Finances (US)

How to fix your credit score in 6 months?

One of the best ways to improve your score is to research a lot about it! And here, you can learn how to fix your credit score in 6 months. So, read on!

Learn about your score and get the best tips on how to fix your credit score in 6 months!

Your credit score is one of the most important numbers in your financial life. It can affect a lot. That’s why, in this post, we’ll show you how to fix your credit score in 6 months!

Also, your credit score can affect everything, from how much you pay for car insurance to how much you can borrow. It can also affect how much interest you’ll have to pay on a mortgage.

How to apply for the Plastk Secured Credit Card?

If you need to improve your credit, the best way can be using a secured card! So, read our post about the Plastk Secured Credit Card application!

You can even get better credit cards and personal loans if you have a high credit score. This way, it’s very important to learn how to take care of your credit score.

In this post, we will tell you if you can fix your score in six months. Also, you’ll find tips on how to learn about your score calculation and use this in your favor.

However, we feel it’s important to emphasize that improving your credit score requires effort and dedication on your part. You shouldn’t expect to notice any benefits overnight.

But if you follow our tips and are consistent, you should see a significant improvement in just six months!

So, we’ll show you that credit scores can be easy to understand if you really want to improve your finances! Therefore, read on to learn more about your score and see how you can fix your credit score in 6 months!

How much can your score increase in 6 months?

There are some things that you can do to know how much you can increase your score in six months.

You’ll need to know how your financial situation is at the moment. You can check the main tips to raise your score in six months below!

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Check your reports regularly

If you want a thorough understanding of your current financial condition and the scope of any necessary improvements, you should check all three of your credit reports.

Your credit score is based on the information in your credit reports, which may include things like your payment history, credit card usage, number of credit inquiries, and more.

Also, you can check your credit reports regularly for any errors or unusual information, such as new credit card or loan accounts, bills, mortgages, or loans that you don’t recognize.

We Fix Money review: get your loan on the same day

Everyone may need a loan at some point. If you need one right now, read our We Fix Money review to learn more about this lending platform!

These might indicate negligence or dishonesty on someone’s part.

Moreover, mistakes on credit reports are common, and they may have a major impact on your credit score and hence your ability to get credit or to negotiate conditions and interest rates in the future.

As soon as possible, inaccuracies should be corrected. Thus, it’s important to get in touch with both the credit bureau and the company that provided the information.

You and the creditor share the responsibility for fixing any errors in your credit report.

It’s important to keep an eye on your credit reports since errors and discrepancies might pop up at any time.

Make on-time payments

Another thing your need is to pay your bills on time, always.

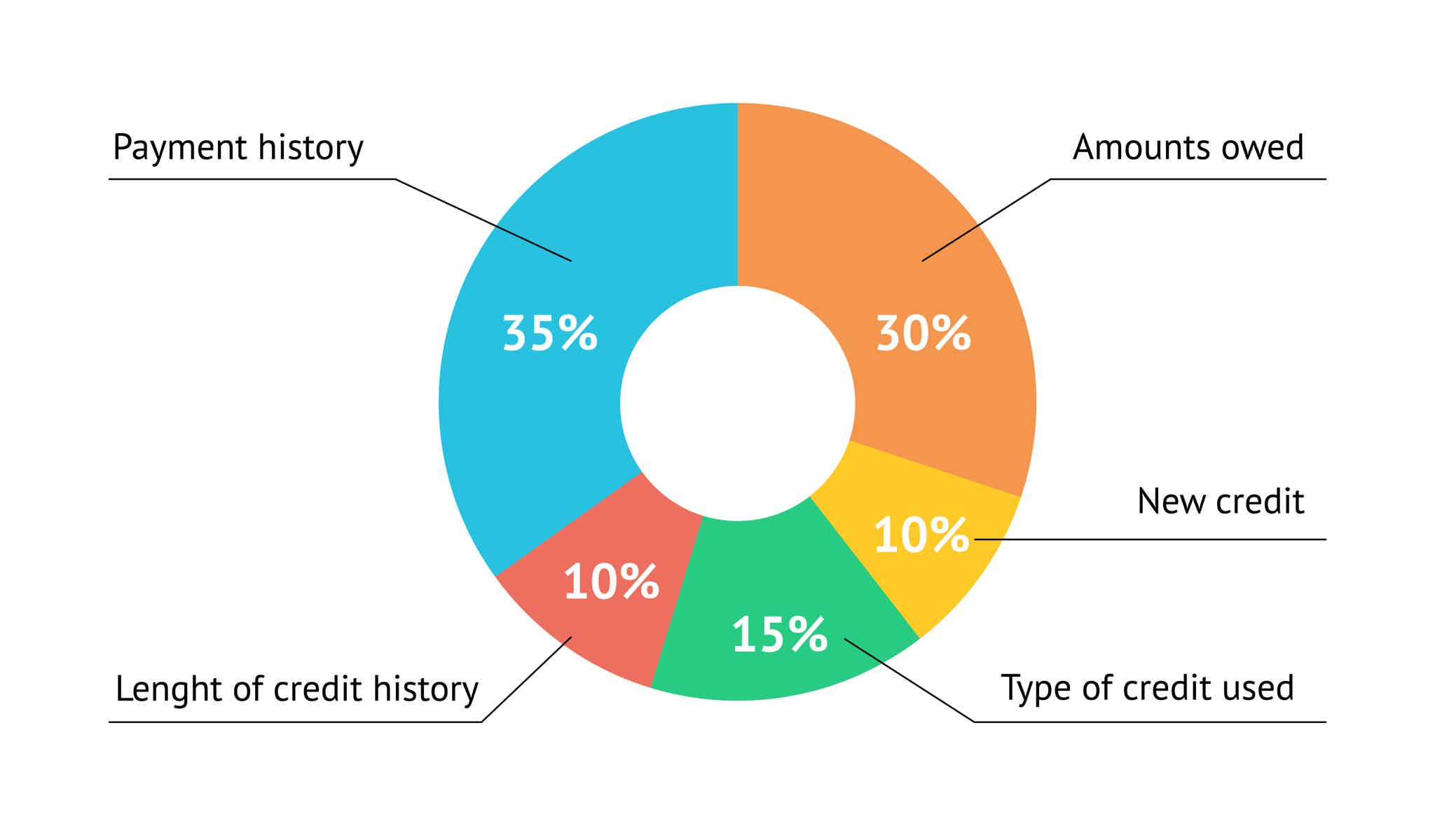

Why should we make such a big deal about paying on time? How consistently you pay off your credit cards accounts for 35% of your credit score.

Over 30 days of late payments might potentially knock 110 points off your credit score. (It’s important to note that if you have a good credit score, the penalty is less harsh).

Pay back any overdue amounts without delay. Even while a missed payment might remain on your credit report for as long as seven years, the negative impact will fade as you prove your capacity to pay on time.

The quickest and easiest way to avoid being late on payments? Make sure that your invoices are paid automatically and that your account details are updated if you switch financial institutions.

By following these tips, you’ll be able to increase your score by up to 100 points in 6 months!

How is your score calculated?

Credit scores are calculated using a number of different factors, including your payment history, how much debt you have, your credit history length, and much more!

This is why one of the ways to improve your credit score is to always make payments on time. This means that you can follow many tips that can go like setting up automatic payments for your bills.

Can an app help you fix your score?

Utilizing a credit score enhancement tool to examine your present condition and track your progress over time is the greatest approach to discovering how to raise your credit score.

Also, you can use these tools to learn more about finances and how to use your credit card or make loans! So, read some main popular credit monitoring apps below!

Experian Boost™

With Experian Boost™, you can get credit for paying bills, such as your phone bill, popular streaming services, and more! All of this for free with Experian!

Moreover, you’ll be able to access your FICO® Score any time you need! And you’ll get alerts when there is any change in your credit report or credit score!

Credit Karma

By using the Credit Karma platform, you can get offers of credit cards and loans that match your credit score and spending profile.

Moreover, they’ll monitor your credit for you and alert you if there are any changes to it! Plus, you’ll get some of the best insights to help you learn more about your score and deal better with your finances!

Credit Sesame

With Credit Sesame, you can create a free account to get the best personal advice on how to deal with your credit score.

Plus, you can find information about how to track your score and manage it closest to following your plan to increase it!

Moreover, you can check your credit report card for free! They also show you credit card and loan offers that match your credit score and chances of approval!

Now that you have these tips and apps to help you out, it can be easier than ever to increase your credit score as much as possible in six months.

And to help you on this journey, we’ve made an article with some of the best secured credit cards on the market. Save money for your security deposit, and start building credit like a pro!

4 best secured cards for raising your score!

If your credit score needs a boost, you can get a secured card to help you build it! Read our post to find a list of the best secured cards for raising your score!

About the author / Victória Lourenço

Reviewed by / Aline Barbosa

Senior Editor

Trending Topics

How to join GO2bank and start banking with this online bank?

Check out how easy and fast it is to join GO2bank. Get overdraft protection, a high yield on savings, and convenience with an all-in-one app.

Keep Reading

VivaLoan review: what you need to know before applying

In this VivaLoan review article, you will learn how it works, its benefits, and how to get up to $15,000 as soon as tomorrow. Check it out!

Keep Reading

Mercury Credit Card review

Check out this Mercury Credit Card review to learn everything about a powerful ally that can help you improve your credit score!

Keep ReadingYou may also like

Chase Ultimate Rewards partners: complete list

Learn about the most popular Chase Ultimate Rewards partners and how you can redeem your points for maximum value.

Keep Reading

How to buy cheap Delta Air Lines flights

Want to buy cheap Delta Air Lines flights? You've come to the right place. We'll show you how to get the best deals on airfare.

Keep Reading

Learn to apply easily for the Veterans United Home Loans

Veterans United Home Loans assists those who have served the country. Find out how to take advantage and apply with 24/7 support! Read on!

Keep Reading