AU

How to apply for the Afterpay Card?

Apply for an Afterpay Card and start shopping now with discounts and sales. Plus, you can pay later over 6-month payments! Read on to learn how!

Afterpay Card application: Apply with no fees!

Are you looking for a card to shop and pay later with no interest? If so, learning how to apply for the Afterpay Card may be the perfect option for you!

Also, you can apply without any fees, making it a great choice if you’re on a budget.

Plus, there are no interest fees, so you can relax and enjoy your shopping spree knowing that you won’t have to worry about additional costs.

However, you need to make your payments on time, or you’ll need to pay some late payment fees. Which won’t accumulate.

So, you can really use this card to make the purchases you need and pay over the time of six weeks! This way, you can shop and get the products you need with discounts and even sales sometimes.

Moreover, you don’t even have to pay annual or monthly fees! So, read our post to learn how to apply for Afterpay today!

Online Application Process

You can create an Afterpay account online through the official website. You’ll only need to provide your email address. However, you can only use the card’s features through the official mobile app.

Moreover, you should know that you don’t need a high score to apply. However, you need to know that you may not get all your purchases approved depending on your situation.

And you can see our tips on the topic below to use your card on the mobile app!

You will be redirected to another website

Application Process using the app

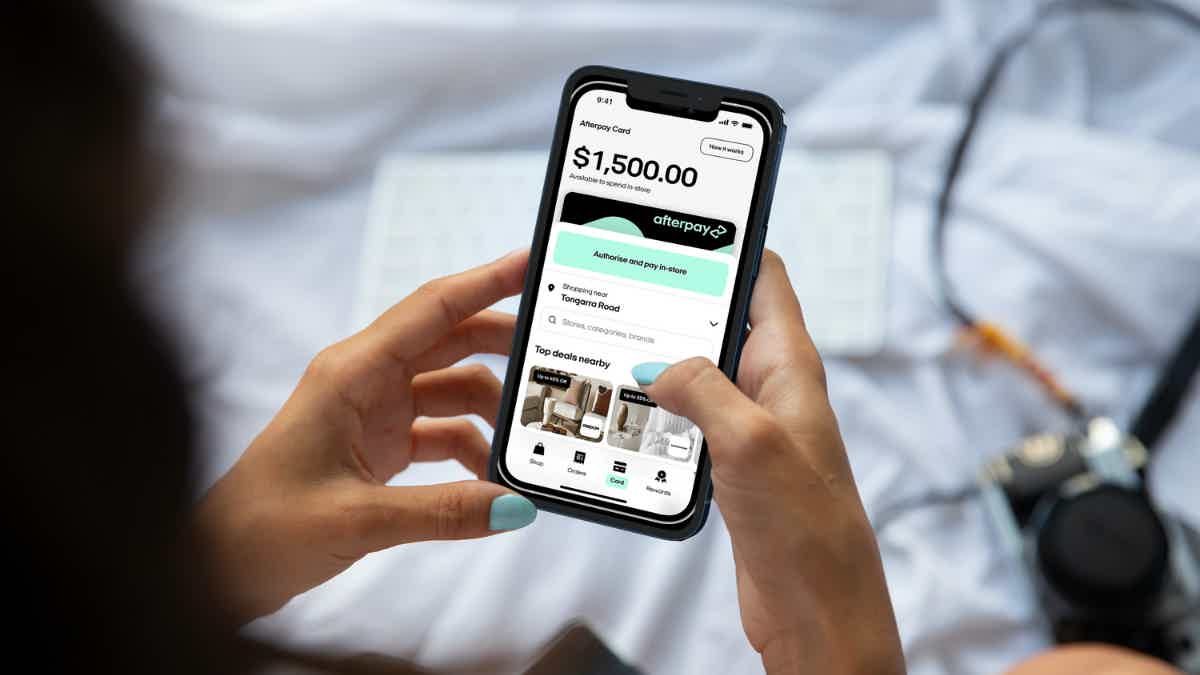

You’ll need to download the Afterpay mobile app to start using your card. Then, you’ll add the Afterpay card to your Google Pay or Apple Wallet.

After all of that, you can open your Afterpay app when making a purchase and see if you can use it in-store or online.

Moreover, you can even check your terminal to make your purchase payments on time. Plus, they will send you payment alerts and reminders, so you never forget to pay and don’t have to pay any late fees!

Afterpay Card vs. Virgin Money Low Rate Credit Card

If you’re not so interested in getting the Afterpay Card to make your purchases with no interest, you can find a different option. For example, you can try applying for the Virgin Money Low Rate Credit Card.

With this credit card option, you’ll need to pay an annual fee and other fees. However, you’ll get access to a really long intro p.a. of 36 months on balance transfers!

So, read our comparison table below to help you decide between these cards!

| Afterpay Card | Virgin Money Low Rate Credit Card | |

| Credit Score | There are no credit score requirements. | Good. |

| P.A. | No p.a. | 0% intro p.a. for 36 months on balance transfers, and there will be no balance transfer fees (limited offer); 11.99% variable p.a. on purchases. |

| Annual Fee | There are no annual fees or monthly fees. | $99. |

| Fees | There are no fees if you make all your payments on time. | Cash advance rate: 21.69% p.a. |

| Welcome bonus | None. | None. |

| Rewards | You can access offers, discounts, and sales from your favorite brands and pay with your card. | N/A. |

If you’re more interested in having a physical credit card, check the Virgin Money Low Rate Credit Card review to learn how it works and how to apply for it.

Virgin Money Low Rate Credit Card review

If you need a low-interest card with other benefits, read our Virgin Money Low Rate Credit Card review to learn this card's pros and cons!

About the author / Victória Lourenço

Reviewed by / Aline Barbosa

Senior Editor

Trending Topics

NAB Bank review: The best financial products!

If you're looking for a bank with competitive rates and great perks, you can read our NAB Bank review to find out how this bank works!

Keep Reading

How to apply for the MoneyPlace Personal Loan?

Do you need a loan with good rates and terms and a quick application? If so, read on to learn how to apply for the MoneyPlace Personal Loan!

Keep Reading

Coles No Annual Fee Mastercard review: Great perks!

If you need a card with no annual fee and intro p.a. offers. Read our Coles No Annual Fee Mastercard review to learn more!

Keep ReadingYou may also like

Get the Ulta Credit Card: A Simple Way to Apply Today!

You can now get your cherished beauty products from Ulta while earning points that can be converted into discounts. Read on and learn more!

Keep Reading

Citi® / AAdvantage® Platinum Select® World Elite Mastercard® application: how does it work?

Are you wondering how to apply for the Citi® / AAdvantage® Platinum Select® World Elite Mastercard® and what you can expect along the way? We've got you covered. Read on to learn more!

Keep Reading

Chase Sapphire Reserve® review: Free airport lounge access worldwide

Are you thinking of jet-setting with a new travel card? Check out our Chase Sapphire Reserve® review and see if it's just what you need for your next adventure. Read on!

Keep Reading