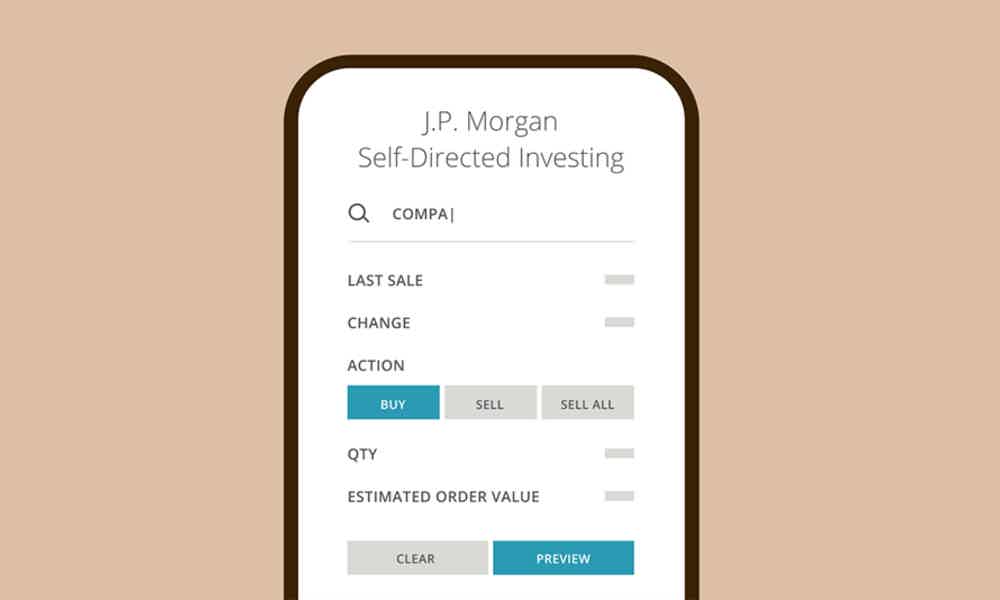

Join using the app

Once you have been approved, you can download the Chase mobile app and start managing your dashboard right in your hand.

JP Morgan Self-directed Investing vs. Robinhood Investing

J.P. Morgan Self-Directed Investing is an option if you are new investor or a Chase customer. But, if you want a promotion and more investments choices, you should look at Robinhood Investing.

Robinhood is a mobile app that allows you to invest without having to pay any fees. The best part about the app is that it doesn’t have any minimums or required amounts for opening an account. So, check out more information about it on our comparison chart below!

| J.P. Morgan Self-Directed Investing | Robinhood Investing | |

| Trading fees | None | None |

| Account minimum | $0 | $0 |

| Promotion | None | One free Stock |

| Investment choices | Stocks, ETFs, Mutual funds, Bonds and options. | Stocks, ETFs, fractional shares, Options, Cryptocurrency and American Depositary Receipts. |

How to join Robinhood Investment?

Robinhood investment is a self-directed account that offers you a full range of investment choices for free. And you may join it today. Learn how to do it now!

About the author / Aline Augusto

Reviewed by / Aline Barbosa

Senior Editor

Trending Topics

How to join Thecreditapplication.com?

Get the B2B credit application management you need by reading our post and learning how to join Thecreditapplication.com!

Keep Reading

HSBC Rewards Credit Card full review: Intro interest!

Are you looking for a rewards card with 0% intro interest? If so, read our HSBC Rewards Credit Card review for the pros and cons!

Keep Reading

Mattress Firm Synchrony HOME™ Credit Card review

If you need to get a brand new mattress, the Mattress Firm Synchrony HOME™ Credit Card can be great for you! Read our full review.

Keep ReadingYou may also like

Earn more: Blue Cash Everyday® Card from American Express review

Want a credit card that rewards you for your everyday spending? Discover the perks of the Blue Cash Everyday® Card from American Express with our review.

Keep Reading

Hassle-free process: Apply for Avant Credit Card

Build better credit without hassle. Introducing Avant Credit Card – apply online with no impact on your score. Discover how in our comprehensive guide.

Keep Reading

Is the U.S. headed for a housing crisis?

The housing market has been booming for years, but there are signs that a crash could be on the horizon. Find out what's causing it and what you can do to prepare.

Keep Reading