Loans (US)

How to apply for a loan with Personal Loan Pro?

Trying to secure yourself a new loan with a solid payment plan and good APR? We've got you covered! Check out our Personal Loan Pro application process post!

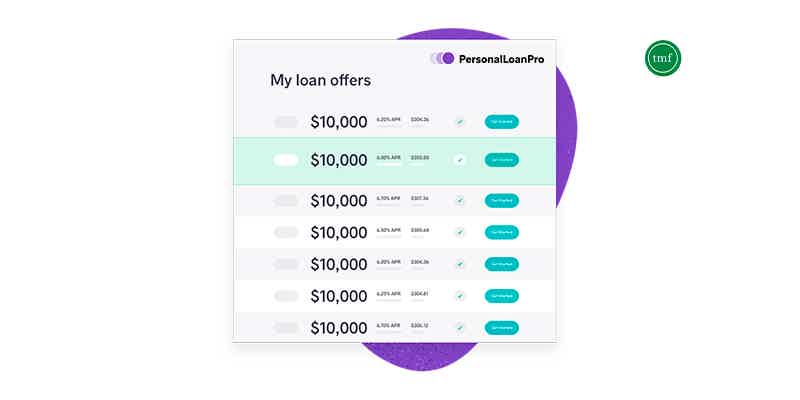

Applying with Personal Loan Pro: learn how to get your loan through this amazing loan selector!

Well hello! You may have gotten here from our full review of this great financial solution, so you’re already interested in it. If not, then check our post out to learn everything Personal Loan Pro is about! Here we will be discussing the intricacies of this loan option and its application process. So fasten your seatbelts and check our Personal Loan Pro application post!

Both as a way to invest in the future or recover from a past debt, Personal Loan Pro features a solution for your financial needs that is reasonable and solid in its presentation. No more shady policies and terms that work against you. Check it out and apply today!

Apply online

Applying for Personal Loan Pro is very simple and easy, as the entire process is done through their website and is very self-explanatory. Simply hit “Get Started” to be prompted into their questionnaire, just a triage for you to align expectations with their team. Choose the amount of credit you want to loan and submit the application for their analysis.

Please bear in mind that applying to see if you qualify or not to receive the loan does not impact your credit score. In conclusion, after affirmatively deciding to sign up for the loan, your credit score will bear a slight negative impact due to this being reported to the relevant credit authorities.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Apply using the app

Since Personal Loan Pro is not a lender, it doesn’t feature a mobile app for you to use. However, you can access it through any mobile phone using a web browser to make your application! It’s as simple as the desktop version, so all you need is internet access.

Personal Loan Pro vs. CashMate Financial® Personal Loan

Still not convinced, though? Take it easy! We at the Mister Finance team know very well what it feels like running through so many different options without a light to guide the way. That’s why we’ve compared Personal Loan Pro as a product to CashMate Financial® Personal Loan, another option in the market! All so you can make the best decision!

| Personal Loan Pro | CashMate Financial® Personal Loan | |

| APR | 2.49% to 35.99%. | On a basis of $300 loan for 14 days: 443.21% on a rate of $17 per $100 borrowed. |

| Loan Amounts | From $2,000 to $50,000. | From $100 to $1,500. |

| Credit score Needed | All credit scores can apply. | Not disclosed. |

How to get the CashMate Financial® Personal Loan?

CashMate Financial® offers a way to get fast access to a personal loan at low costs. Check out how to apply for it today!

About the author / Victória Lourenço

Reviewed by / Aline Barbosa

Senior Editor

Trending Topics

First Access Visa® Card application

First Access Visa® credit card helps you build your credit score and it doesn’t need a secured deposit. Check out how to apply for it now!

Keep Reading

Bank of America® Unlimited Cash Rewards card full review

A sign-up bonus, rewards, and no annual fee on a credit card? Check out now the Bank of America® Unlimited Cash Rewards review!

Keep Reading

How to apply for the Assent Platinum Secured credit card?

The Assent Platinum Secured card can help you build your credit score. Learn how to apply for it today and enjoy its benefits!

Keep ReadingYou may also like

How to buy cheap WestJet flights

Find out how to buy cheap WestJet flights on their website so that you can travel more and spend less! Night flights from $49.99! Read on!

Keep Reading

RBC Bank Application: Simplify Your Banking Experience

The RBC Bank application is a simple process which will only take you a few minutes. Let us help you get your bank account with this step-by-step guide.

Keep Reading

US Bank Altitude® Go Visa Signature® Card review: is it worth it?

Check out this US Bank Altitude® Go Visa Signature® credit card review and learn all about its benefits, such as $0 annual fee, rewards, and more!

Keep Reading