CA

How to apply for the CIBC Smart Prepaid Travel Visa Card?

Want to learn more about getting your hands on a fixed exchange rate prepaid card? Read all our CIBC Smart Prepaid Travel Visa Card application post!

CIBC Smart Prepaid Travel Visa Card application: learn how to get this great prepaid travel card for your next trip!

Have you checked our CIBC Smart Prepaid Travel Visa Card full review? You haven’t? That’s okay. We also cover tons of key information about this great prepaid card here in this post. Feel free to check what it can offer you in the full review! For now, let’s cover the CIBC Smart Prepaid Travel Visa Card application and learn how simple it can be to get your hands on this solid travel card!

Apply online

To get your CIBC Smart Prepaid Travel Visa Card, all you need is internet access from anywhere! Proceed to their webpage and click “Buy now.” Then, if you already have a CIBC account, sign on with your details. Should you not have a CIBC online banking account, you can create one without trouble! You can just select “Register now” and create one.

You can also buy your CIBC Smart Prepaid Travel Visa Card at the Toronto Pearson Airport banking center in Canada by simply providing two pieces of identification! In conclusion, a very simple and versatile application process, so you can get your card without trouble!

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Apply using the app

After you get your account opened, you’ll gain access to CIBC’s online banking platform. From there, you can check your card’s balance and load it again with more money, as well as have access to some other information and security configurations for your profile.

CIBC Smart Prepaid Travel Visa Card vs. CIBC Air Canada® AC conversion™ Visa Prepaid Card

Still unsure about this card? We’ve selected an alternative for you to evaluate and consider as well, all so you can have the key information needed to make your decision!

| CIBC Smart Prepaid Travel Visa Card | CIBC Air Canada® AC conversion™ Visa Prepaid Card | |

| Credit Score | No credit score. | No credit score. |

| Bank and ATM Fees* | No monthly or purchase fees in domestic currency. 2.5% exchange rate on international currency transactions. $0 for domestic ATMs. *Terms apply. | No monthly or purchase fees in domestic currency. 2.5% exchange rate on international currency transactions. $0 for domestic ATMs. *Terms apply. |

| Cash Withdrawals * | Free within Canada – variable fees for international withdrawals. | $2,000 CAD 24-hour maximum withdrawal limit. *Terms apply. |

| Welcome bonus | No welcome bonus. | No welcome bonus. |

| Rewards | No reward plan. | For a limited time, earn 1% cashback on all purchases. *Terms apply. |

How to apply for CIBC Air Canada® AC conversion™?

See how to apply to your new and portable multi-currency solution! Check our CIBC Air Canada® AC conversion™ Visa Prepaid card application post and learn more!

About the author / Victória Lourenço

Reviewed by / Aline Barbosa

Senior Editor

Trending Topics

How to start banking with EQ Bank?

EQ Bank offers high-interest rates for savings and investments, with no monthly or transactions fees. Check out how to start banking with it!

Keep Reading

How to join Scotia Smart Investor?

Are you looking for trustworthy investment advice and recommendations? If so, read on to learn how to join Scotia Smart Investor!

Keep Reading

How to apply for Simplii Financial™ GMT?

Are you looking for a banking solution that is both convenient and affordable? If so, read on to apply for Simplii Financial™ GMT!

Keep ReadingYou may also like

CreditFresh Review: Fast Cash and Flexible Credit

Need cash fast? CreditFresh promises $5K and no credit check, but is it too good to be true? Read our in-depth review to decide for yourself.

Keep Reading

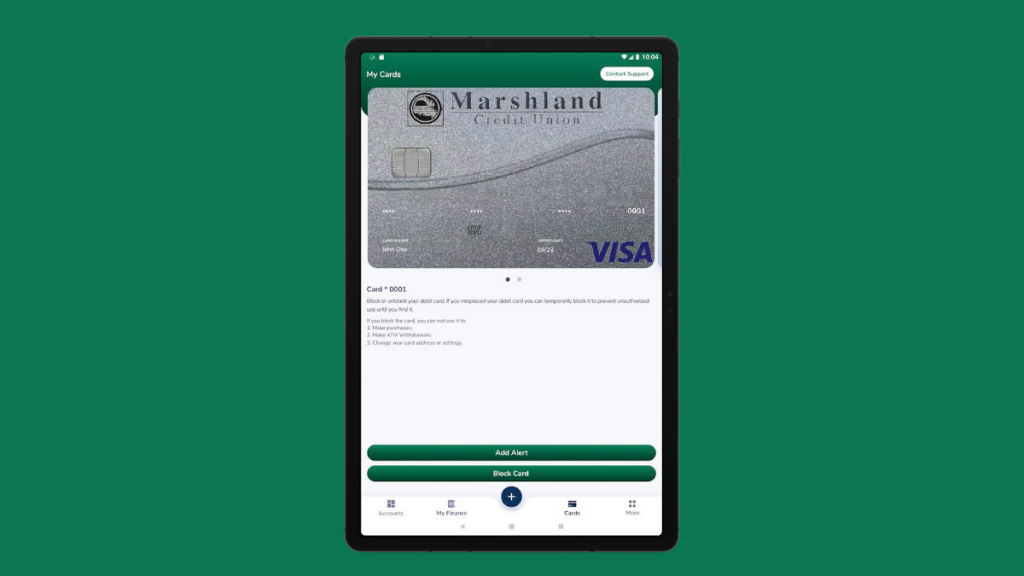

The Perfect Card for Savvy Spenders: Marshland Visa® Credit Card review

With competitive rewards and low-interest rates, our review of the Marshland Visa® Credit Card shows why this card is a strong candidate for economic shoppers who want to save big. Keep reading!

Keep Reading

What is an emergency fund and why do you need one?

If you need to cover for a financial emergency today, are you prepared? What about facing unemployment? That's why you should have an emergency fund. We'll give you some easy tips to build one.

Keep Reading