CA

How to apply for Lendful Personal Loan?

If you need a personal loan that can give you relatively low rates and up to 5 years terms, read our post and learn how to apply for a Lendful Personal Loan!

Applying for Lendful Personal Loan: get fast loans that are easy to apply.

Are you in need of some fast cash? A Lendful personal loan may be the solution for you. Applying for a loan is easy, and in most cases, you can have your money within a few days. In this post, we’ll walk you through applying for a Lendful personal loan. So whether you’re looking to renovate your home, take a vacation, or cover an unexpected expense, read on to learn how to apply for a Lendful personal loan!

Apply online

You can easily apply for a Lendful loan online. All you need to do is go to Lendful’s official website and look for the personal loan. Then, you can read the loan’s features and click on Get a Quote. After that, you will need to provide some of your personal information. For example, your home address, document numbers, full name, and others.

However, you should keep in mind that you must be at least 19 years old and have a credit score of at least 600 points to be considered for the loan. Moreover, if you meet the requirements, you can complete your application and take advantage of your loan!

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Apply using the app

It is unfortunate that you must complete your application through Lendful’s official website to be considered. In addition, you must manage your loan information through the official website of the lending institution.

Lendful Personal Loan vs. CashMate Financial® Personal Loan

If you are still unsure about applying for a loan with Lendful, we can help you out by giving you a different lender option. The CashMate Financial® Personal Loan can give you a better chance of approval if you don’t have a high score. On the other hand, the Landful personal loan requires at least a good score to qualify. Moreover, with the CashMate loan, you also don’t need to pay an early payoff fee. So, read our comparison table below to decide!

| Lendful Personal Loan | CashMate Financial® Personal Loan | |

| APR | 10.78% to 22.48%. *Terms apply. | On a $300 loan for 14 days: 443.21% on $17 per $100 borrowed. |

| Loan Purpose | Personal. | Personal. |

| Loan Amounts | $5,000 to $35,000. | $100 to $1500 |

| Credit Needed | Minimum of 600 points. | N/A. |

| Terms | 6 months to 5 years. | Up to your next payday. |

| Origination Fee | N/A. | N/A. |

| Late Fee | $50 NSF fee. | N/A. |

| Early Payoff Penalty | None. | None. |

How to get a CashMate Financial® Loan?

If you have an emergency or a surprise bill to pay, CashMate Financial® can help you with that. Learn now how to get fast access to a CashMate Financial® loan!

About the author / Victória Lourenço

Reviewed by / Aline Barbosa

Senior Editor

Trending Topics

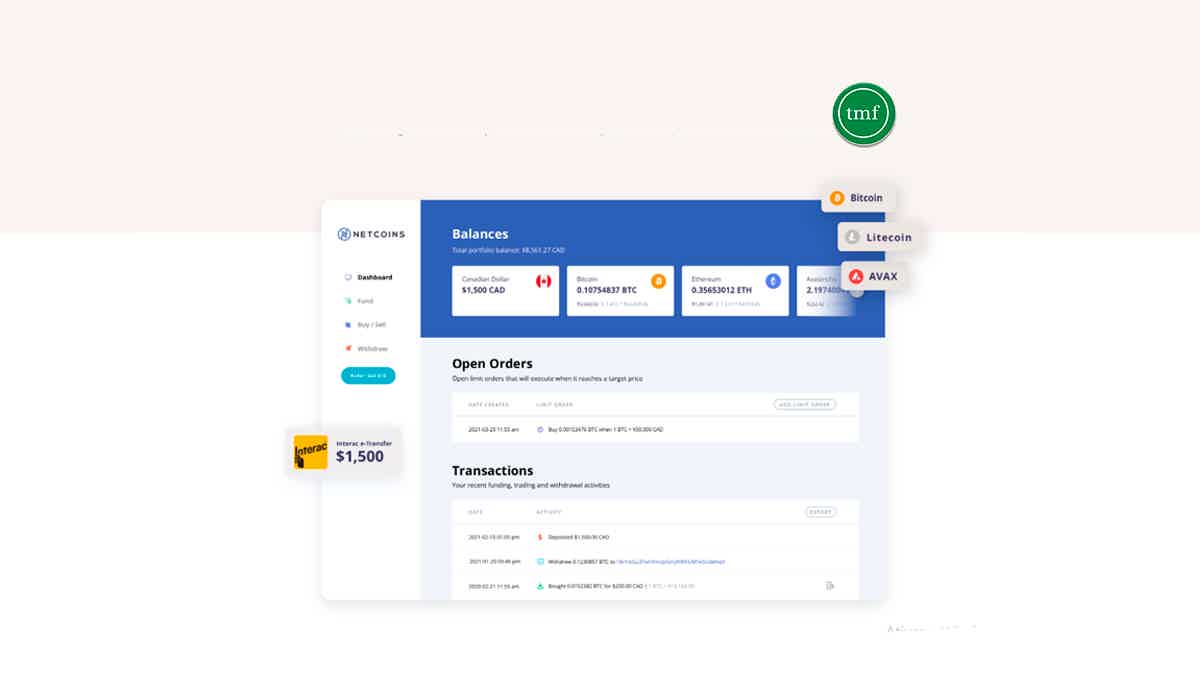

Netcoins wallet review: no funding fees

Looking for a crypto wallet with no funding fees and free cash withdrawals? Check out our Netcoins wallet review to learn more!

Keep Reading

How to apply for the KOHO Card?

Do you need a credit card with great cashback options and a great platform? If so, keep reading to know how to apply for the KOHO card!

Keep Reading

MR. PAYDAY Loans review: get up to $1,500

Are you looking for a loan in Canada? MR. PAYDAY offers loans of up to $1,500 without a credit check! Check out our MR. PAYDAY Loans review!

Keep ReadingYou may also like

9 of the easiest credit cards to apply for: get approved fast!

If you're suffering from a low credit score, don't worry. You still have a chance to get a credit card and rebuild your history. This content will present you with some of the best credit card options for you.

Keep Reading

Fortiva® Mastercard® Credit Card application: how does it work?

Learn how to get your Fortiva® Mastercard® Credit Card application started by following easy steps! Read on!

Keep Reading

Blaze Mastercard® Credit Card Review: The best tool for building credit

Get the credit boost you need without settling for a typical secured card. Discover if the Blaze Mastercard® Credit Card is the right choice with our review. Keep reading!

Keep Reading