Loans (US)

How to apply for the Upstart Loans?

Are you looking for an online lender that can help you with fast funding? The Upstart Personal Loans can be a great choice. Read on to learn how you can apply for it!

Applying for the Upstart Personal Loans

The Upstart Loans offers great features to those who need to make fast and good personal loans. This platform can be great for those who do not want to have a hard credit inquiry when applying for a loan.

That is because this type of inquiry can negatively affect credit scores.

Also, this platform has a different type of analysis for loans, such as great AI features to analyze your data. So, if you want to know how to apply for an Upstart Loans, keep reading our post!

Apply online

To apply for an Upstart Loans, you can go to their website and check your rate first. You can do this in just a few minutes. After that, you will need to provide some of your personal information. Then, you can get a fast response.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Apply for the Upstart Loans using the app

Unfortunately, you cannot apply for loans using a mobile app on your phone. Upstart does not even offer a mobile app to people who already got approved for loans.

Upstart vs. OneMain Financial personal loan

If you still want to do more research before applying for a loan, we can help you with information about another lender platform. The OneMain Financial personal loan can also be great for people who do not have a very high credit score. So, here is a comparison between Upstart Loans and OneMain Financial.

| Upstart | OneMain Financial | |

| APR | 5.42% – 35.99%. | From 18.00% to 35.99% |

| LOAN PURPOSE | You may take out loans to pay off credit cards, consolidate debt, and more. | You can get this loan to use for home improvement, weddings, debt consolidation, some kind of emergency, and more. |

| LOAN AMOUNTS | Loans are available in quantities ranging from $1,000 to $50,000. | $1,500 to $20,000 |

| CREDIT NEEDED | A credit score of at least 580. | There is no minimum point credit needed. |

| TERMS | This lender gives you the option of a 3- or 5-year payback period. | The loan terms are 24, 36, 48, or 60 months. |

| ORIGINATION FEE | The costs charged might range from 0% to 8% of the loan amount. | In certain states, the origination fee goes from 425 to $500. In other states, this fee ranges from 1% to 10% of the amount of the loan. |

| LATE FEE | A late fee of 5% of the late amount, or $15, whichever is larger, will be charged. | The late fees are from up to $30 or 15% of your late payment. |

| EARLY PAYOFF PENALTY | No early payoff penalty. | There is no early payoff penalty with this loan. |

How to apply for OneMain Financial personal loan?

Check out how to apply for OneMain Financial personal loan!

About the author / Victória Lourenço

Reviewed by / Aline Barbosa

Senior Editor

Trending Topics

First Premier Lending review

Check out our First Premier Lending review to see why they're one of the top lending companies in the country!

Keep Reading

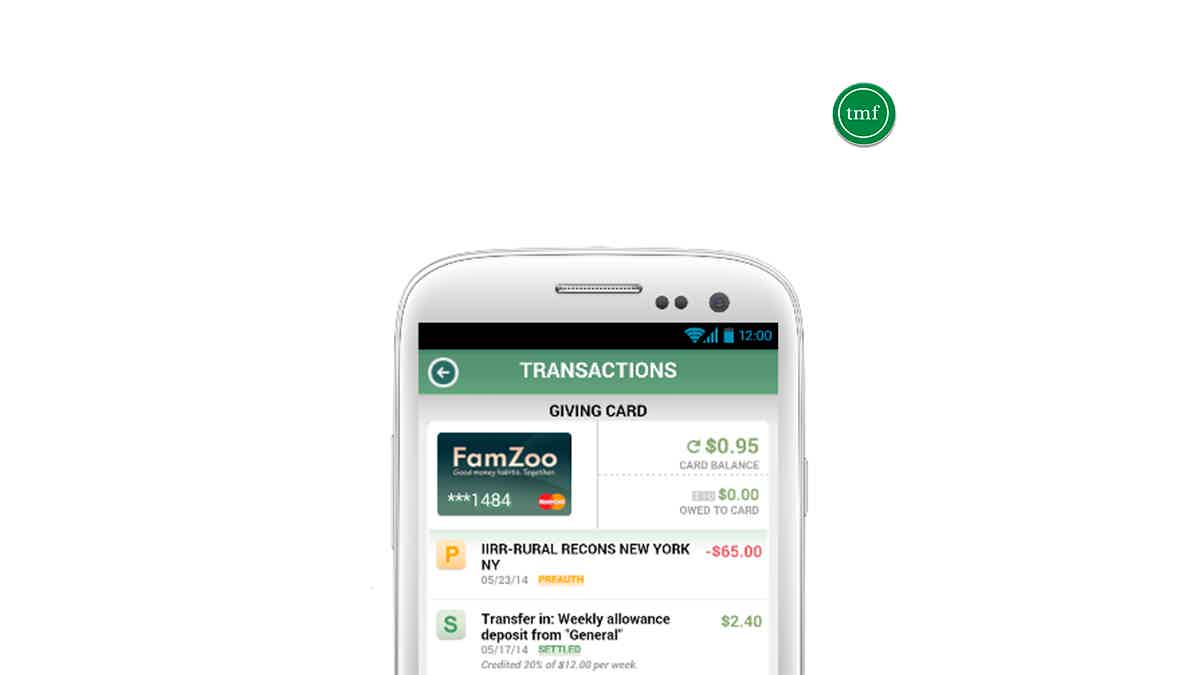

FamZoo Prepaid card full review

Do you need a card to help your kids learn how to use their money? Read our FamZoo Prepaid card review to learn more about this product!

Keep Reading

Cortex crypto: how does it work? Get Started With Cortex Today!

In this Cortex crypto review article, we will show you how this cryptocurrency works and how users can use Smart Contracts. Check it out!

Keep ReadingYou may also like

Application for the U.S. Bank Cash+™ Visa Signature® card: how does it work?

Learn how to apply for the U.S. Bank Cash+™ Visa Signature® card and get cashback on every purchase. It has many bonus categories you can choose to get even more cashback.

Keep Reading

Apply for Navy Federal More Rewards American Express® Card now

Ensure exclusive benefits with the Navy Federal More Rewards American Express® Card - up to 3 points on purchases and more!

Keep Reading

How to fight back inflation hitting American households

Inflation is quickly raising prices for households in essential areas of their monthly budgets. Find out how you can protect your finances from the impact of rising prices.

Keep Reading