Credit Cards (US)

How to apply for the Apple credit card?

Wondering how to apply for the new Apple credit card? We'll show you how easy it is to get started. Read more to know about the Apple credit card application!

Apple credit card application: learn how to apply and get rewards for Apple purchases

If you’re a fan of Apple products, you may be interested in the company’s new credit card. The Apple Card is designed to make it easy for customers to earn rewards and manage their finances. Also, you can get cash back rewards and other perks if you love Apple products. We’ll explain the application process and what you can expect if you are approved! So, if you’re curious about how to apply, keep reading our post about the Apple credit card application!

Apply online

You can easily apply for the Apple credit card through Apple’s official website. You can click on Apply now, and you’ll be redirected to a page to start your application process. Also, before you start the official process, you can see if you are pre-approved with no impact on your credit score. Moreover, you need to provide your Apple ID to start your application process. After that, you can provide your personal information and see if you’re pre-approved in minutes.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Apply using the app

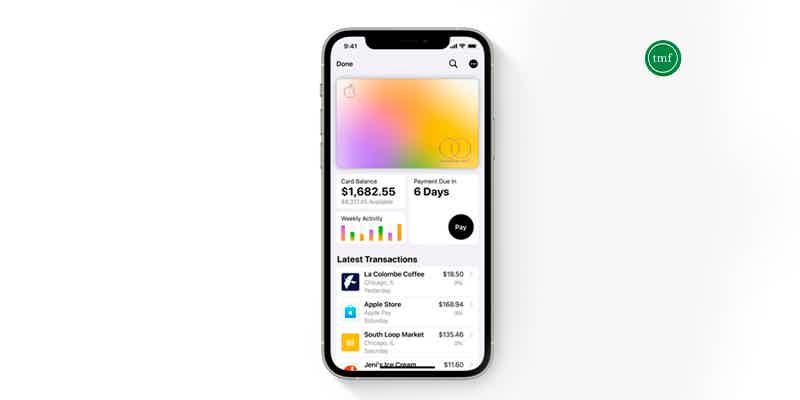

Although you need to follow the tips in the topic above to apply for an Apple credit card, you can use the mobile app to manage your card. Also, you can access your account through your iPhone in your Wallet app. Therefore, you can sign in and start using your Apple credit card after you already have an account.

Apple credit card vs. Amazon credit card

If you still don’t know if you want to apply for an Apple credit card, we can give you other options. For example, the Amazon credit card gives you perks if you love Amazon products. Therefore, check out our comparison table below to help you decide which one of these excellent credit cards you want to apply for.

| Apple credit card | Amazon credit card | |

| Credit Score | Fair to excellent. | Good to excellent. |

| Annual Fee | No annual fee. | $0 with Prime Membership. |

| Regular APR | 10.99% to 21.99% variable APR. | 14.24% to 22.24% variable APR |

| Welcome bonus | No welcome bonus. | You can get a $100 Amazon Gift Card. |

| Rewards* | Unlimited 3% daily cash back for purchases made at Apple. 2% daily cash back when you make purchases through Apple Pay. 1% cash back on every other purchase you make with the card. *Terms apply. | Prime Members get 5% back at drugstores, gas stations, and restaurants. 2% back at drugstores, restaurants, and gas stations. 1% back on all other purchases. |

How to apply for the Amazon credit card

Are you interested in getting the Amazon Prime Rewards card? You can get special rewards like 5% unlimited cash back at Amazon.com! Keep reading to know how to apply!

About the author / Victória Lourenço

Reviewed by / Aline Barbosa

Senior Editor

Trending Topics

CareCredit® card review: what you need to know before applying

Learn how a credit card designed for health care works with this CareCredit® card review post! Decide now if it fits your needs and budget!

Keep Reading

How to join Checkmyfile?

If you are looking for a credit score monitoring platform in the UK, check out our post about how to join Checkmyfile!

Keep Reading

Nash crypto wallet full review

If you want a crypto wallet that offers great interest, Nash can be for you. Read our Nash crypto wallet review to know more!

Keep ReadingYou may also like

Net First Platinum card application: how does it work?

What would you do with a $750 credit limit to buy at the Horizon Outlet website? If you think of something you need, you can apply for this card and get the membership to enjoy exclusive offers.

Keep Reading

Bad credit accepted: apply for BankAmericard® Secured Credit Card

Looking for a secure way to build credit? Then discover how to apply for the BankAmericard® Secured Credit Card. Keep reading to learn more.

Keep Reading

LoanPionner review: how does it work and is it good?

Are you ready for a life makeover?LoanPionner can help you get the money you need! Connect with several lenders easily! Keep reading to learn!

Keep Reading