CA

How to apply for Fairstone Loans?

Fairstone Loans offers so many services that surely you can benefit from one of them. It also has a century of experience in the financial assistance field. Check out how to apply!

Applying for Fairstone Loans

It is very easy to apply for Fairstone Loans as the website guides you through the process.

All you need to do is fill in the information requested, and the process is started. It would be best if you met the following criteria to be able to apply:

- Citizen/Resident of Canada

- Have reached majority age;

- Have a stable credit history;

- Can afford to make monthly payments;

Regarding the documents required, you should provide the following:

- Government ID;

- Proof of income;

- Housing verification

Check below how to get started quickly and apply online for Fairstone Loans.

Apply online

Once you have gathered all the information needed and all the documents that are going to be requested and are listed above, you are ready to apply for Fairstone Loans by following these steps:

- 1: The application process is started by clicking in the “GET A LOAN QUOTE” button on the top of the right side of the home page of their website.

- 2: File some a loan quote, in which you will be asked a few and simple questions in order to find the loan that best suits your profile.

- 3: You will receive an email with all the information regarding your loan terms and conditions, and also a confirmation link for you to click if you decide to agree.

- 4: If you decide to agree, you will be required to confirm and accept the contract’s terms in an in-branch or online.

- 5: Providing your documents: now it’s the time to provide the documents listed above.

- Step 6: Your money will be deposited directly in your account of preference.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Apply using the app

Fairstone Loans doesn’t have an app just yet.

However, its webpage is also designed to be used on your smartphone and also on any device.

Just scan the QR Code or type the webpage address in your browser file your application using your phone or any device you need.

Fairstone Loans vs. Fat Cat Loans

And if you’re looking for another option, check out our comparison chart below!

| Fairstone Loans | Fat Cat Loans | |

| APR | secured personal loans: 19.99% unsecured loans: 26.99% mortgage refinancing: .49% | from 4.84% to 35.99% |

| LOAN PURPOSE | emergency personal loans, debt consolidation loans | personal loans |

| LOAN AMOUNTS | Up to $50,000 | $200 to $5,000 |

| CREDIT NEEDED | No minimum credit required | personal loans |

| TERMS | six months to ten years | from 3 to 84 months |

| ORIGINATION FEE | Depends on the type of loan | According to lender terms |

| LATE FEE | Depends on the type of loan | According to lender terms |

| EARLY PAYOFF PENALTY | Depends on the type of loan | According to lender terms |

How to apply for the Fat Cat loans?

Get an instant online loan through the Fat Cat loans! Check out how to get a quote and receive an instant decision!

About the author / Aline Augusto

Reviewed by / Aline Barbosa

Senior Editor

Trending Topics

How to join Shakepay and make money with Bitcoin?

Learn how to join Shakepay so you can easily buy and sell the most popular cryptocurrencies in the world and make money with digital coins!

Keep Reading

Fat Cat Loans review

Need a loan but don't know where to start? Check out our Fat Cat Loans review and find out if they're the right lender for you.

Keep Reading

How to apply for the CIBC Smart Prepaid Travel Visa Card?

Want the versatility of having a prepaid balance in the currency you need? Read our CIBC Smart Prepaid Travel Visa Card application post!

Keep ReadingYou may also like

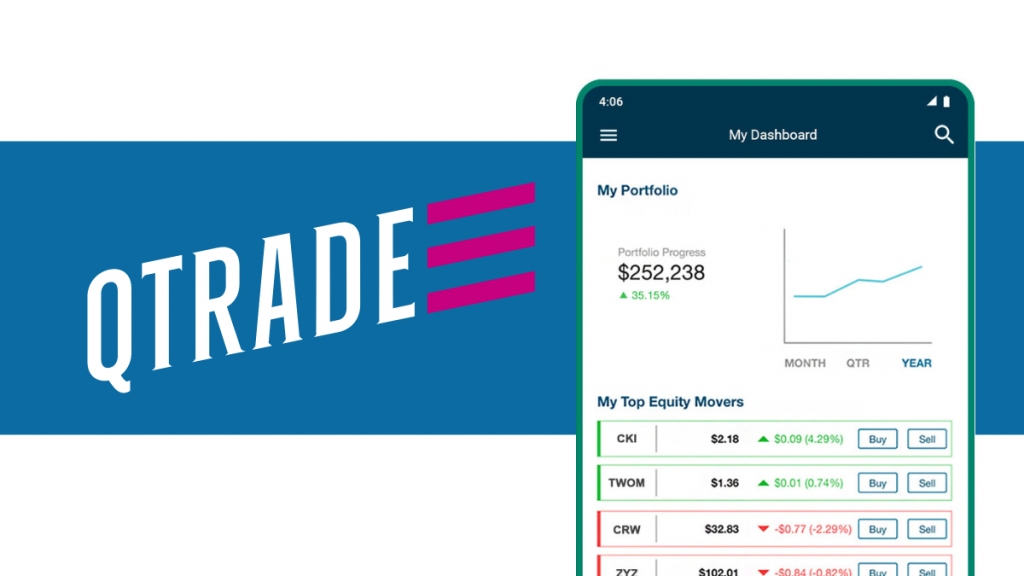

Qtrade Direct Investing Review: Build Your Wealth

Read our Qtrade Direct Investing review to learn about its top-notch customer service and intuitive trading platform. Ideal for both new and seasoned investors, Qtrade offers a streamlined experience for smart investment decisions.

Keep Reading

How to prepare for a recession?

A recession might be underway, and it’s best to be ready for it. Here are some tips on what you can do now to help cushion the blow when the next economic downturn happens.

Keep Reading

What is a money market account and how to open one?

A money market account is a type of savings account that allows you to earn a higher interest rate than what you would get with an ordinary savings account. Find out if it's right for you by reading this post!

Keep Reading