Credit Cards (US)

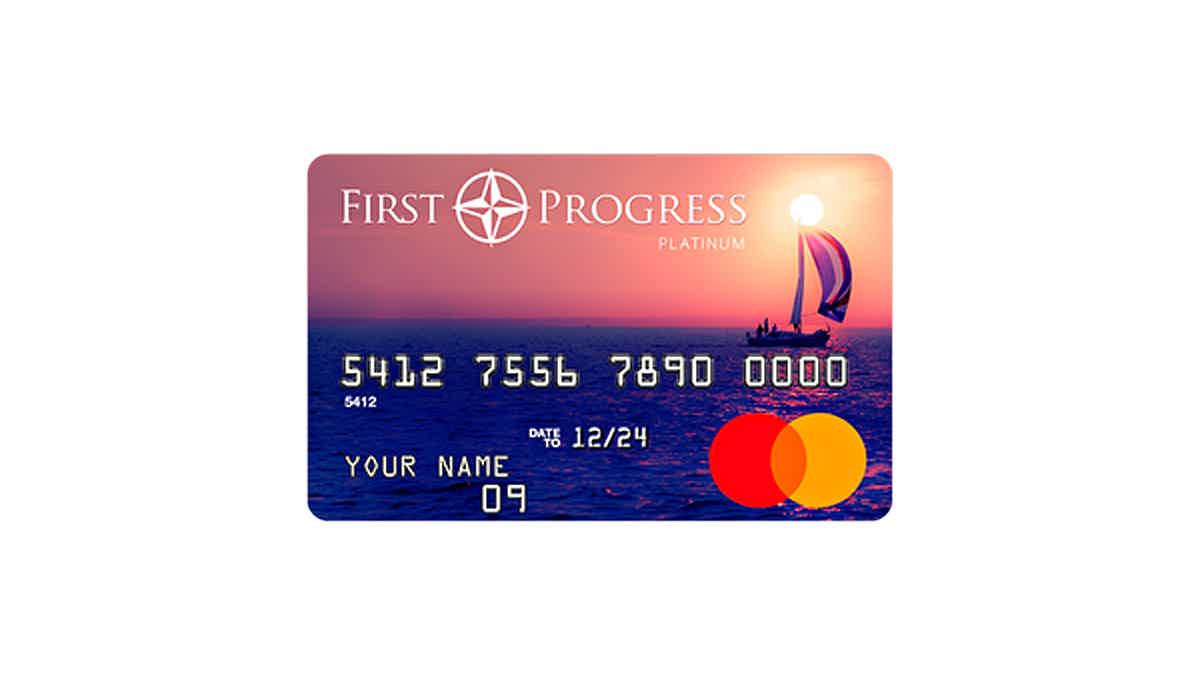

First Progress Platinum Elite Mastercard® Secured Card application

Are you looking for a card that does not require hard credit inquires to apply? The First Progress Platinum Elite MasterCard® Secured Card can be for you! Read more to know how to apply!

First Progress Platinum Elite Mastercard® Secured Credit Card application.

The First Progress Platinum Elite Mastercard® Secured Card is for those looking for a credit card with relatively low APR fees to rebuild credit. Moreover, this card requires a minimum security deposit of $200, and your credit limit will be equal to your deposit amount.

Also, it can be hard to find a similar secured card that requires lower deposits. So, if you are interested in applying for this secured credit card, keep reading our post to know how to apply!

Apply online

The application process to get this First Progress credit card is almost the same for the other two secured cards offered by First Progress. Also, you can apply online through the credit card company’s website.

Moreover, be sure that you read about all of the secured cards offered by First Progress before you apply to one of them. So, read about all the features, especially the fees charged.

Therefore, you can go to their official website, choose the secured card you want to apply for, and click on Apply Now. Then, you can provide the personal information required. Also, make sure that you read all of their terms and conditions before finishing your application.

After that, you can wait for a response. Moreover, if you get approved, you will have to pay for a security deposit of at least $200 before you start using your credit card.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Apply using the app

Unfortunately, you can not apply to get this credit card through a mobile app offered by First Progress or any other mobile app. Also, it can be safer to apply using the official website of the credit card company. That is, applying online through the official website brings more reliability, and it is safer.

First Progress Platinum Elite Mastercard® Secured Credit Card vs. First Progress Platinum Prestige Mastercard® Secured Credit Card

If you got interested in this card, you might want to know about the features of other First Progress secured cards. So, we made a comparison with another First Progress card that charges an even lower APR fee. Also, First Progress approved your Elite card application, you will also get approved for the other First Progress secured cards.

So, here is our comparison between the Platinum Elite Mastercard® Secured Credit Card and the Platinum Prestige Mastercard® Secured Credit Card.

| First Progress Platinum Elite Mastercard® Secured Credit Card | First Progress Platinum Prestige Mastercard® Secured Credit Card | |

| Credit Score | Poor/Limited/No Credit. | Poor/Limited/No Credit. |

| Annual Fee | $29. | $49. |

| Regular APR | 24.74% (V) | 14.74% (V) |

| Cash Advance APR | 29.74% (V) | 23.74% (V) |

| Welcome bonus | There is no initial bonus for new card members. | There is no initial bonus for new cardholders. |

| Rewards | There is no rewards program. | 1% cash back on credit card payments. |

First Progress Prestige Mastercard®: how to apply?

Do you need to re-establish your credit? Check out our post to know how to apply for the First Progress Platinum Prestige Mastercard® Secured Credit Card!

About the author / Victória Lourenço

Reviewed by / Aline Barbosa

Senior Editor

Trending Topics

Copper Banking review: Investing and more!

If you need a banking solution for your kids or teens to learn how to finance, read our Copper Banking review to learn more!

Keep Reading

How to join Cash Magnet app?

The Cash Magnet app offers rewards as points for you to redeem for cash or gifts. Learn how to sign up today and enjoy its perks!

Keep Reading

Annuities as an Investment: a guide for beginners

Are you interested in Annuities as Investments? If so, we can guide you through this part of the investment world! Keep reading to know more!

Keep ReadingYou may also like

United℠ Explorer Card application: how does it work?

Wondering how to apply for the United℠ Explorer Card? We'll show you how easy it is and what benefits you can expect. Keep reading!

Keep Reading

Investing for students: how to get started today!

This guide will help you start investing today if you're a student. Learn six steps to learn about investing for students and start your investment journey!

Keep Reading

Apply for Navy Federal cashRewards Credit Card: $0 annual fee

Looking to apply for the Navy Federal cashRewards Credit Card? We'll guide you through an easy online application. $0 annual fee and $250 bonus cash back!

Keep Reading