Credit Cards (US)

How to apply for the Disney® Visa® debit card from Chase?

The Disney® Visa® debit card from Chase offers you discounts, perks, protection, and benefits. So you can plan your visit to Walt Disney World and Disneyland safely and soundly! See how to apply for it!

Disney® Visa® debit card application

Disney® Visa® debit card from Chase offers all features of a regular debit card. As a Visa-branded card, you won’t be responsible for unauthorized charges with a $0 Fraud Liability.

Plus, as a Chase account member, you get a great mobile app to manage your finances 24/7. Also, it provides you with chip & contactless technologies and compatibility with several digital wallets.

The best of all are the perks you earn when applying for this debit card. If you plan to visit Disney resorts or even purchase at the store, you are in the right place.

This Chase-Visa offers you discounts on shopping, experiences, guided tours, dining, and the resorts, so you can make your dream finally come true! learn how you can apply for a Disney® Visa® debit card below.

Apply online

First of all, you must open a Chase checking account if you don’t have one yet. You can choose between several options, such as Chase Total Checking, Chase Premier Plus Checking, or Chase College Checking.

Then, sign in, pick your favorite card design, and click on Apply Now.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Apply using the app

After opening a Chase account, download the mobile app available on App Store or Google Play. Then, sign in and follow the step-by-step to get your new debit card.

Disney® Visa® debit card vs. Extra debit card?

The Disney® Visa® debit card is ideal for those who already have a Chase account and want to visit Walt Disney World and Disneyland resorts. Plus, if you don’t want a credit card or a credit checking process, this card might be an alternative.

However, note that fees apply to the account.

On the other hand, an Extra debit card may do the job if you don’t want to go to Disney or shop there. Also, it offers rewards, even though it charges monthly fees.

Check out the comparison table right below!

| Disney® Visa® debit card from Chase | Extra debit card | |

| Intro Balance Transfer APR | None | None |

| APY | None | None |

| Balance Transfer Fee | None | See terms and conditions |

| Monthly Fee | None (terms and conditions apply for the type of account you choose before getting the card) | From $8 to $12 to earn rewards |

| ATM Fee | None for Chase Premier Plus Checking account at non-Chase ATMs; Free for Chase ATMs | No access |

How to apply for an Extra debit card?

Build your credit history and earn rewards with an Extra debit card. Learn how to apply for this card today!

About the author / Aline Augusto

Reviewed by / Aline Barbosa

Senior Editor

Trending Topics

ZenGo wallet or Coinomi wallet: Which is the best to invest in?

If you love to invest in crypto and need the best crypto wallet, read our comparison to know which is best: ZenGo wallet or Coinomi wallet!

Keep Reading

How to apply for the Citi Rewards+® Card?

Looking for a card that gives points for supermarket and other purchases? Read our Citi Rewards+® card application post to know more!

Keep Reading

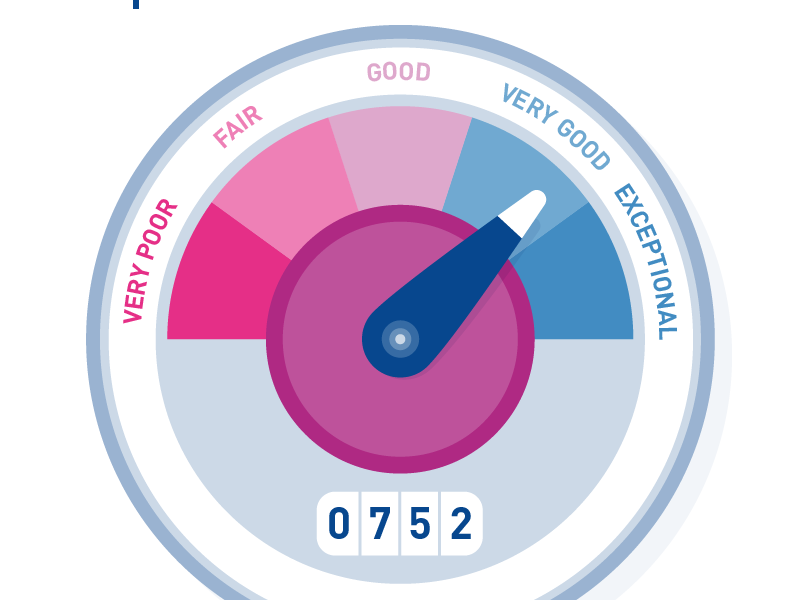

How to increase your credit score

Know all the advantages, percentages, how to use it correctly and what you need to increase your credit score!

Keep ReadingYou may also like

Unique Platinum Card review: Elevate your spending power

Maximize your spending - Unique Platinum Card brings amazing benefits for you! Build credit like a pro and enjoy no interest rate!

Keep Reading

Colorfy App review: Unlock your creativity and release stress!

Find out why coloring books are the latest trend or a new way to relax. See what sets this app apart from other coloring apps and why you should give it a try! Read on to a Colorfy app review.

Keep Reading

Apply for the Navy Federal Visa Signature® Flagship Rewards

Ready to apply and access the benefits of the Navy Federal Visa Signature® Flagship Rewards? Apply today and earn up to 3X points on purchases!

Keep Reading