Investing (US)

J.P. Morgan Self-Directed Investing full review

If you are looking for an investment account with $0 commissions and no account minimum, you should check out our J.P. Morgan Self-Directed Investing review!

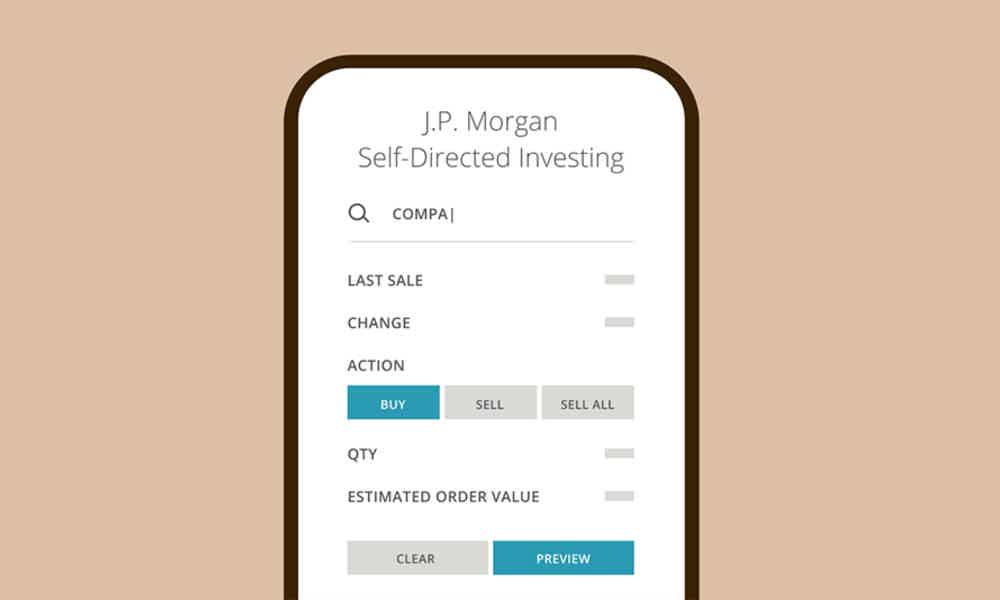

J.P. Morgan Self-Directed Investing review

On today’s review, you’ll learn more about J.P. Morgan Self-Directed Investing, an investing account by Chase that features a good platform mobile app.

It doesn’t charge trading fees for stocks and ETFs.

Also, it doesn’t require an account minimum. And, it is recognized as one of the best trading platforms to invest in the market. It is easy to use and manage.

If you are already a Chase member, you should take a look at it.

If you are not, it is a valuable opportunity to learn more about it.

| Trading fees | None |

| Account minimum | $0 |

| Promotion | None |

| Investment choices | Stocks, ETFs, Mutual funds, Bonds and options. |

How to join J.P. Morgan Self-Directed Investing?

Looking for investing in stocks, ETFs, and more? Check out how to join J.P. Morgan Self-Directed Investing!

How does the J.P. Morgan Self-Directed Investing work?

You should meet the J.P. Morgan Self-Directed Investing account if you are thinking about investing your money through an easy-to-manage online platform.

It doesn’t require an account minimum, as well as it doesn’t charge commission fees on stocks and ETFs.

But note that they might charge you $0.65 on Options trade per contract and other fees on some investments.

J.P. Morgan features 3 types of accounts: general investment, traditional IRA, and Roth IRA.

On the other hand, it doesn’t feature a wide number of tools and research providers.

Also, it doesn’t offer fractional shares, futures, and crypto trading.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

J.P. Morgan Self-Directed Investing benefits

The main advantage of this account is the free commission and the no account minimum requirement. So, it is good if you are a new investor on the market.

Plus, it provides an All-in-one app that helps you manage your investment online.

On the other hand, it offers limited investment choices, and on some of them are trading fees charged.

Pros

- No commission fee

- No account minimum required

- All-in-one app

- Good customer service

- Portfolio Builder that helps you build your portfolio based on your risk tolerance and goals

Cons

- Limited investment options

- No bonus

- Trade on margin not allowed

- Portfolio Builder requires a balance of at least $2,500

Should you join J.P. Morgan Self-Directed Investing?

This investment account features some good choices of investments and no commission fees or account minimum required. So, if you are new on the market or already have a Chase account, it might offer you a great start.

Can anyone open a J.P. Morgan Self-Directed Investing account?

Anyone can open an account, but it is more recommended for a new investor or people who already have a Chase account.

How to open a J.P. Morgan Self-Directed Investing account?

Click on the link below to learn how to open an account at J.P. Morgan Self-Directed Investing. That way, you can start to invest in basic trades with no commission fee or account minimum!

How to join J.P. Morgan Self-Directed Investing?

Looking for investing in stocks, ETFs, and more? Check out how to join J.P. Morgan Self-Directed Investing!

About the author / Aline Augusto

Reviewed by / Aline Barbosa

Senior Editor

Trending Topics

FHA loans review: what you need to know before applying

In this FHA loans review, you will learn about how it works and how you can get reasonable offers, so you finally buy your dream home!

Keep Reading

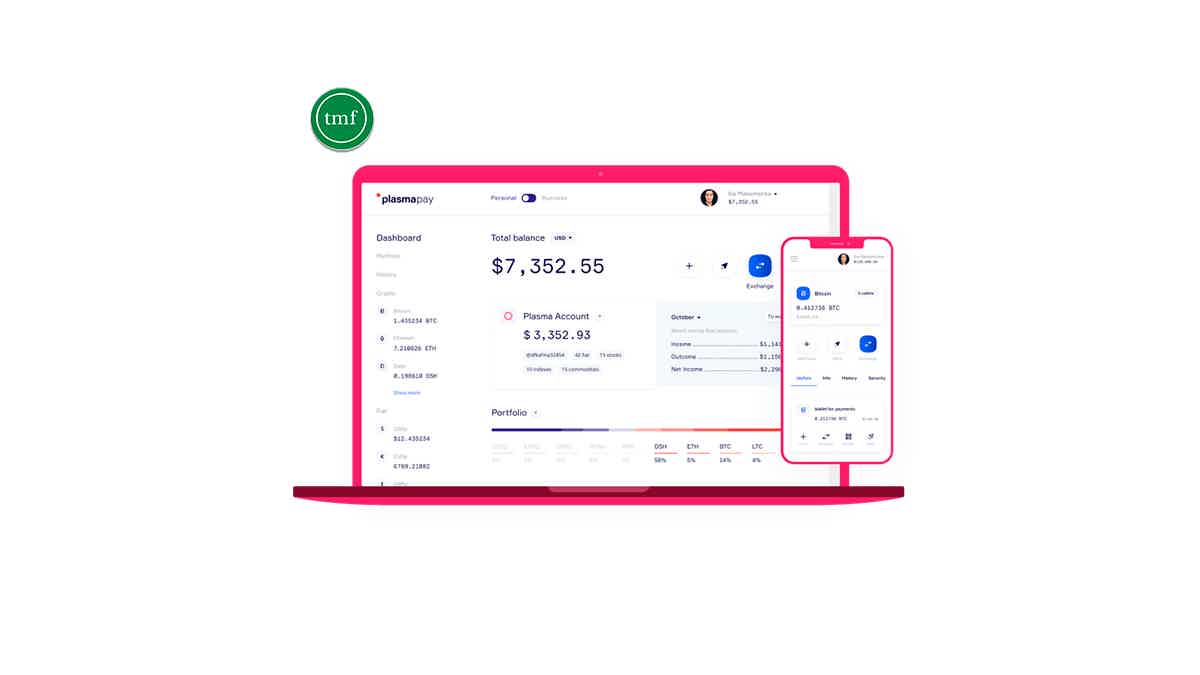

PlasmaPay crypto wallet full review

Looking for a crypto wallet that offers more than 300 coins and tokens? If so, check our PlasmaPay crypto wallet review to learn more!

Keep Reading

Merrick Bank review: is it trustworthy?

In this Merrick Bank review, we will show all its financial products so you can decide if it fulfills your needs and goals. Check it out!

Keep ReadingYou may also like

Understanding Annuities as an Investment: a guide for starters

We know investing can be confusing sometimes. Do you know how to have annuities as an investment? If you don't even know what an annuity is, don't worry. You can learn more about this topic by reading this article.

Keep Reading

Milestone® Mastercard® application: how does it work?

Are you looking for a way to build credit? If so, you can try with the Milestone® Mastercard®. And there is no need for security deposit! Read on to learn how to apply!

Keep Reading

Capital One Spark Miles for Business review: Travel on budget while earning rewards

You might want to read the Capital One Spark Miles for Business review if you constantly travel on business. With this credit card, you can earn miles and rewards to redeem on your trips. Read on to learn more!

Keep Reading