AU

How to join Citi PayAll?

Are you looking for a convenient way to pay your bills and earn rewards with your Citi card? If so, read on to learn how to join Citi PayAll!

Join Citi PayAll: Easily join through the app!

Do you need a way to manage your everyday payments with your Citi card and earn rewards? If so, read on to learn how to join Citi PayAll!

Also, this program from Citi is offered exclusively for their Australian customers, giving them the opportunity to turn their everyday payments into rewards.

This offers an easy way for us Aussies to get back something for every cent we spend, making life easier by streamlining our day-to-day transactions.

Therefore, keep reading our post to learn more about this feature and how to join it!

Online Application Process: join Citi PayAll

You can join Citi PayAll only if you are already a Citi credit card holder. Also, only a few Citi cards are eligible.

Moreover, you should know that with no holds or suspensions on your card, you can use Citi PayAll.

Therefore, Citi PayAll promotions require an active and in good standing account to be available. So, you must be a Citi card holder that uses your card responsibly.

Now, if you meet these requirements, you can go to the Citi Mobile App and see if you can find the Citi PayAll payment option. If you find it, it means you got approved for it!

Then, you can schedule your payments and start using your Citi PayAll features!

You will be redirected to another website

Application Process using the app

The Citi Mobile® App may be used to initiate a Citi PayAll. Also, to take advantage of this opportunity, you must enroll within 30 days of receiving the email or SMS invitation.

Also, you can manage your Citi PayAll features through the Citi mobile app at all times to keep track of your spending.

Other recommendation: Citi Clear Credit Card

If you want to use Citi PayAll’s features, you must be a Citi credit card holder. However, you can’t own just any Citi credit card.

Therefore, we will show you an option to give you access to Citi PayAll and many other perks!

Also, with the Citi Clear Credit Card, you’ll be able to earn rewards besides the Citi PayAll rewards! Moreover, you can even get complimentary insurance, access to luxury escapes, and more!

In addition, this card offers cashback offers each month for you to diversify your earnings! Moreover, there is a 0% intro p.a. for balance transfers for 15 months (terms apply)!

Therefore, read our table below to learn more about this incredible card and see if it’s the best choice for your finances!

| Credit Score | Good score. |

| P.A.* | 0% p.a. for balance transfers for 15 months with no balance transfer fee; 14.99% p.a. for purchases. *Terms apply. |

| Annual Fee | $49 in your first year. Then, $99. |

| Fees* | 22.24% p.a. for cash advances. Additional cardholder fee of $0 for up to four additional cardholders. *Terms apply. |

| Welcome bonus* | $400 cashback when you spend $3,000 on qualifying purchases in your first 90 days with the card. *Terms apply. |

| Rewards* | 10% off Limited Time Lux Exclusive hotel offers until 1 March 2024. *Terms apply. |

Next, you can learn everything about the Citi Clear Credit Card application process!

How to apply for the Citi Clear Credit Card?

If you're wondering how to get a low-interest card with incredible benefits, read on to learn how to apply for the Citi Clear Credit Card!

About the author / Victória Lourenço

Reviewed by / Aline Barbosa

Senior Editor

Trending Topics

How to apply for the BOQ Platinum Visa Credit Card?

If you're looking for a new balance transfer credit card, read on to learn how to apply for the BOQ Platinum Visa Credit Card!

Keep Reading

NOW Finance Personal Loans full review: Varied loans!

Are you in the market for a good personal loan? If so, you can read our NOW Finance Personal Loans review to see the pros and cons!

Keep Reading

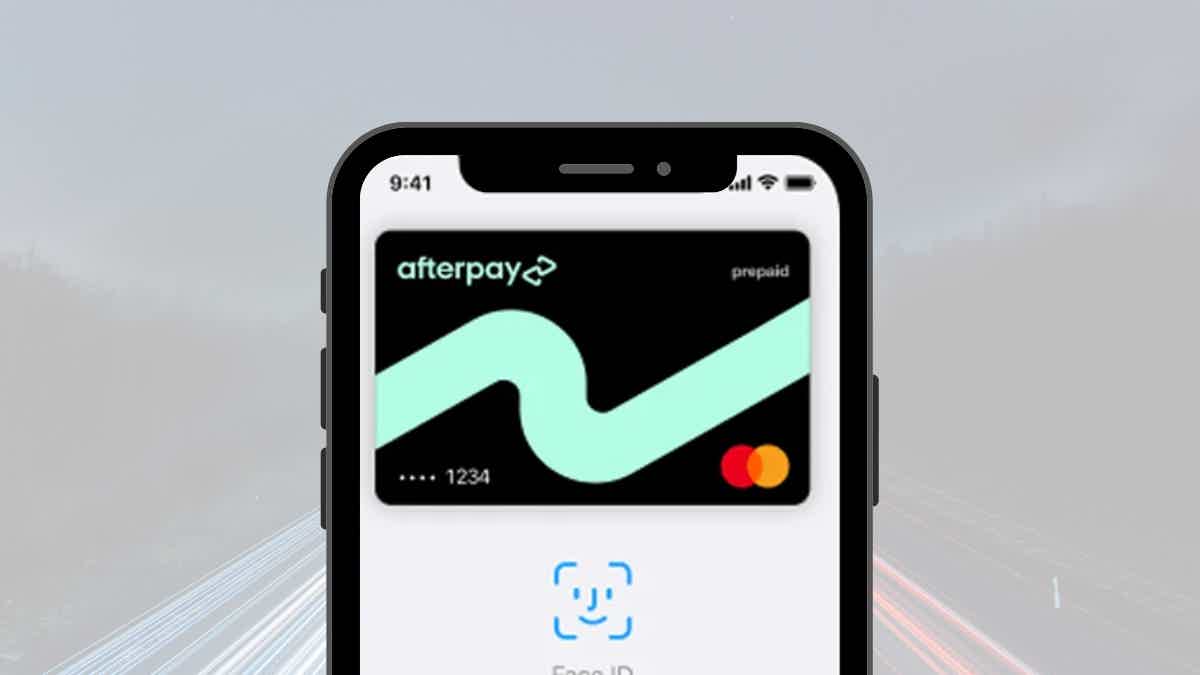

How to apply for the Afterpay Card?

Are you looking for a card to make payments and pay over time with no interest? If so, read on to learn how to apply for the Afterpay Card!

Keep ReadingYou may also like

How to apply for the Scotiabank Preferred Package

In this article we are going to walk you through the application process for the Scotiabank Preferred Package account. Keep reading if you want to learn more!

Keep Reading

U.S. Bank Cash+™ Visa Signature® credit card review: is it worth it?

When it comes to cashback, the more you get on daily spending, the better. That's the case with the U.S. Bank Cash+™ Visa Signature® credit card. You can choose the best categories for you. Learn more about it in this article.

Keep Reading

Low Income Home Energy Assistance Program (LIHEAP)

Learn about the Low Income Home Energy Assistance Program. Uncover eligibility requirements and find out how you can apply for assistance today!

Keep Reading