Credit Cards (US)

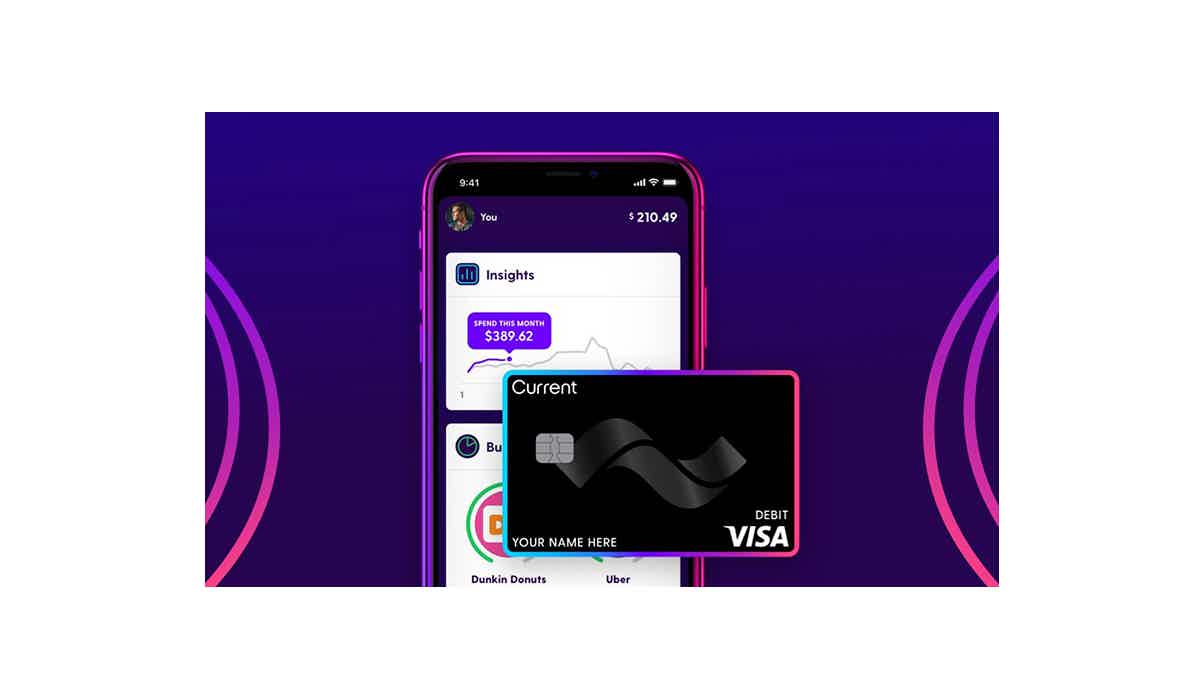

How to apply for the Current Visa debit card?

The Current Visa debit card application is fast and simple. So, check out how to apply for it and teach financial discipline to your kids.

Current Visa debit card application: build your kids’ financial path!

It is challenging to try to begin your teenagers into financial discipline. Especially if you use cash every time they ask for money. But you don’t need to do it anymore. Because the days of cash allowance are over. The Current Visa debit card application is straightforward and takes less than 2 minutes.

The Current offers a fantastic solution for you and your family. With a Current account and a Visa debit card, your teen will be free to use it and start managing money responsibly.

And you will be able to control all these processes through an outstanding app that sends alerts, allows you to block merchants, and gives the possibility to set spending limits and chores to complete.

Also, Current provides security, protection features, and 24/7 excellent customer support.

Check out how to apply for it today!

Apply online

Access the Current website and click on Sign Up. It takes less than 2 minutes to apply for the account and debit card.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Apply using the app

You can also download the Current mobile app to link with your bank account and start depositing money. Plus, through this app, you can add alerts, notifications, set spending limits, block specific merchants, and more.

Current Visa debit card vs. Disney® Visa® debit card

The Current Visa debit card is an amazing tool for parents and teenagers to achieve the first step into a solid financial path.

It offers a fantastic mobile app so you can let your kid be free; at the same time, you can control and supervise the process through alerts and block options.

But if you don’t think this is an option for you, we give you another choice: the Disney® Visa® debit card. Check it out!

| Current Visa debit card | Disney® Visa® debit card | |

| Credit Score | Not required | Not required |

| Annual Fee | $36 | None (terms and conditions apply for the type of account you choose before getting the card) |

| Regular APR | None | None |

| Welcome bonus | None | None |

| Rewards | Up to 15x points for eligible purchases | None |

How to apply for Disney® Visa® debit card?

Enjoy perks and more with a Disney® Visa® debit card from Chase! Check out how to apply for it!

About the author / Aline Augusto

Reviewed by / Aline Barbosa

Senior Editor

Trending Topics

Capital One Walmart Rewards® vs Capital One Savor Rewards card: Which is the best?

Capital One Walmart Rewards® or Capital One Savor Rewards? Find out how their different benefits can help you save money and earn rewards!

Keep Reading

Priceline VIP Rewards™ Visa® Card review

This review of the Priceline VIP Rewards™ Visa® Card gathers all you need to know: how the card works, the rewards, and the costs involved.

Keep Reading

Capital One Quicksilver Cash Rewards Credit Card full review

No annual fee and 1.5% cash back on all purchases? Check out this Capital One Quicksilver Cash Rewards Credit Cardreview to learn more!

Keep ReadingYou may also like

Learn to apply easily for 100 Lenders personal loan

Do you need some money for an emergency or other personal matter? If so, read our post and learn how to apply for 100 Lenders personal loan!

Keep Reading

How to prepare for buying a house in 2023

Want to buy a house in the near future? Start planning now with these tips on saving money, building your credit score, and more. Read on!

Keep Reading

Neo Credit Card review: Up to 15% cashback on first-time purchases!

The Neo Credit Card offers an exceptional blend of benefits for modern consumers: high cashback rewards, no annual fees, and a user-friendly digital platform. Perfect for those seeking value and convenience.

Keep Reading