Credit Cards (US)

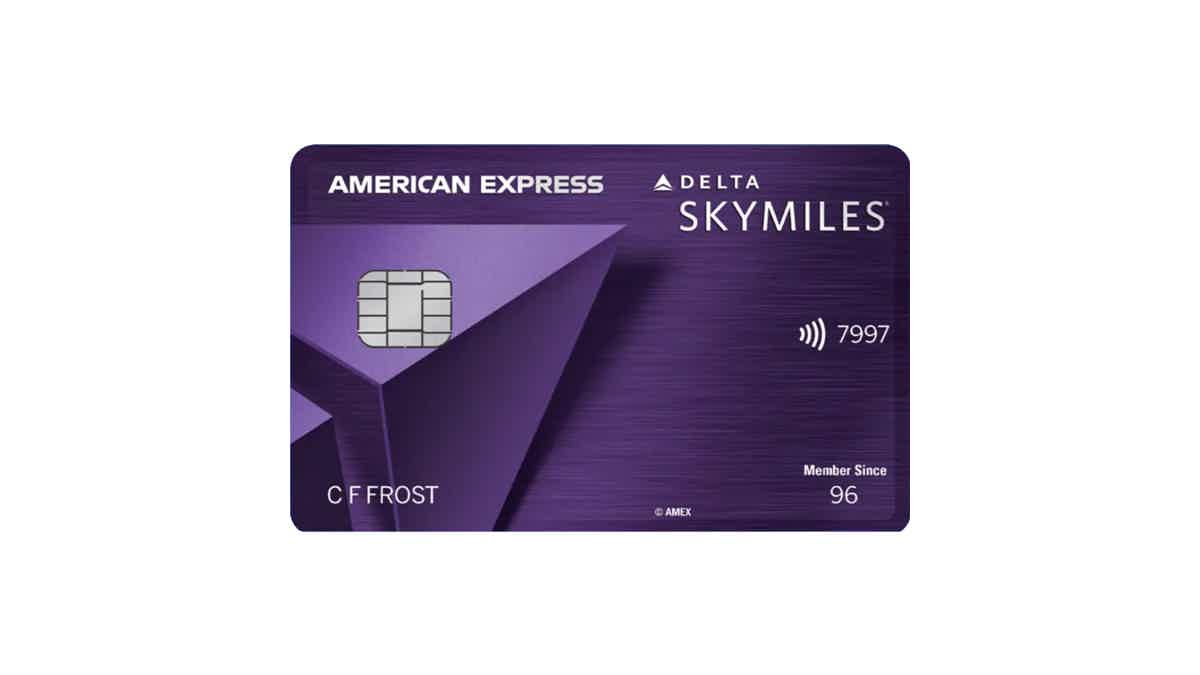

How do you get The Delta SkyMiles® Reserve American Express Card?

If you fit the profile and want to get The Delta SkyMiles® Reserve American Express Card, just keep reading our post to know how to apply!

Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.

Partner Offer through CreditCards.com

The Delta SkyMiles® Reserve American Express Card application.

If you want to know how to apply for The Delta SkyMiles® Reserve American Express Card, you are in the right place. This card can be a great choice for people who love amazing travel experiences and great rewards that can come with it. So, to know more about the application process of this great travel card, keep reading our post!

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Apply online

To make the online application for this credit card, you need to check if you pre-qualify to get it. You can go on American Express’s website, search for the card, and provide your personal information. After that, you can get a response in about 30 seconds, as they inform on their website!

Apply using the app

If you download the Amex app, you can check your Amex card accounts and manage them through the mobile app. However, the application for this card needs to be made online, as we have explained above.

The Delta SkyMiles® Reserve American Express Card vs. Bank of America Cash Rewards card

If you are still unsure about getting the Delta SkyMiles Reserve Amex card, it can be a good thing to read about other great cards. So, here is a comparison with the Bank of America Cash Rewards card.

| The Delta SkyMiles® Reserve American Express Card | Bank of America® Customized Cash Rewards credit card | |

| Credit Score | Good to excellent | Good to excellent |

| Annual Fee | $550 Rates & Fees | $0 |

| Regular APR | Purchases APR: 20.49%-29.49% variable. Cash Advance APR: 29.99% variable. Rates & Fees | 0% intro APR for 18 billing cycles; 16.99% – 26.99% Variable APR after that period. |

| Welcome bonus* | Earn 50,000 bonus miles and 10,000 Medallion® Qualification Miles (MQMs) after you spend $5,000 in purchases on your new Card in your first 6 months. *Terms apply | $200 online cash rewards bonus after you make at least $1,000 in purchases in the first 3 months of account opening. |

| Rewards* | 3X miles for spendings directly with Delta 1X miles on other spendings *Terms apply | 3% cash back in the category of your choice; 2% at grocery stores and wholesale clubs (up to $2,500 in combined quarterly purchases); Unlimited 1% on all other purchases. *Terms apply |

How to get the BofA Customized Cash Rewards Card?

With the Bank of America® Customized Cash Rewards credit card you can choose your bonus categories. Keep reading to know how to get this great cash back card!

Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.

Partner Offer through CreditCards.com

About the author / Thais Daou

Reviewed by / Aline Barbosa

Senior Editor

Trending Topics

Fortiva® Mastercard® Credit Card review

If you don't have a high score and need a credit card to help you increase it, check out our Fortiva® Mastercard® Credit Card review!

Keep Reading

How do you get the Verve credit card?

Are you wondering how you can get the Verve Credit Card? We'll give you a walkthrough in this article. Read on to learn more!

Keep Reading

Discover it® Cash Back or Discover it® Miles?

Check out our credit card comparison to find out which Discover card is best between the Discover it® Cash Back and the Discover it® Miles.

Keep ReadingYou may also like

Dare App review: Cope with anxiety and Panic Attacks!

This app can be a powerful tool for reducing anxiety in your life. Sometimes it just takes creativity to make a new approach to managing stress and anxiety, so have fun with this Dare app review!

Keep Reading

Apply For the OpenSky® Plus Secured Visa®

Achieving financial stability and freedom requires building credit, but it can be tough with limited or poor credit history. Discover how to apply for the OpenSky® Plus Secured Visa® Credit Card today!

Keep Reading

Capital One Venture X Business Review: Unlocking Travel Rewards

Make the most of your business trips, and earn an appealing welcome bonus: Capital One Venture X Business. Read on and learn more!

Keep Reading