Finances (US)

How to join and start banking with Spring Bank?

Check out how to join Spring Bank and enjoy all advantages a B Corp bank offers, including transparency and commitment to the whole community.

Join Spring Bank: products and services for both personal and business banking

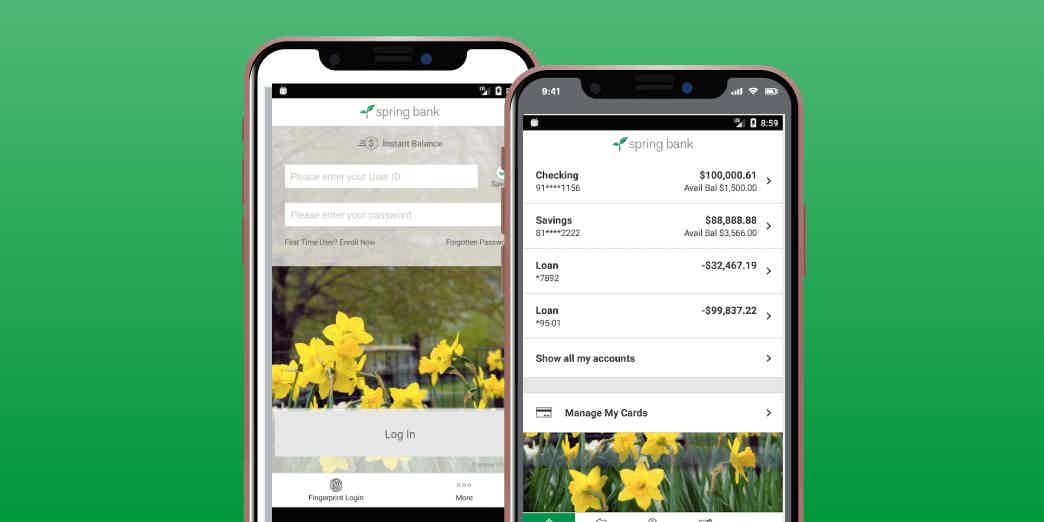

Spring Bank is the first B Corp in New York, which means the company is committed to high transparency, accountability, community, and performance standards. Learn how to join Spring Bank, a bank that offers a wide range of products and services for both personal and business banking.

Besides checking accounts, Spring Bank features savings and CDs with competitive rates and lending options with flexible terms for various purposes. Also, you can access excellent 24-hour support and a vast ATM network nationwide for free.

Apply for an account

First, access the official website and click on Personal Checking or Business Checking, according to what you need.

You can choose between a Money Market account and Interest Checking, a Basic option, or a Green Checking.

On the other hand, if you need an account for your business, you can choose between Nonprofit Banking, a Money Market, or Basic Checking with essential features.

All accounts require a minimum to open, and although they have fees, you can waive them by maintaining a minimum balance.

Also, you can choose a savings account among the many options available.

After selecting which better suits you, fill in the form with your contact. The bank will access you to finish the opening process.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Apply for the loans

If you need to borrow money, you can access the lending options this bank offers. So, access the website and choose the option that fits your goal and need.

Then, fill in the form with your contact, and they will contact you.

Spring Bank vs. TAB Bank

If you want an alternative, check out TAB Bank, an option that offers a full service for many purposes.

How to start banking with TAB Bank?

TAB Bank offers a wide range of financial solutions for you or your business. Check out how to join!

| Spring Bank | TAB Bank | |

| Financial products and services offered | Personal Checking, Personal Savings, Personal Lending, Business Checking, Commercial Lending, and Small Business Lending | Personal solutions and accounts, business accounts and services, insurance |

| Fees | Accounts feature waived fees if you maintain minimum balance | Most accounts have no monthly fees, and in those that have, you can avoid fees by maintaining a minimum balance and following some requirements |

| Minimum balance | From $100. Each type of account requires a minimum balance in order to waive maintenance fees | It starts from $1, and it varies depending on the account you choose |

About the author / Aline Augusto

Reviewed by / Aline Barbosa

Senior Editor

Trending Topics

Should you be scared to take out a Home Equity Loan?

Do you need to find equity for your home to pay a debt? If so, you can read our post to understand more about how to take out a home loan!

Keep Reading

Merrick Bank Double Your Line® Secured Credit Card review

A secured card is an option for those with a bad credit score. So, check out the Merrick Bank Double Your Line® Secured Credit Card review!

Keep Reading

How to start budgeting: 5 simple steps!

Learning how to start budgeting doesn't need to be any harder than earning your money! Check out five simple steps to be on the right path.

Keep ReadingYou may also like

Capital One Savor Cash Rewards Credit Card vs. Capital One Walmart Rewards® Mastercard®: card comparison

Unsure if you should apply for the Capital One Savor Cash Rewards Credit Card or Capital One Walmart Rewards® Mastercard®? Check out this comparison to see which offers the best benefits for you!

Keep Reading

The hidden cost of banking: 6 common bank fees you may not know about

It's no secret that banks charge fees. But what many people don't know is why they do it. This post will explain the common bank fees and why they're necessary.

Keep Reading

Axos High Yield Savings Account review: is it good?

Read our Axos High Yield Savings Account review to see if it’s a good fit for your financial needs. This online savings account has competitive interest rates, no monthly maintenance fees, and much more!

Keep Reading