Credit Cards (US)

How to apply for the Oportun® Visa® card?

Are you looking for a card that does not require a specific credit score and offers high credit lines? If so, read our post about the Oportun® Visa® card application!

Oportun® Visa® card application: no credit history needed

If you are looking for a credit card that does not require a Social Security Number or a credit history, this credit card can be for you. Also, currently, you have to get invited to apply for the Oportun® Visa® card. But, you can check out if you prequalify through the official website with no harm to your credit score! We will give you all the details about the Oportun® Visa® card application. Therefore, keep reading our post to know more!

Apply online

Unfortunately, you can only see if you are prequalified to get this Visa card through Oportun’s official website. Also, you don’t really need a credit history to apply, but it can be good to have one. This is because your annual fee and APR fee depend on your creditworthiness. So, after you get an invitation from Oportun®, you can properly apply to get this excellent Visa credit card.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Apply using the app

Because you need an invitation in order to submit an application for this card, it is not feasible to apply for it through a mobile app. Instead, you will need to make an application in person. In addition, the only place you can check to see if you already meet the prequalification requirements for the position is on the official website.

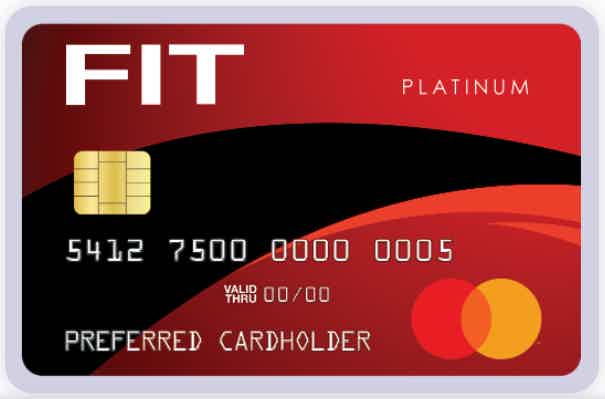

Oportun® Visa® credit card vs. Fit Mastercard credit card

If you are still on the fence about applying for this Visa credit card, we have another suggestion for you that might better suit your needs. Take, for instance, the Fit Mastercard as an illustration. This Mastercard card is open to applicants with credit scores ranging from poor to average. Additionally, the annual price can be quite hefty and is now set at $99.

In addition, similar to the Oportun® Visa® card, the Fit card does not come with a sign-up bonus or a rewards program that you may participate in. Check out the following comparison table, which should help you make your choice!

| Oportun® Visa® card | Fit Mastercard credit card | |

| Credit Score | All credit scores. | Bad to fair. |

| Annual fee | It depends on your creditworthiness. | $99. |

| Regular APR | N/A. | 22.99% variable APR. |

| Welcome bonus | No welcome bonus. | There is no welcome bonus. |

| Rewards | N/A. | There is no rewards program. |

How to apply for the Fit Mastercard credit card?

Do you need to organize your finances and clear debt? The Fit Mastercard card can be a great option for you. Keep reading our post about how to get this card!

About the author / Victória Lourenço

Reviewed by / Aline Barbosa

Senior Editor

Trending Topics

First Access Visa® Card review

Do you have trouble asking for a credit card because you have no credit history? Then, check out our First Access Visa® Card review!

Keep Reading

How to apply for CareCredit®: learn the application process

Find out how the CareCredit® application works, so you can have a great tool for you and your family to pay off your medical and pet bills.

Keep Reading

Ally Bank review: get simplified solutions!

Interested in a simpler banking experience without missing on the quality? Check our Ally Bank review and learn all about it today!

Keep ReadingYou may also like

Learn to apply easily for Pick a Lender Personal Loan

Get your projects off the ground with Pick a Lender! This online personal loan marketplace will help you apply and get $40K quickly. Read on!

Keep Reading

Southwest Rapid Rewards® Premier Credit Card review

Discover the secret to economic travel with our Southwest Rapid Rewards® Premier Credit Card review. Earn 30K bonus points and much more!

Keep Reading

How do prepaid cards work?

Have you ever wondered: How do prepaid cards work? If so, you can keep reading to learn all about it!

Keep Reading