Credit Cards (US)

How to apply for the My GM Rewards card?

If you want to get great rewards and perks related to GM vehicles, keep reading our post to know more about the My GM Rewards card application!

My GM Rewards card application: see how to apply and get the best rewards related to GM vehicles

If you are a big fan of General Motors vehicles and want to start earning rewards for your loyalty, you wonder how to apply for the My GM Rewards card. This guide will take you through the application process step by step to get started on your way to earning rewards. So, read on to find out everything you need to know about the My GM Rewards card application!

Apply online

It can be easy to complete the application process to get your My GM Rewards card. You need to go to GM’s official website and look for the card. Then, you can click on Enroll Now and create your GM account. To do this, you need to give your best email address and create a password. After that, you can start your application process from your login account.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Apply using the app

You can only access your My GM Rewards card account through GM’s mobile app. However, you cannot complete your application process to get the card with GM’s mobile app. Also, you can use your GM mobile app to manage your finances and your account.

My GM Rewards card vs. Citi Rewards+® card

If you still don’t know if you want the My GM Rewards card, we can help with a different card option. For example, the Citi Rewards+® card. This card offers great benefits, a lower variable APR, and it also has no annual fee. So, check out our comparison table below to help you decide!

| My GM Rewards card | Citi Rewards+® Card | |

| Credit Score | Good to excellent. | Good to excellent. |

| Annual Fee | No annual fee. | No annual fee. |

| Regular APR | 14.99% to 24.99% variable APR. | 13.74% to 23.74% variable APR. |

| Welcome bonus* | 10,000 points after spending $1,000 within the first 90 days. *Terms apply. | You can earn 20,000 bonus points if you spend $1,500 in your first three months. *Terms apply. |

| Rewards* | 4 points for each dollar you spend. 7 points for every dollar you spend on qualifying purchases. *Terms apply. | Get 2x points at gas stations and supermarkets. Earn 1x points on every other purchase. *Terms apply. |

How to apply for the Citi Rewards+® Card?

Wondering how to apply for the Citi Rewards+ card? Read our Citi Rewards+® credit card application post to know how to apply and get the best out of this card's perks!

About the author / Victória Lourenço

Reviewed by / Aline Barbosa

Senior Editor

Trending Topics

What you need to know about credit scores and loans

What you need to know about credit scores and loans is here! Learn how your credit score affects the odds of you getting approved for a loan!

Keep Reading

How to apply for the Upstart Loans?

If you're looking for an affordable personal loan, check out how the Upstart Loans application process works and get yours today!

Keep Reading

Chime® Credit Builder card or Self Visa® Credit Builder?

Chime® Credit Builder card or Self Visa® Credit Builder? Check out the following comparison and choose wisely which one is the best for you!

Keep ReadingYou may also like

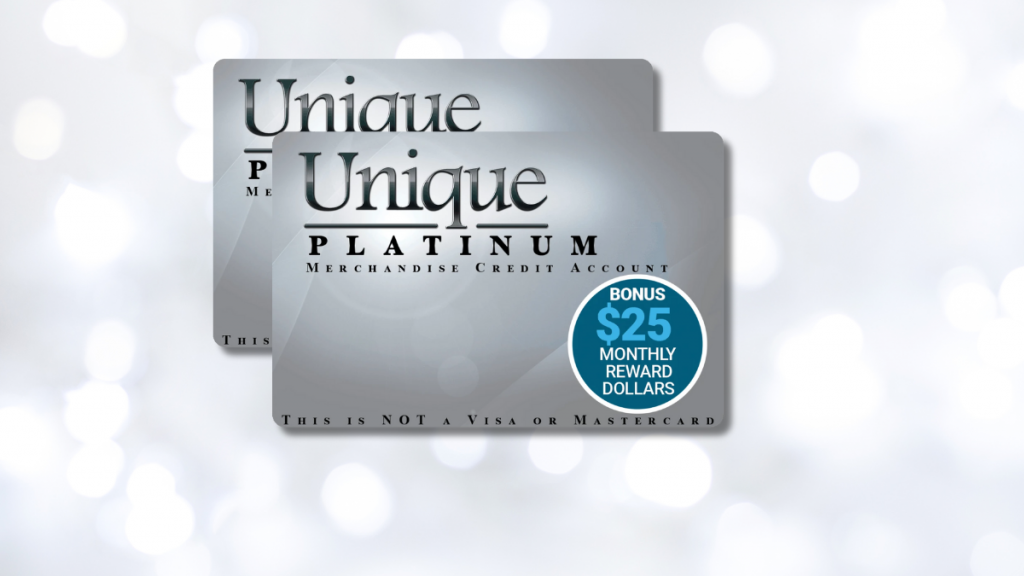

Apply for Unique Platinum Card: quick and simple

Unlock a world of opportunities with the Unique Platinum Card - with 0% APR, this is the perfect card to build credit! Read on and learn more!

Keep Reading

Chase Bank Account application: how does it work?

Chase Bank is one of the most popular banks in the United States. They offer a wide variety of accounts and services to their customers. If you are interested in opening a Chase bank account, this guide will give you all the information you need to get started.

Keep Reading

What is a mortgage and how does it work?

When buying a house, it's important to know "what is a mortgage," so we are here to help. This post will explore this kind of loan and how it can be useful when purchasing real estate. Keep reading!

Keep Reading